Sales Retums and Allowances $410,000 Sales Discount 140,000 Sales 1,500,000 Salaries Expenses - Sales Rent Revenue 52,000 22,000 Purchases Retums and Allowances 120,000 Purchases Loss from write down of Inventory 600,000 17,000 Inventory, January 1, 2020 460,000 Interest Expense Gain from Sale of Building Freight-out Freight-in Depreciation Expense - Sales Cost of Goods Sold 55,000 23,000 14,000 30,000 22,000 600,000 Based on the data above, the inventory account showed a balance of $------ on December 31, 2020: * O $340,000 $370,000 O $354,000 EO None of the above

Sales Retums and Allowances $410,000 Sales Discount 140,000 Sales 1,500,000 Salaries Expenses - Sales Rent Revenue 52,000 22,000 Purchases Retums and Allowances 120,000 Purchases Loss from write down of Inventory 600,000 17,000 Inventory, January 1, 2020 460,000 Interest Expense Gain from Sale of Building Freight-out Freight-in Depreciation Expense - Sales Cost of Goods Sold 55,000 23,000 14,000 30,000 22,000 600,000 Based on the data above, the inventory account showed a balance of $------ on December 31, 2020: * O $340,000 $370,000 O $354,000 EO None of the above

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.23EX

Related questions

Question

Transcribed Image Text:2:24 O P

3 all 31%

docs.google.com/forms/d/e/11

8

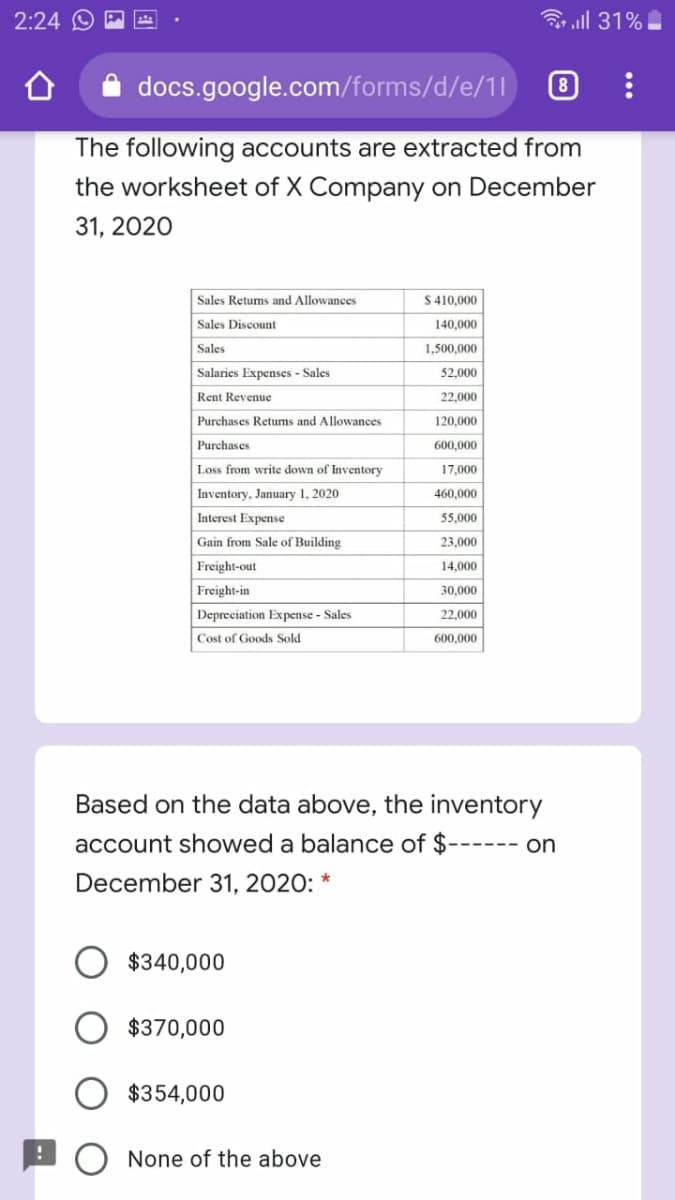

The following accounts are extracted from

the worksheet of X Company on December

31, 2020

Sales Retums and Allowances

S410,000

Sales Discount

140,000

Sales

1,500,000

Salaries Expenses - Sales

52,000

Rent Revenue

22,000

Purchases Retums and Allowances

120,000

Purchases

600,000

Loss from write down of Inventory

17,000

Inventory, January 1, 2020

460,000

Interest Expense

55,000

Gain from Sale of Building

23,000

Freight-out

14,000

Freight-in

30,000

Depreciation Expense - Sales

22,000

Cost of Goods Sold

600,000

Based on the data above, the inventory

account showed a balance of $------ on

December 31, 2020: *

$340,000

$370,000

$354,000

None of the above

Transcribed Image Text:2:24 P

令l 31%

docs.google.com/forms/d/e/11

8

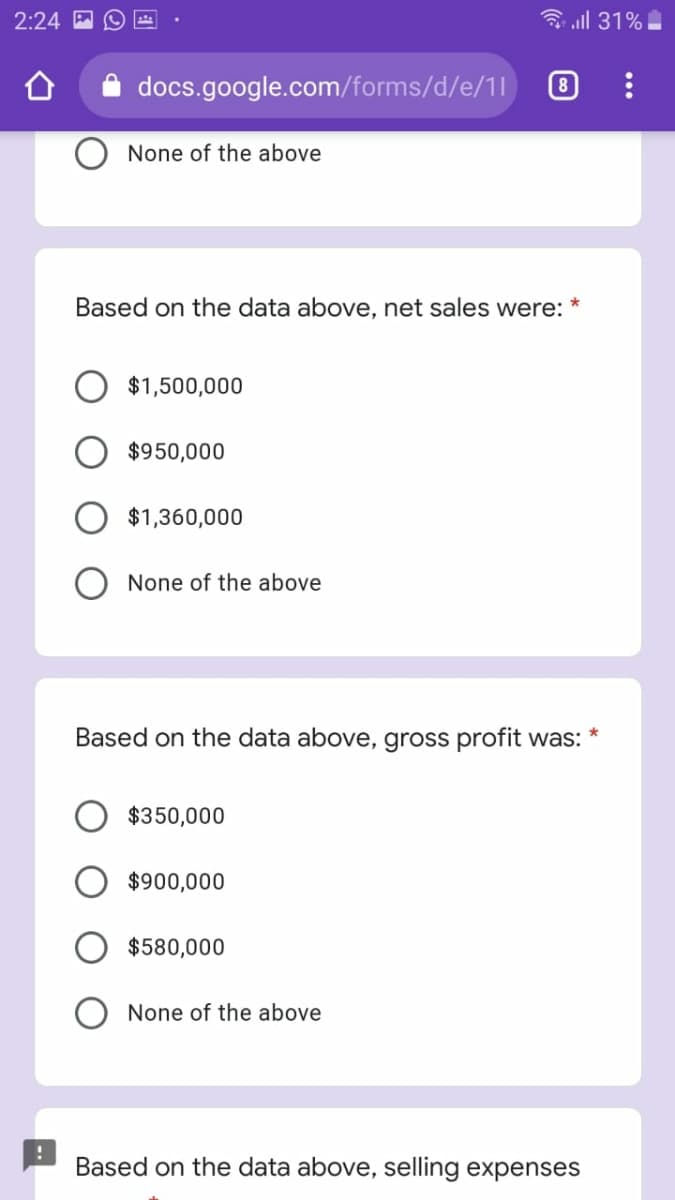

None of the above

Based on the data above, net sales were:

$1,500,000

$950,000

$1,360,000

None of the above

Based on the data above, gross profit was:

$350,000

$900,000

$580,000

None of the above

Based on the data above, selling expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning