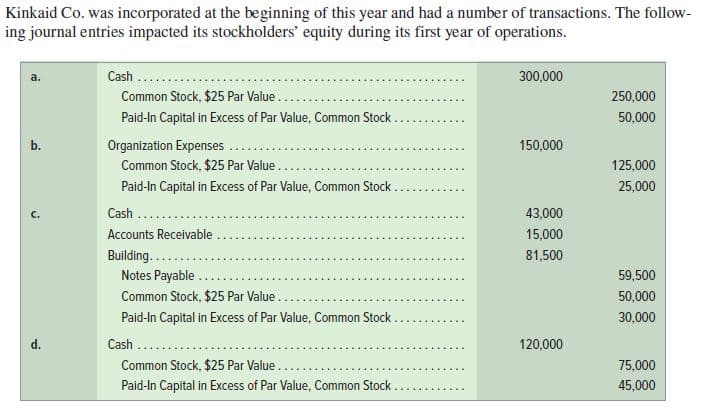

Kinkaid Co. was incorporated at the beginning of this year and had a number of transactions. The follow- ing journal entries impacted its stockholders' equity during its first year of operations. Cash .... 300,000 Common Stock, $25 Par Value . 250,000 Paid-In Capital in Excess of Par Value, Common Stock. 50,000 b. Organization Expenses .. 150,000 Common Stock, $25 Par Value.. 125,000 Paid-In Capital in Excess of Par Value, Common Stock 25,000 Cash ..... 43,000 Accounts Receivable 15,000 Building... 81,500 Notes Payable . 59,500 Common Stock, $25 Par Value 50,000 Paid-In Capital in Excess of Par Value, Common Stock 30,000 d. Cash .. 120,000 Common Stock, $25 Par Value 75,000 Paid-In Capital in Excess of Par Value, Common Stock 45,000

Kinkaid Co. was incorporated at the beginning of this year and had a number of transactions. The follow- ing journal entries impacted its stockholders' equity during its first year of operations. Cash .... 300,000 Common Stock, $25 Par Value . 250,000 Paid-In Capital in Excess of Par Value, Common Stock. 50,000 b. Organization Expenses .. 150,000 Common Stock, $25 Par Value.. 125,000 Paid-In Capital in Excess of Par Value, Common Stock 25,000 Cash ..... 43,000 Accounts Receivable 15,000 Building... 81,500 Notes Payable . 59,500 Common Stock, $25 Par Value 50,000 Paid-In Capital in Excess of Par Value, Common Stock 30,000 d. Cash .. 120,000 Common Stock, $25 Par Value 75,000 Paid-In Capital in Excess of Par Value, Common Stock 45,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the...

Related questions

Question

Required

1. Explain the transaction(s) underlying each

2. How many shares of common stock are outstanding at year-end?

3. What is the total paid-in capital at year-end?

4. What is the book value per share of the common stock at year-end if total paid-in capital plus

earnings

Transcribed Image Text:Kinkaid Co. was incorporated at the beginning of this year and had a number of transactions. The follow-

ing journal entries impacted its stockholders' equity during its first year of operations.

Cash ....

300,000

Common Stock, $25 Par Value .

250,000

Paid-In Capital in Excess of Par Value, Common Stock.

50,000

b.

Organization Expenses ..

150,000

Common Stock, $25 Par Value..

125,000

Paid-In Capital in Excess of Par Value, Common Stock

25,000

Cash .....

43,000

Accounts Receivable

15,000

Building...

81,500

Notes Payable .

59,500

Common Stock, $25 Par Value

50,000

Paid-In Capital in Excess of Par Value, Common Stock

30,000

d.

Cash ..

120,000

Common Stock, $25 Par Value

75,000

Paid-In Capital in Excess of Par Value, Common Stock

45,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage