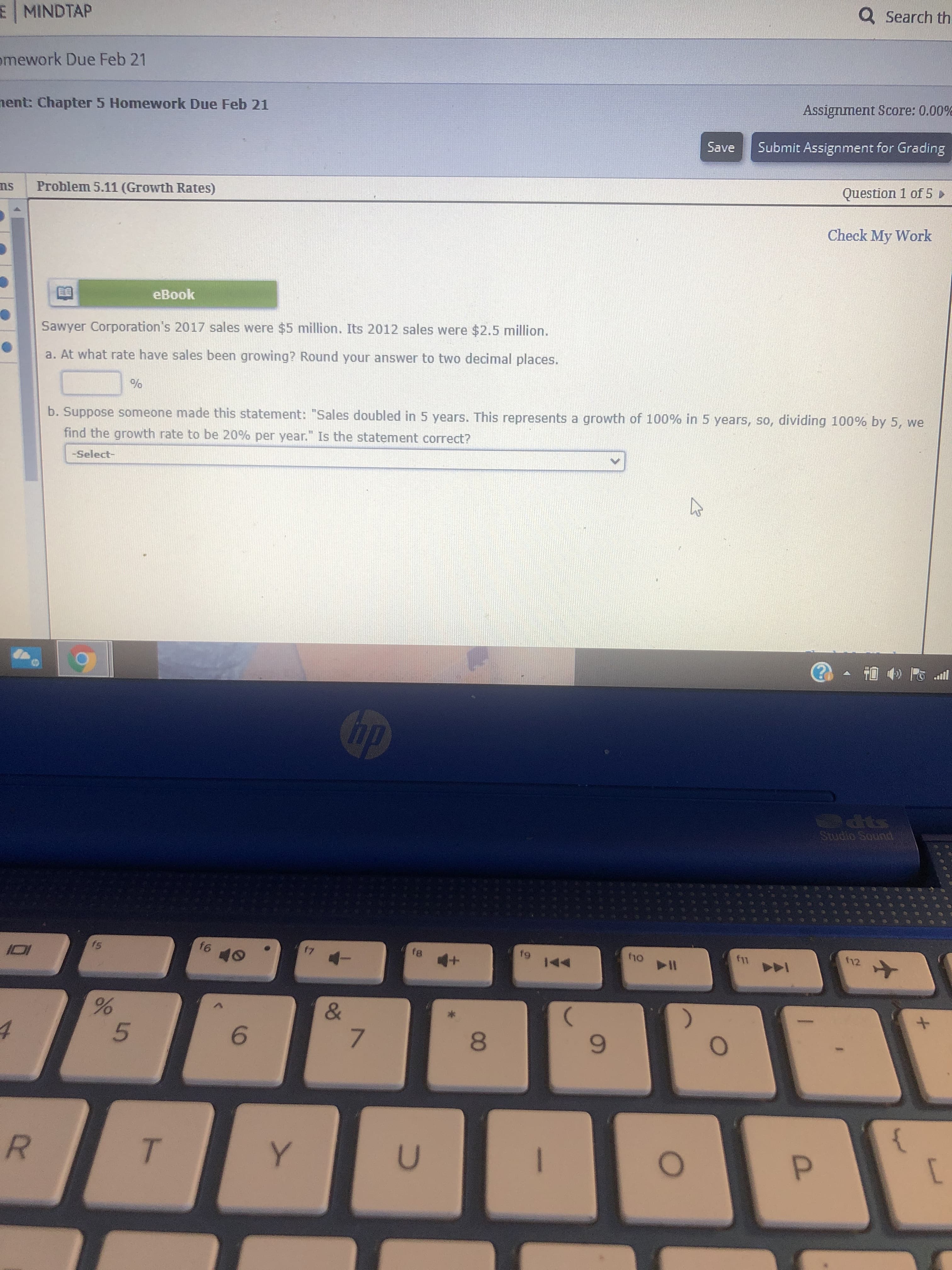

Sawyer Corporation's 2017 sales were $5 million. Its 2012 sales were $2.5 million. a. At what rate have sales been growing? Round your answer to two decimal places. b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years, so, dividing 100% by 5, we find the growth rate to be 20% per year." Is the statement correct? -Select-

Sawyer Corporation's 2017 sales were $5 million. Its 2012 sales were $2.5 million. a. At what rate have sales been growing? Round your answer to two decimal places. b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years, so, dividing 100% by 5, we find the growth rate to be 20% per year." Is the statement correct? -Select-

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 3P

Related questions

Question

100%

Transcribed Image Text:Sawyer Corporation's 2017 sales were $5 million. Its 2012 sales were $2.5 million.

a. At what rate have sales been growing? Round your answer to two decimal places.

b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years, so, dividing 100% by 5, we

find the growth rate to be 20% per year." Is the statement correct?

-Select-

Expert Solution

Step 1 - Formula

CAGR = [ Future value / Present Value ]1/n - 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT