Sale of Asset Equipment acquired on January 9, 20Y3, at a cost of $50 residual value of $80,480, and is depreciated by the strai

Sale of Asset Equipment acquired on January 9, 20Y3, at a cost of $50 residual value of $80,480, and is depreciated by the strai

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 14PC

Related questions

Question

Transcribed Image Text:=

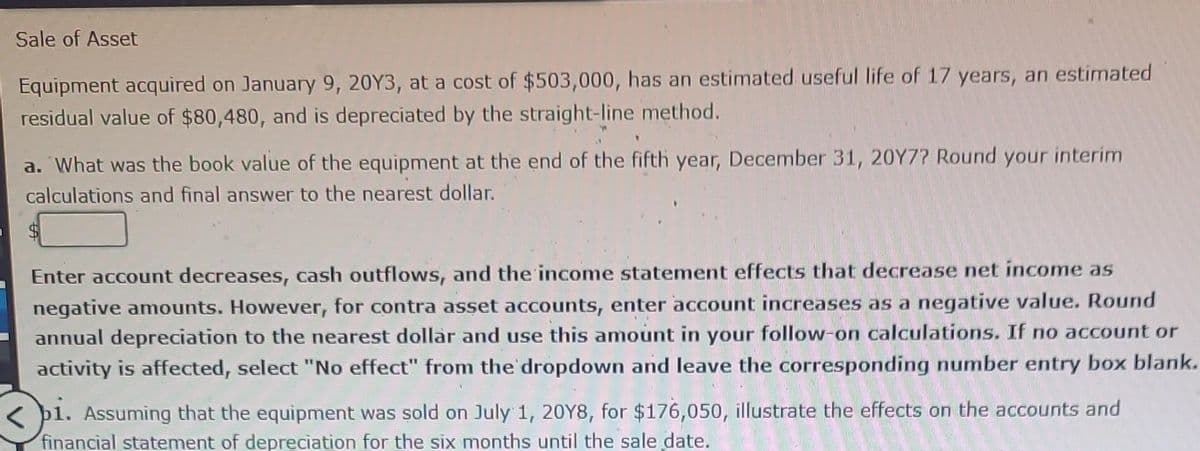

Sale of Asset

Equipment acquired on January 9, 20Y3, at a cost of $503,000, has an estimated useful life of 17 years, an estimated

residual value of $80,480, and is depreciated by the straight-line method.

a. What was the book value of the equipment at the end of the fifth year, December 31, 20Y7? Round your interim

calculations and final answer to the nearest dollar.

Enter account decreases, cash outflows, and the income statement effects that decrease net income as

negative amounts. However, for contra asset accounts, enter account increases as a negative value. Round

annual depreciation to the nearest dollar and use this amount in your follow-on calculations. If no account or

activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank.

1. Assuming that the equipment was sold on July 1, 2018, for $176,050, illustrate the effects on the accounts and

financial statement of depreciation for the six months until the sale date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning