Sheridan Corp. incurred the following costs during 2023 in connection with its research and development phase activities: Cost of equipment acquired for use in research and development projects over the next 5 years (straight-line depreciation used) Materials consumed in research projects Materials consumed in the development of a product committed for manufacturing in the first quarter of 2024 Consulting fees paid in the last quarter of 2023 to outsiders for research and development projects, including $4,200 for advice related to the $30,000 of materials used above Personnel costs for research and development projects Indirect costs reasonably allocated to research and development projects General borrowing costs on the company's line of credit Training costs for a new customer service software program $255,000 Amount to be reported. research and development expense $ 61,300 30,000 89,600 109,600 28,200 13,300 19,300 (a) Calculate the amount to be reported as research and development expense by Sheridan on its income statement for 2023. Assume the equipment is purchased at the beginning of the year. Assume the company follows IFRS for financial reporting purposes.

Sheridan Corp. incurred the following costs during 2023 in connection with its research and development phase activities: Cost of equipment acquired for use in research and development projects over the next 5 years (straight-line depreciation used) Materials consumed in research projects Materials consumed in the development of a product committed for manufacturing in the first quarter of 2024 Consulting fees paid in the last quarter of 2023 to outsiders for research and development projects, including $4,200 for advice related to the $30,000 of materials used above Personnel costs for research and development projects Indirect costs reasonably allocated to research and development projects General borrowing costs on the company's line of credit Training costs for a new customer service software program $255,000 Amount to be reported. research and development expense $ 61,300 30,000 89,600 109,600 28,200 13,300 19,300 (a) Calculate the amount to be reported as research and development expense by Sheridan on its income statement for 2023. Assume the equipment is purchased at the beginning of the year. Assume the company follows IFRS for financial reporting purposes.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10E: Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual...

Related questions

Question

please answer the follow question, thanks

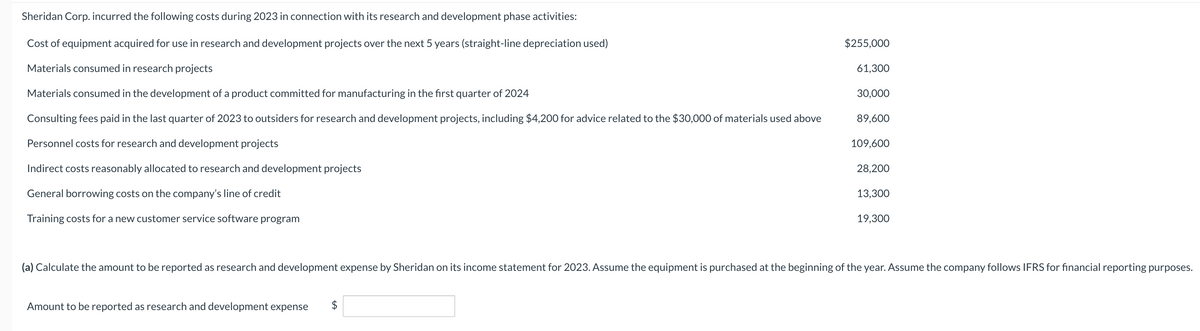

Transcribed Image Text:Sheridan Corp. incurred the following costs during 2023 in connection with its research and development phase activities:

Cost of equipment acquired for use in research and development projects over the next 5 years (straight-line depreciation used)

Materials consumed in research projects

Materials consumed in the development of a product committed for manufacturing in the first quarter of 2024

Consulting fees paid in the last quarter of 2023 to outsiders for research and development projects, including $4,200 for advice related to the $30,000 of materials used above

Personnel costs for research and development projects

Indirect costs reasonably allocated to research and development projects

General borrowing costs on the company's line of credit

Training costs for a new customer service software program

$255,000

Amount to be reported as research and development expense $

61,300

30,000

89,600

109,600

28,200

13,300

19,300

(a) Calculate the amount to be reported as research and development expense by Sheridan on its income statement for 2023. Assume the equipment is purchased at the beginning of the year. Assume the company follows IFRS for financial reporting purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning