Sales Service and Service Revenue are two income statement accounts that relate to Accounts Receivable . Name two other accounts related to Accounts Receivable and Notes Receivable that would be reported on income statement and indicate whether each would appear before or after Income from Operations

Sales Service and Service Revenue are two income statement accounts that relate to Accounts Receivable . Name two other accounts related to Accounts Receivable and Notes Receivable that would be reported on income statement and indicate whether each would appear before or after Income from Operations

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 85APSA: Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto...

Related questions

Question

Sales Service and Service Revenue are two income statement accounts that relate to Accounts Receivable . Name two other accounts related to Accounts Receivable and Notes Receivable that would be reported on income statement and indicate whether each would appear before or after Income from Operations

![equired information

The following information applies to the questions displayed below.]

Neb Wizard, Inc., has provided information technology services for several years. For the first two months of the current

year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter,

the company switched to the aging of accounts receivable method. The company entered into the following partial list of

transactions during the first quarter.

a. During January, the company provided services for $38,000 on credit.

b. On January 31, the company estimated bad debts using 1 percent of credit sales.

C. On February 4, the company collected $19,000 of accounts receivable.

d. On February 15, the company wrote off a $100 account receivable.

e. During February, the company provided services for $28,000 on credit.

f. On February 28, the company estimated bad debts using 1 percent of credit sales.

g. On March 1, the company loaned $2,400 to an employee, who signed a 6% note, due in 6 months.

h. On March 15, the company collected $100 on the account written off one month earlier.

i. On March 31, the company accrued interest earned on the note.

j. On March 31, the company adjusted for uncollectible accounts, based on an aging analysis (below). Allowance for

Doubtful Accounts has an unadjusted credit balance of $1180.

Number of Days Unpaid

61-90

Customer

Alabama Tourism

Bayside Bungalows

Others (not shown to save space)

Xciting Xcursions

Total Accounts Receivable

Estimated Uncollectible (%)

Total

0-30

24

31-60

Over 90

%$4

200

100

80

20

380

380

16,600

6,600

8, 200

1,000

400

800

400

$17,580

$7,100

$ 8,280

15%

$1,020

$1,180

2%

20%

40%

< Prev

of 8

Next >

earch](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F1454e492-0a2a-4983-9bfe-b4968324df4e%2Fa7d58958-c782-4179-bc51-fdaa9c543a87%2Focb1yzof_processed.jpeg&w=3840&q=75)

Transcribed Image Text:equired information

The following information applies to the questions displayed below.]

Neb Wizard, Inc., has provided information technology services for several years. For the first two months of the current

year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter,

the company switched to the aging of accounts receivable method. The company entered into the following partial list of

transactions during the first quarter.

a. During January, the company provided services for $38,000 on credit.

b. On January 31, the company estimated bad debts using 1 percent of credit sales.

C. On February 4, the company collected $19,000 of accounts receivable.

d. On February 15, the company wrote off a $100 account receivable.

e. During February, the company provided services for $28,000 on credit.

f. On February 28, the company estimated bad debts using 1 percent of credit sales.

g. On March 1, the company loaned $2,400 to an employee, who signed a 6% note, due in 6 months.

h. On March 15, the company collected $100 on the account written off one month earlier.

i. On March 31, the company accrued interest earned on the note.

j. On March 31, the company adjusted for uncollectible accounts, based on an aging analysis (below). Allowance for

Doubtful Accounts has an unadjusted credit balance of $1180.

Number of Days Unpaid

61-90

Customer

Alabama Tourism

Bayside Bungalows

Others (not shown to save space)

Xciting Xcursions

Total Accounts Receivable

Estimated Uncollectible (%)

Total

0-30

24

31-60

Over 90

%$4

200

100

80

20

380

380

16,600

6,600

8, 200

1,000

400

800

400

$17,580

$7,100

$ 8,280

15%

$1,020

$1,180

2%

20%

40%

< Prev

of 8

Next >

earch

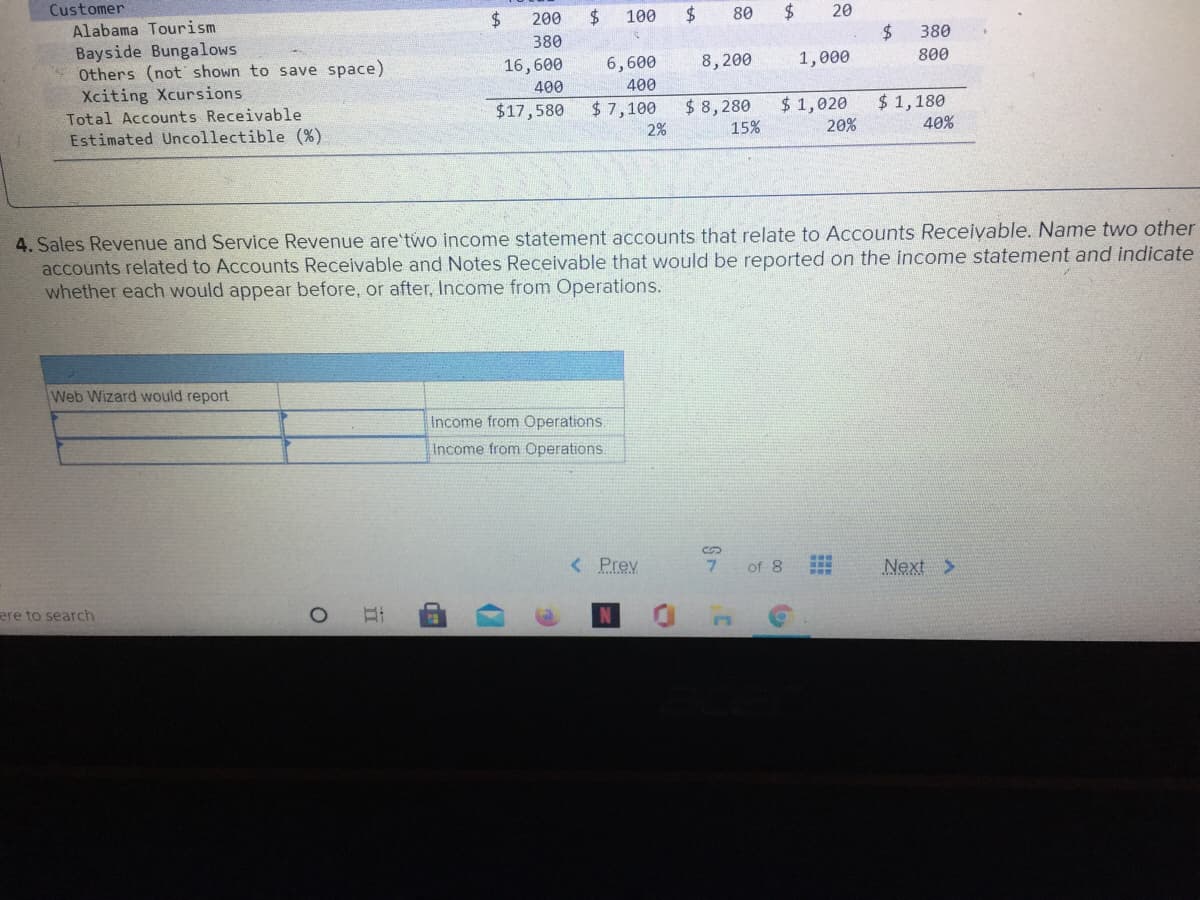

Transcribed Image Text:Customer

Alabama Tourism

2$

200

100

2$

80

24

20

%24

1,000

380

Bayside Bungalows

Others (not shown to save space)

380

800

16,600

400

6,600

8,200

Xciting Xcursions

Total Accounts Receivable

Estimated Uncollectible (%).

400

$ 7,100

$ 8,280

$ 1,020

$ 1,180

40%

$17,580

2%

15%

20%

4. Sales Revenue and Service Revenue are'two income statement accounts that relate to Accounts Receivable. Name two other

accounts related to Accounts Receivable and Notes Receivable that would be reported on the income statement and indicate

whether each would appear before, or after, Income from Operations.

Web Wizard would report

Income from Operations

Income from Operations

< Prev

of 8

Next>

ere to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College