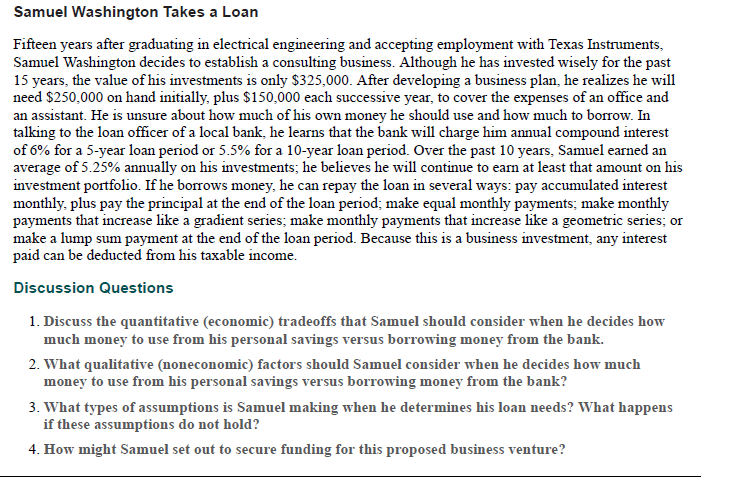

Samuel Washington Takes a Loan Fifteen years after graduating in electrical engineering and accepting employment with Texas Instruments, Samuel Washington decides to establish a consulting business. Although he has invested wisely for the past 15 years, the value of his investments is only $325,000. After developing a business plan, he realizes he will need $250,000 on hand initially, plus $150,000 each successive year, to cover the expenses of an office and an assistant. He is unsure about how much of his own money he should use and how much to borrow. In talking to the loan officer of a local bank, he learns that the bank will charge him annual compound interest of 6% for a 5-year loan period or 5.5% for a 10-year loan period. Over the past 10 years, Samuel earned an average of 5.25% annually on his investments; he believes he will continue to earn at least that amount on his investment portfolio. If he borrows money, he can repay the loan in several ways: pay accumulated interest monthly, plus pay the principal at the end of the loan period; make equal monthly payments; make monthly payments that increase like a gradient series; make monthly payments that increase like a geometric series; or make a lump sum payment at the end of the loan period. Because this is a business investment, any interest paid can be deducted from his taxable income. Discussion Questions 1. Discuss the quantitative (economic) tradeoffs that Samuel should consider when he decides how much money to use from his personal savings versus borrowing money from the bank. 2. What qualitative (noneconomic) factors should Samuel consider when he decides how much money to use from his personal savings versus borrowing money from the bank? 3. What types of assumptions is Samuel making when he determines his loan needs? What happens if these assumptions do not hold? 4. How might Samuel set out to secure funding for this proposed business venture?

Samuel Washington Takes a Loan Fifteen years after graduating in electrical engineering and accepting employment with Texas Instruments, Samuel Washington decides to establish a consulting business. Although he has invested wisely for the past 15 years, the value of his investments is only $325,000. After developing a business plan, he realizes he will need $250,000 on hand initially, plus $150,000 each successive year, to cover the expenses of an office and an assistant. He is unsure about how much of his own money he should use and how much to borrow. In talking to the loan officer of a local bank, he learns that the bank will charge him annual compound interest of 6% for a 5-year loan period or 5.5% for a 10-year loan period. Over the past 10 years, Samuel earned an average of 5.25% annually on his investments; he believes he will continue to earn at least that amount on his investment portfolio. If he borrows money, he can repay the loan in several ways: pay accumulated interest monthly, plus pay the principal at the end of the loan period; make equal monthly payments; make monthly payments that increase like a gradient series; make monthly payments that increase like a geometric series; or make a lump sum payment at the end of the loan period. Because this is a business investment, any interest paid can be deducted from his taxable income. Discussion Questions 1. Discuss the quantitative (economic) tradeoffs that Samuel should consider when he decides how much money to use from his personal savings versus borrowing money from the bank. 2. What qualitative (noneconomic) factors should Samuel consider when he decides how much money to use from his personal savings versus borrowing money from the bank? 3. What types of assumptions is Samuel making when he determines his loan needs? What happens if these assumptions do not hold? 4. How might Samuel set out to secure funding for this proposed business venture?

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Solve,

Transcribed Image Text:Samuel Washington Takes a Loan

Fifteen years after graduating in electrical engineering and accepting employment with Texas Instruments,

Samuel Washington decides to establish a consulting business. Although he has invested wisely for the past

15 years, the value of his investments is only $325,000. After developing a business plan, he realizes he will

need $250,000 on hand initially, plus $150,000 each successive year, to cover the expenses of an office and

an assistant. He is unsure about how much of his own money he should use and how much to borrow. In

talking to the loan officer of a local bank, he learns that the bank will charge him annual compound interest

of 6% for a 5-year loan period or 5.5% for a 10-year loan period. Over the past 10 years, Samuel earned an

average of 5.25% annually on his investments; he believes he will continue to earn at least that amount on his

investment portfolio. If he borrows money, he can repay the loan in several ways: pay accumulated interest

monthly, plus pay the principal at the end of the loan period; make equal monthly payments; make monthly

payments that increase like a gradient series; make monthly payments that increase like a geometric series; or

make a lump sum payment at the end of the loan period. Because this is a business investment, any interest

paid can be deducted from his taxable income.

Discussion Questions

1. Discuss the quantitative (economic) tradeoffs that Samuel should consider when he decides how

much money to use from his personal savings versus borrowing money from the bank.

2. What qualitative (noneconomic) factors should Samuel consider when he decides how much

money to use from his personal savings versus borrowing money from the bank?

3. What types of assumptions is Samuel making when he determines his loan needs? What happens

if these assumptions do not hold?

4. How might Samuel set out to secure funding for this proposed business venture?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning