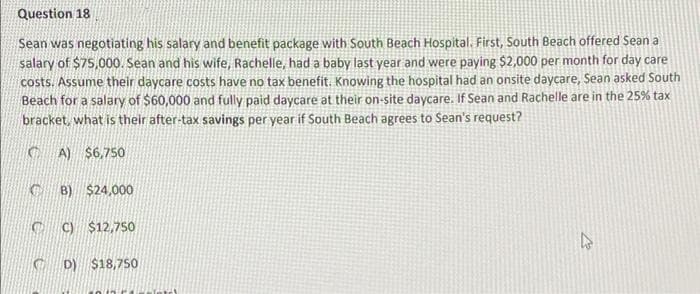

Sean was negotiating his salary and benefit package with South Beach Hospital. First, South Beach offered Sean a salary of $75,000. Sean and his wife, Rachelle, had a baby last year and were paying $2,000 per month for day care costs. Assume their daycare costs have no tax benefit. Knowing the hospital had an onsite daycare, Sean asked South Beach for a salary of $60,000 and fully paid daycare at their on-site daycare. If Sean and Rachelle are in the 25% tax bracket, what is their after-tax savings per year if South Beach agrees to Sean's request? C A) $6,750 B) $24,000 C ) $12,750 C D) $18,7so

Sean was negotiating his salary and benefit package with South Beach Hospital. First, South Beach offered Sean a salary of $75,000. Sean and his wife, Rachelle, had a baby last year and were paying $2,000 per month for day care costs. Assume their daycare costs have no tax benefit. Knowing the hospital had an onsite daycare, Sean asked South Beach for a salary of $60,000 and fully paid daycare at their on-site daycare. If Sean and Rachelle are in the 25% tax bracket, what is their after-tax savings per year if South Beach agrees to Sean's request? C A) $6,750 B) $24,000 C ) $12,750 C D) $18,7so

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 4FPE

Related questions

Question

Transcribed Image Text:Question 18

Sean was negotiating his salary and benefit package with South Beach Hospital. First, South Beach offered Sean a

salary of $75,000. Sean and his wife, Rachelle, had a baby last year and were paying $2,000 per month for day care

costs. Assume their daycare costs have no tax benefit, Knowing the hospital had an onsite daycare, Sean asked South

Beach for a salary of $60,000 and fully paid daycare at their on-site daycare. If Sean and Rachelle are in the 25% tax

bracket, what is their after-tax savings per year if South Beach agrees to Sean's request?

C A) $6,750

C B) $24,000

C C) $12,75so

C D) $18,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning