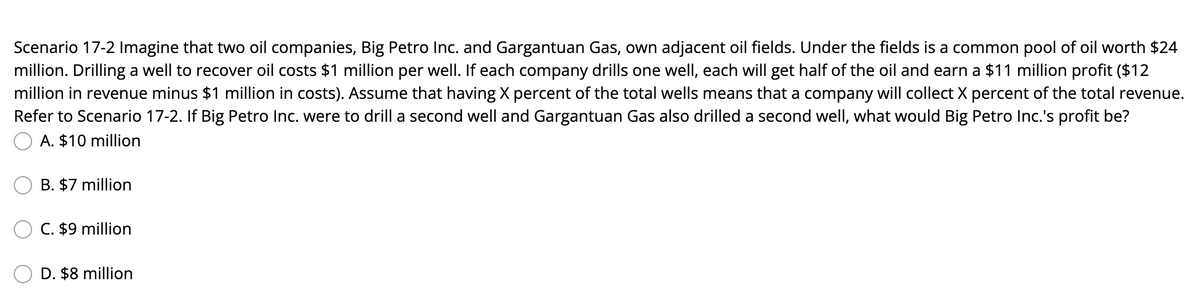

Scenario 17-2 Imagine that two oil companies, Big Petro Inc. and Gargantuan Gas, own adjacent oil fields. Under the fields is a common pool of oil worth $24 million. Drilling a well to recover oil costs $1 million per well. If each company drills one well, each will get half of the oil and earn a $11 million profit ($12 million in revenue minus $1 million in costs). Assume that having X percent of the total wells means that a company will collect X percent of the total revenue. Refer to Scenario 17-2. If Big Petro Inc. were to drill a second well and Gargantuan Gas also drilled a second well, what would Big Petro Inc.'s profit be? A. $10 million B. $7 million C. $9 million D. $8 million

Scenario 17-2 Imagine that two oil companies, Big Petro Inc. and Gargantuan Gas, own adjacent oil fields. Under the fields is a common pool of oil worth $24 million. Drilling a well to recover oil costs $1 million per well. If each company drills one well, each will get half of the oil and earn a $11 million profit ($12 million in revenue minus $1 million in costs). Assume that having X percent of the total wells means that a company will collect X percent of the total revenue. Refer to Scenario 17-2. If Big Petro Inc. were to drill a second well and Gargantuan Gas also drilled a second well, what would Big Petro Inc.'s profit be? A. $10 million B. $7 million C. $9 million D. $8 million

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter9: The Financial Markets And The Economy: The Tail That Wags The Dog

Section: Chapter Questions

Problem 5TY

Related questions

Question

Answer it correctly please. I will rate accordingly. This is my last attempt. Multiple votes will be given. Ty-

Transcribed Image Text:Scenario 17-2 Imagine that two oil companies, Big Petro Inc. and Gargantuan Gas, own adjacent oil fields. Under the fields is a common pool of oil worth $24

million. Drilling a well to recover oil costs $1 million per well. If each company drills one well, each will get half of the oil and earn a $11 million profit ($12

million in revenue minus $1 million in costs). Assume that having X percent of the total wells means that a company will collect X percent of the total revenue.

Refer to Scenario 17-2. If Big Petro Inc. were to drill a second well and Gargantuan Gas also drilled a second well, what would Big Petro Inc.'s profit be?

A. $10 million

B. $7 million

C. $9 million

D. $8 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning