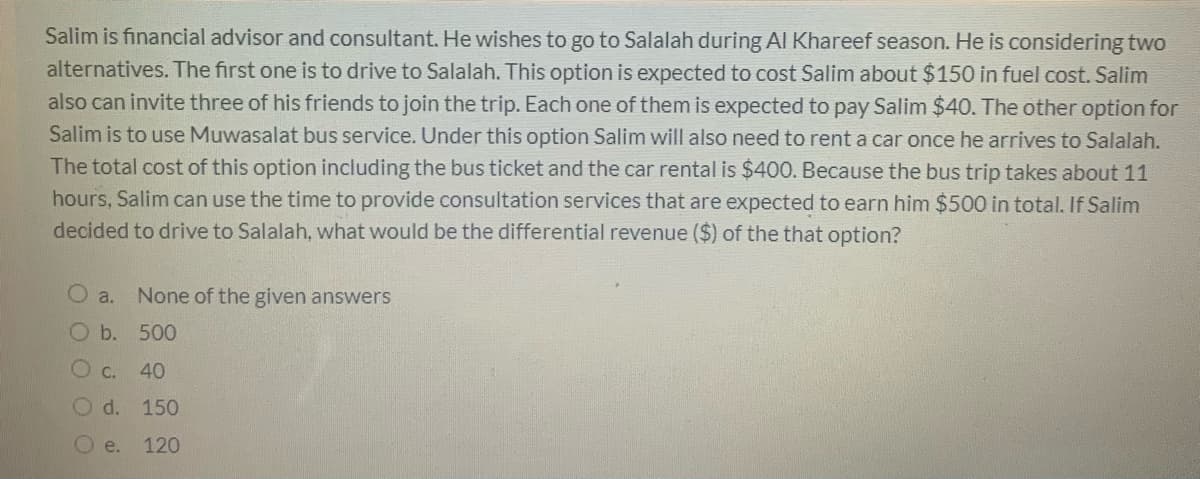

Salim is financial advisor and consultant. He wishes to go to Salalah during Al Khareef season. He is considering two alternatives. The first one is to drive to Salalah. This option is expected to cost Salim about $150 in fuel cost. Salim also can invite three of his friends to join the trip. Each one of them is expected to pay Salim $40. The other option for Salim is to use Muwasalat bus service. Under this option Salim will also need to rent a car once he arrives to Salalah. The total cost of this option including the bus ticket and the car rental is $400. Because the bus trip takes about 11 hours, Salim can use the time to provide consultation services that are expected to earn him $500 in total. If Salim decided to drive to Salalah, what would be the differential revenue ($) of the that option? a. None of the given answers O b. 500 C. 40 Od. 150 O e. 120 O O O

Salim is financial advisor and consultant. He wishes to go to Salalah during Al Khareef season. He is considering two alternatives. The first one is to drive to Salalah. This option is expected to cost Salim about $150 in fuel cost. Salim also can invite three of his friends to join the trip. Each one of them is expected to pay Salim $40. The other option for Salim is to use Muwasalat bus service. Under this option Salim will also need to rent a car once he arrives to Salalah. The total cost of this option including the bus ticket and the car rental is $400. Because the bus trip takes about 11 hours, Salim can use the time to provide consultation services that are expected to earn him $500 in total. If Salim decided to drive to Salalah, what would be the differential revenue ($) of the that option? a. None of the given answers O b. 500 C. 40 Od. 150 O e. 120 O O O

Chapter16: Tax Research

Section: Chapter Questions

Problem 64DNC

Related questions

Question

Transcribed Image Text:Salim is financial advisor and consultant. He wishes to go to Salalah during Al Khareef season. He is considering two

alternatives. The first one is to drive to Salalah. This option is expected to cost Salim about $150 in fuel cost. Salim

also can invite three of his friends to join the trip. Each one of them is expected to pay Salim $40. The other option for

Salim is to use Muwasalat bus service. Under this option Salim will also need to rent a car once he arrives to Salalah.

The total cost of this option including the bus ticket and the car rental is $400. Because the bus trip takes about 11

hours, Salim can use the time to provide consultation services that are expected to earn him $500 in total. If Salim

decided to drive to Salalah, what would be the differential revenue ($) of the that option?

a.

None of the given answers

O b.

500

C.

40

O d. 150

O e.

120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT