Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her long-time job as a data analyst for an environmental lobbying firm to recuperate. Using Appendix B answer these questions: a. If her earnings averaged $35,000, what would be her monthly Social Security disability benefit? Round your answer to the nearest dollar. $ b. If her earnings instead averaged $80,000, what would be the monthly benefit? Round your answer to the nearest dollar. $

Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her long-time job as a data analyst for an environmental lobbying firm to recuperate. Using Appendix B answer these questions: a. If her earnings averaged $35,000, what would be her monthly Social Security disability benefit? Round your answer to the nearest dollar. $ b. If her earnings instead averaged $80,000, what would be the monthly benefit? Round your answer to the nearest dollar. $

Chapter11: Planning For Health Care Expenses

Section: Chapter Questions

Problem 3DTM

Related questions

Question

Transcribed Image Text:Sandra Hilton of Sisseton, South Dakota, age 60, recently was in a vehicle accident, was hospitalized, and then suffered a heart attack. She took a leave of absence from her long-time job as a

data analyst for an environmental lobbying firm to recuperate. Using Appendix B answer these questions:

a. If her earnings averaged $35,000, what would be her monthly Social Security disability benefit? Round your answer to the nearest dollar.

$

b. If her earnings instead averaged $80,000, what would be the monthly benefit? Round your answer to the nearest dollar.

$

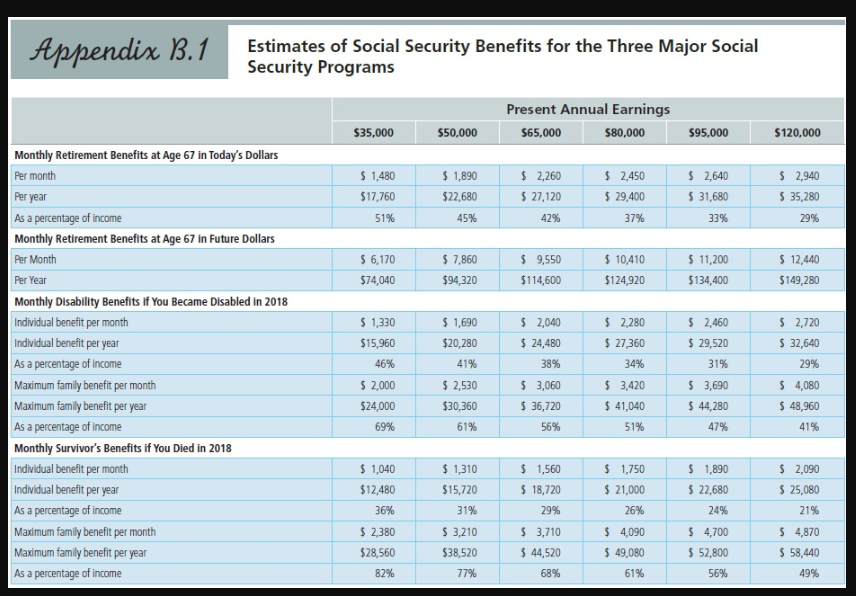

Transcribed Image Text:Appendix B.1

Monthly Retirement Benefits at Age 67 in Today's Dollars

Per month

Per year

Estimates of Social Security Benefits for the Three Major Social

Security Programs

As a percentage of income

Monthly Retirement Benefits at Age 67 in Future Dollars

Per Month

Per Year

Monthly Disability Benefits if You Became Disabled in 2018

Individual benefit per month

Individual benefit per year

As a percentage of income

Maximum family benefit per month

Maximum family benefit per year

As a percentage of income

Monthly Survivor's Benefits if You Died in 2018

Individual benefit per month

Individual benefit per year

As a percentage of income

Maximum family benefit per month

Maximum family benefit per year

As a percentage of income

$35,000

$ 1,480

$17,760

51%

$ 6,170

$74,040

$ 1,330

$15,960

46%

$ 2,000

$24,000

69%

$ 1,040

$12,480

36%

$ 2,380

$28,560

82%

$50,000

$ 1,890

$22,680

45%

$ 7,860

$94,320

$ 1,690

$20,280

41%

$ 2,530

$30,360

61%

$ 1,310

$15,720

31%

$ 3,210

$38,520

77%

Present Annual Earnings

$65,000

$80,000

$ 2,260

$ 27,120

42%

$ 9,550

$114,600

$ 2,040

$ 24,480

38%

$ 3,060

$36,720

56%

$ 1,560

$ 18,720

29%

$ 3,710

$ 44,520

68%

$ 2,450

$ 29,400

37%

$ 10,410

$124,920

$ 2,280

$ 27,360

34%

$ 3,420

$ 41,040

51%

$ 1,750

$ 21,000

26%

$ 4,090

$ 49,080

61%

$95,000

$ 2,640

$ 31,680

33%

$ 11,200

$134,400

$ 2,460

$ 29,520

31%

$ 3,690

$ 44,280

47%

$ 1,890

$ 22,680

24%

$ 4,700

$ 52,800

56%

$120,000

$ 2,940

$ 35,280

29%

$ 12,440

$149,280

$ 2,720

$ 32,640

29%

$ 4,080

$ 48,960

41%

$ 2,090

$ 25,080

21%

$ 4,870

$ 58,440

49%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT