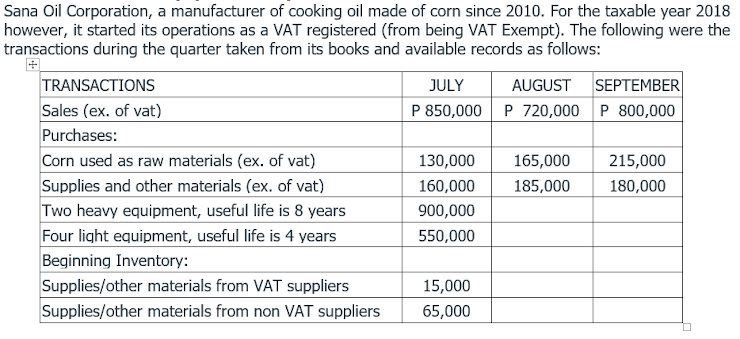

Sana Oil Corporation, a manufacturer of cooking oil made of corn since 2010. For the taxable year 2018 however, it started its operations as a VAT registered (from being VAT Exempt). The following were th transactions during the quarter taken from its books and available records as follows: TRANSACTIONS Sales (ex. of vat) Purchases: Corn used as raw materials (ex. of vat) Supplies and other materials (ex. of vat) Two heavy equipment, useful life is 8 years Four light equipment, useful life is 4 years Beginning Inventory: Supplies/other materials from VAT suppliers Supplies/other materials from non VAT suppliers JULY P 850,000 130,000 160,000 900,000 550,000 15,000 65,000 AUGUST SEPTEMBER P 720,000 P 800,000 165,000 185,000 215,000 180,000

Sana Oil Corporation, a manufacturer of cooking oil made of corn since 2010. For the taxable year 2018 however, it started its operations as a VAT registered (from being VAT Exempt). The following were th transactions during the quarter taken from its books and available records as follows: TRANSACTIONS Sales (ex. of vat) Purchases: Corn used as raw materials (ex. of vat) Supplies and other materials (ex. of vat) Two heavy equipment, useful life is 8 years Four light equipment, useful life is 4 years Beginning Inventory: Supplies/other materials from VAT suppliers Supplies/other materials from non VAT suppliers JULY P 850,000 130,000 160,000 900,000 550,000 15,000 65,000 AUGUST SEPTEMBER P 720,000 P 800,000 165,000 185,000 215,000 180,000

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 33P

Related questions

Question

How much is the Input tax should be recognized in July’s capital expenditures (equipment purchases are net of vat)?

3,175

174,000

2,900

108,800

Transcribed Image Text:Sana Oil Corporation, a manufacturer of cooking oil made of corn since 2010. For the taxable year 2018

however, it started its operations as a VAT registered (from being VAT Exempt). The following were the

transactions during the quarter taken from its books and available records as follows:

TRANSACTIONS

Sales (ex. of vat)

Purchases:

Corn used as raw materials (ex. of vat)

Supplies and other materials (ex. of vat)

Two heavy equipment, useful life is 8 years

Four light equipment, useful life is 4 years

Beginning Inventory:

Supplies/other materials from VAT suppliers

Supplies/other materials from non VAT suppliers

JULY

P 850,000

130,000

160,000

900,000

550,000

15,000

65,000

AUGUST

P 720,000

165,000

185,000

SEPTEMBER

P 800,000

215,000

180,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning