Sax Company signs a lease agreement dated January 1, 2016, that provides for it to lease computers from Appleton Company beginning January 1, 2016. The lease terms, provisions, and related events are as folovs: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. 2. The computers have an estimated ife of 5 years, a fair value of 5300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs. 4. The lease contains no renewal or bargain purchase option. 5. The annual payment is set by Appleton at 583,22 92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate, which is equal to its borrowing rate. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax 2. Calculate the amount of the asset and liability of Sax at the inception of the lease. 3. Prepare a table summarizing the lease payments and interest expense 4. Prepare journal entries for Sax for the years 2016 and 2017. 5. Next Level if the lease term is 3 years and the annual payment is $110,000, how would Sax classity the lease under (a) U.S. GAAP and (b) IFRS?

Sax Company signs a lease agreement dated January 1, 2016, that provides for it to lease computers from Appleton Company beginning January 1, 2016. The lease terms, provisions, and related events are as folovs: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. 2. The computers have an estimated ife of 5 years, a fair value of 5300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs. 4. The lease contains no renewal or bargain purchase option. 5. The annual payment is set by Appleton at 583,22 92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate, which is equal to its borrowing rate. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax 2. Calculate the amount of the asset and liability of Sax at the inception of the lease. 3. Prepare a table summarizing the lease payments and interest expense 4. Prepare journal entries for Sax for the years 2016 and 2017. 5. Next Level if the lease term is 3 years and the annual payment is $110,000, how would Sax classity the lease under (a) U.S. GAAP and (b) IFRS?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 3E: Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides...

Related questions

Question

need help with parts 4 and 5

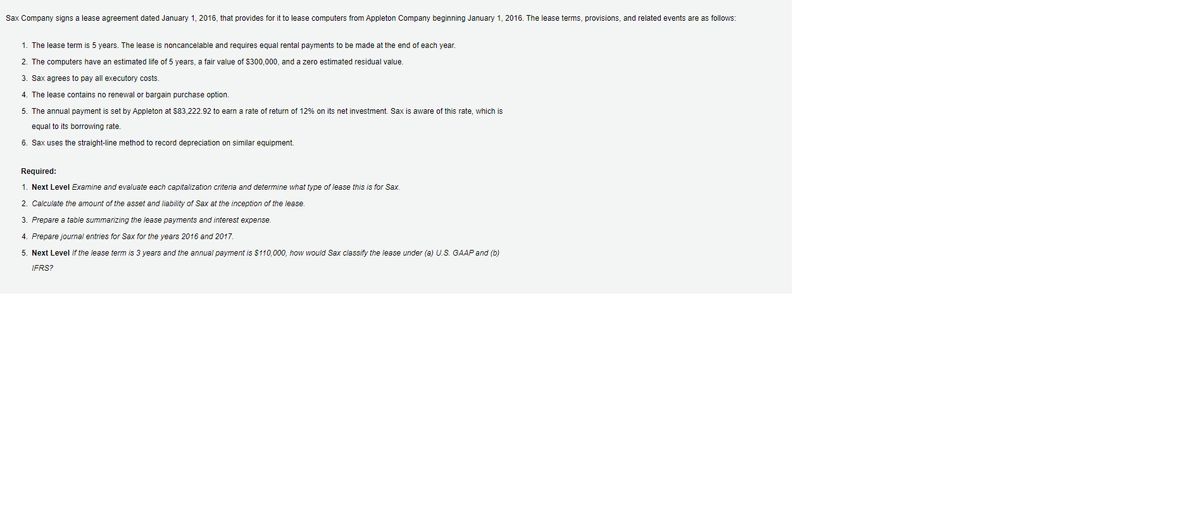

Transcribed Image Text:Sax Company signs a lease agreement dated January 1, 2016, that provides for it to lease computers from Appleton Company beginning January 1, 2016. The lease terms, provisions, and related events are as follows:

1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year.

2. The computers have an estimated life of 5 years, a fair value of $300,000, and a zero estimated residual value.

3. Sax agrees to pay all executory costs.

4. The lease contains no renewal or bargain purchase option.

5. The annual payment is set by Appleton at $83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate, which is

equal to its borrowing rate.

6. Sax uses the straight-line method to record depreciation on similar equipment.

Required:

1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax.

2. Calculate the amount of the asset and liability of Sax at the inception of the lease.

3. Prepare a table summarizing the lease payments and interest expense.

4. Prepare journal entries for Sax for the years 2016 and 2017.

5. Next Level If the lease term is 3 years and the annual payment is $110,000, how would Sax classify the lease under (a) U.S. GAAP and (b)

IFRS?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning