Santa Maria Village received voter approval to issue bonds for construction of a bike path, including restrooms and picnic shelters, along village oceanfront. The finance department has discussed three different financing mechanisms. As a new accountant for the village, you want to be prepared to record each option. Required Prepare journal entries for capital projects fund and the government-wide governmental activities general journal for each of the following unrelated transactions. (The General Fund should not be used.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Fund/ Governmental Transaction General Journal Debit Activities 1. The village sells $3,600,000 of 3 percent construction-related bonds at par. The construction is related to governmental activities. Capital Projects Fund Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental activities in Capital Projects Fund. 1 Govemmental Activities Credit Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental activities in Governmental Activities 2. The village secures a bond anticipation note payable in the amount of $166,000 to pay initial expenses. This note is considered short-term Capital Projects Fund Record the payment of $166,000 initial expenses on the short-term note payable in Capital Projects Fund. 2

Santa Maria Village received voter approval to issue bonds for construction of a bike path, including restrooms and picnic shelters, along village oceanfront. The finance department has discussed three different financing mechanisms. As a new accountant for the village, you want to be prepared to record each option. Required Prepare journal entries for capital projects fund and the government-wide governmental activities general journal for each of the following unrelated transactions. (The General Fund should not be used.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Fund/ Governmental Transaction General Journal Debit Activities 1. The village sells $3,600,000 of 3 percent construction-related bonds at par. The construction is related to governmental activities. Capital Projects Fund Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental activities in Capital Projects Fund. 1 Govemmental Activities Credit Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental activities in Governmental Activities 2. The village secures a bond anticipation note payable in the amount of $166,000 to pay initial expenses. This note is considered short-term Capital Projects Fund Record the payment of $166,000 initial expenses on the short-term note payable in Capital Projects Fund. 2

Chapter6: Business Expenses

Section: Chapter Questions

Problem 78IIP

Related questions

Question

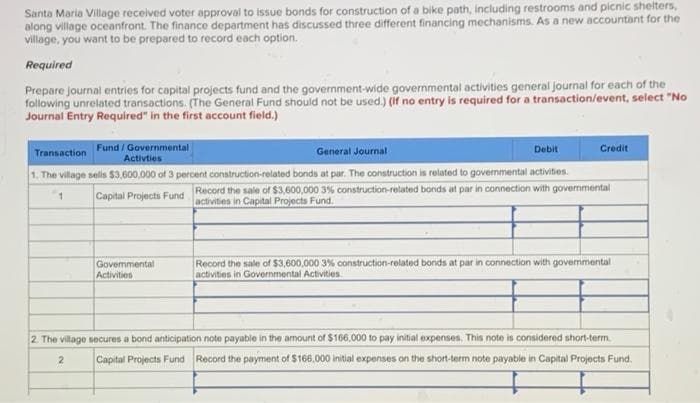

Transcribed Image Text:Santa Maria Village received voter approval to issue bonds for construction of a bike path, including restrooms and picnic shelters,

along village oceanfront. The finance department has discussed three different financing mechanisms. As a new accountant for the

village, you want to be prepared to record each option.

Required

Prepare journal entries for capital projects fund and the government-wide governmental activities general journal for each of the

following unrelated transactions. (The General Fund should not be used.) (If no entry is required for a transaction/event, select "No

Journal Entry Required" in the first account field.)

Fund/ Governmental

Transaction

General Journal

Debit

Activities

1. The village sells $3,600,000 of 3 percent construction-related bonds at par. The construction is related to governmental activities.

Capital Projects Fund

Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental

activities in Capital Projects Fund.

Govemmental

Activities

2

Credit

Record the sale of $3,600,000 3% construction-related bonds at par in connection with governmental

activities in Governmental Activities.

2. The village secures a bond anticipation note payable in the amount of $166,000 to pay initial expenses. This note is considered short-term

Capital Projects Fund Record the payment of $166,000 initial expenses on the short-term note payable in Capital Projects Fund.

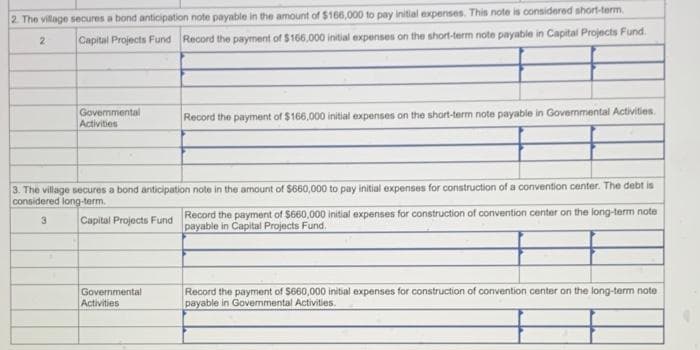

Transcribed Image Text:2. The village secures a bond anticipation note payable in the amount of $166,000 to pay initial expenses. This note is considered short-term

Capital Projects Fund Record the payment of $166,000 initial expenses on the short-term note payable in Capital Projects Fund.

2

Governmental

Activities

Record the payment of $166,000 initial expenses on the short-term note payable in Governmental Activities.

3. The village secures a bond anticipation note in the amount of $660,000 to pay initial expenses for construction of a convention center. The debt is

considered long-term.

3

Capital Projects Fund

Governmental

Activities

Record the payment of $660,000 initial expenses for construction of convention center on the long-term note

payable in Capital Projects Fund.

Record the payment of $660,000 initial expenses for construction of convention center on the long-term note

payable in Govemmental Activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you