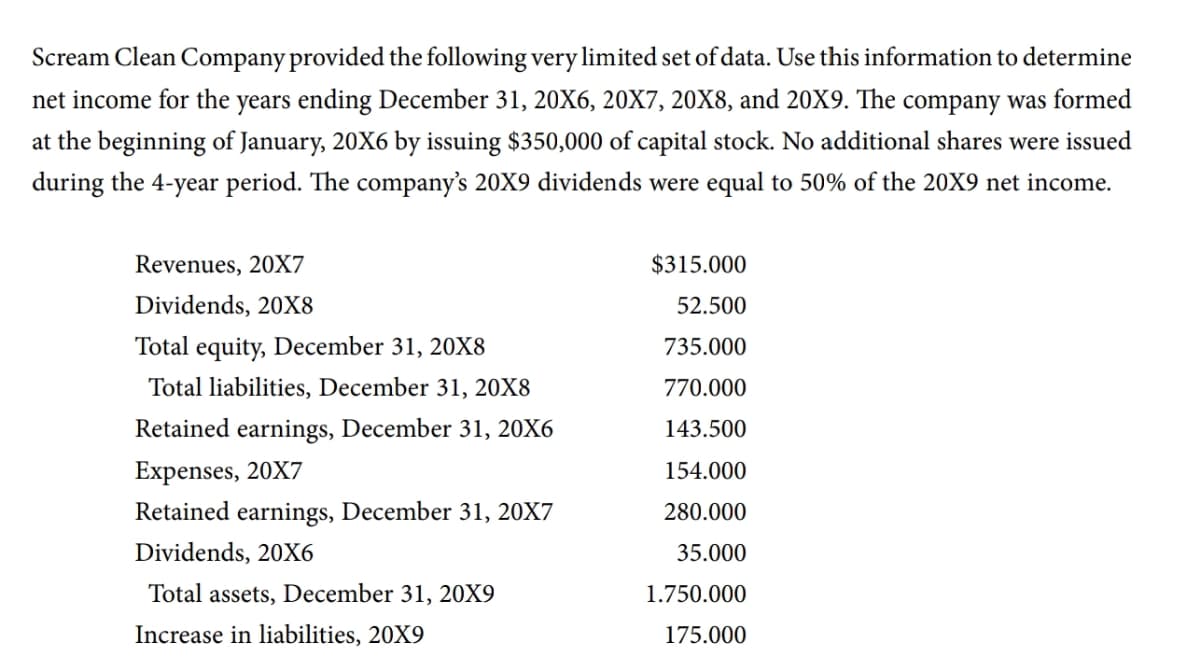

Scream Clean Company provided the following very limited set of data. Use this information to determine net income for the years ending December 31, 20X6, 20X7, 20X8, and 20X9. The company was formed at the beginning of January, 20X6 by issuing $350,000 of capital stock. No additional shares were issued during the 4-year period. The company's 20X9 dividends were equal to 50% of the 20X9 net income. Revenues, 20X7 $315.000 Dividends, 20X8 52.500 Total equity, December 31, 20X8 735.000 Total liabilities, December 31, 20X8 770.000 Retained earnings, December 31, 20X6 143.500 Expenses, 20X7 154.000 Retained earnings, December 31, 20X7 280.000 Dividends, 20X6 35.000 Total assets, December 31, 20X9 1.750.000 Increase in liabilities, 20X9 175.000

Scream Clean Company provided the following very limited set of data. Use this information to determine net income for the years ending December 31, 20X6, 20X7, 20X8, and 20X9. The company was formed at the beginning of January, 20X6 by issuing $350,000 of capital stock. No additional shares were issued during the 4-year period. The company's 20X9 dividends were equal to 50% of the 20X9 net income. Revenues, 20X7 $315.000 Dividends, 20X8 52.500 Total equity, December 31, 20X8 735.000 Total liabilities, December 31, 20X8 770.000 Retained earnings, December 31, 20X6 143.500 Expenses, 20X7 154.000 Retained earnings, December 31, 20X7 280.000 Dividends, 20X6 35.000 Total assets, December 31, 20X9 1.750.000 Increase in liabilities, 20X9 175.000

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 21EB: Brunleigh Corporation earned net income of $200,000 this year. The company began the year with...

Related questions

Question

100%

Transcribed Image Text:Scream Clean Company provided the following very limited set of data. Use this information to determine

net income for the years ending December 31, 20X6, 20X7, 20X8, and 20X9. The company was formed

at the beginning of January, 20X6 by issuing $350,000 of capital stock. No additional shares were issued

during the 4-year period. The company's 20X9 dividends were equal to 50% of the 20X9 net income.

Revenues, 20X7

$315.000

Dividends, 20X8

52.500

Total equity, December 31, 20X8

735.000

Total liabilities, December 31, 20X8

770.000

Retained earnings, December 31, 20X6

143.500

Expenses, 20X7

154.000

Retained earnings, December 31, 20X7

280.000

Dividends, 20X6

35.000

Total assets, December 31, 20X9

1.750.000

Increase in liabilities, 20X9

175.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning