Prob current year: 5,250,000 150,000 250,000 Purchases Purchase returns and allowances Rental income Selling expenses: Freight out Salesmen's commission Depreciation - store equipment Merchandise inventory, January 1 Merchandise inventory, December 31 Sales Sales returns and allowances Sales discounts Administrative expenses: Officers' salaries 175,000 650,000 125,000 1,000,000 1,500,000 7,850,000 140,000 10,000 500,000 300,000 500,000 250,000 50,000 100,000 150,000 50,000 Depreciation- office equipment Freight in Income tax Loss on sale of equipment Purchase discounts Dividend revenue Loss on sale of investment Required: a. Prepare an income statement for the year using the "functional" method with supporting notes. b. Prepare an income statement for the year using the "natural" method with supporting notor

Prob current year: 5,250,000 150,000 250,000 Purchases Purchase returns and allowances Rental income Selling expenses: Freight out Salesmen's commission Depreciation - store equipment Merchandise inventory, January 1 Merchandise inventory, December 31 Sales Sales returns and allowances Sales discounts Administrative expenses: Officers' salaries 175,000 650,000 125,000 1,000,000 1,500,000 7,850,000 140,000 10,000 500,000 300,000 500,000 250,000 50,000 100,000 150,000 50,000 Depreciation- office equipment Freight in Income tax Loss on sale of equipment Purchase discounts Dividend revenue Loss on sale of investment Required: a. Prepare an income statement for the year using the "functional" method with supporting notes. b. Prepare an income statement for the year using the "natural" method with supporting notor

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

answer with explanation/solution

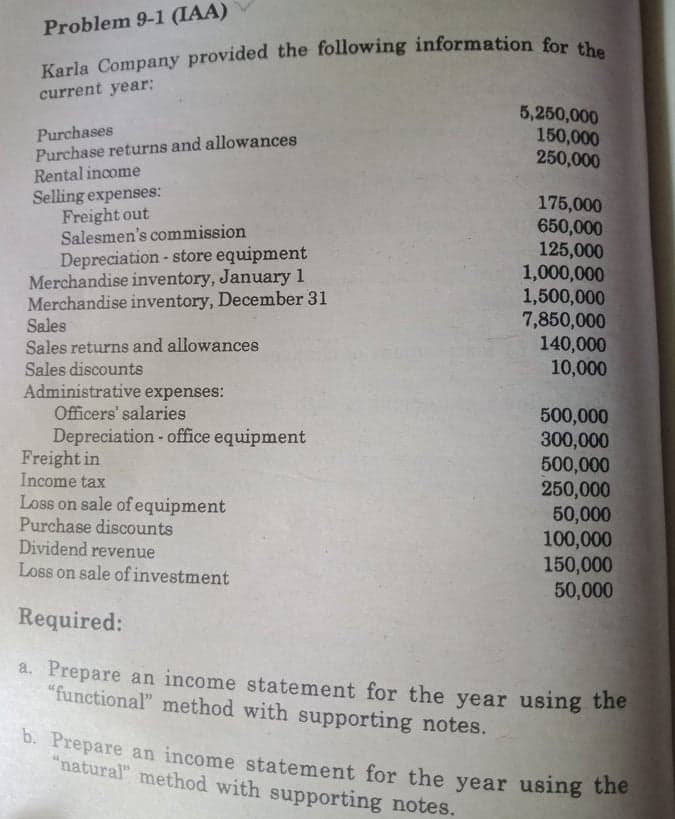

Transcribed Image Text:Karla Company provided the following information for the

Problem 9-1 (IAA)

Karla Company provided the following information for 41

current year:

5,250,000

150,000

250,000

Purchases

Purchase returns and allowances

Rental income

Selling expenses:

Freight out

Salesmen's commission

Depreciation - store equipment

Merchandise inventory, January 1

Merchandise inventory, December 31

Sales

Sales returns and allowances

Sales discounts

Administrative expenses:

Officers' salaries

Depreciation - office equipment

Freight in

Income tax

Loss on sale of equipment

Purchase discounts

Dividend revenue

Loss on sale ofinvestment

175,000

650,000

125,000

1,000,000

1,500,000

7,850,000

140,000

10,000

500,000

300,000

500,000

250,000

50,000

100,000

150,000

50,000

Required:

a. Prepare an income statement for the year using the

"functional" method with supporting notes.

D. Prepare an income statement for the year using the

"natural" method with supporting notes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning