se Excel Skills in completing these requirements. You must use formulas and functions, cell references, and professional formatting. 1. Using examples from your textbook, or online research, prepare the Solar Solutions multi-step income statement for the year ended December 31, 2020. Include the EPS at the bottom. Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 1 decimal place.) 2. Prepare the Solar Solutions balance sheet for December 31, 2020. Include a vertical analysis column at the right and perform a vertical analysis of the balance sheet. (Use the percentage format with 1 decimal place.) 3. Prepare the Solar Solutions statement of cash flows for the year ended December 31, 2020. Use the indirect method. Your textbook has examples of this.

se Excel Skills in completing these requirements. You must use formulas and functions, cell references, and professional formatting. 1. Using examples from your textbook, or online research, prepare the Solar Solutions multi-step income statement for the year ended December 31, 2020. Include the EPS at the bottom. Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 1 decimal place.) 2. Prepare the Solar Solutions balance sheet for December 31, 2020. Include a vertical analysis column at the right and perform a vertical analysis of the balance sheet. (Use the percentage format with 1 decimal place.) 3. Prepare the Solar Solutions statement of cash flows for the year ended December 31, 2020. Use the indirect method. Your textbook has examples of this.

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 13PB: Following is the adjusted trial balance data for Garage Parts Unlimited as of December 31, 2019. A....

Related questions

Question

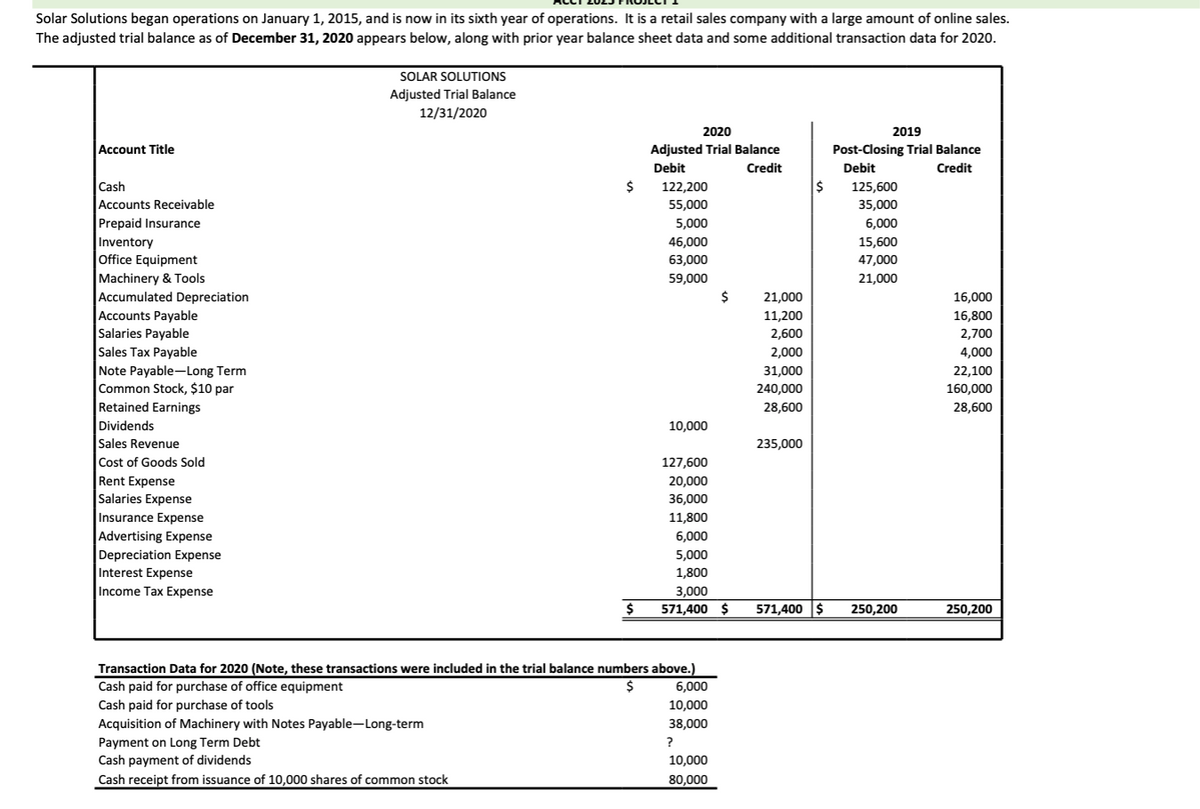

Transcribed Image Text:Solar Solutions began operations on January 1, 2015, and is now in its sixth year of operations. It is a retail sales company with a large amount of online sales.

The adjusted trial balance as of December 31, 2020 appears below, along with prior year balance sheet data and some additional transaction data for 2020.

SOLAR SOLUTIONS

Adjusted Trial Balance

12/31/2020

2020

2019

Account Title

Adjusted Trial Balance

Post-Closing Trial Balance

Debit

Credit

Debit

Credit

Cash

$

122,200

55,000

125,600

Accounts Receivable

35,000

Prepaid Insurance

5,000

6,000

|Inventory

Office Equipment

Machinery & Tools

Accumulated Depreciation

Accounts Payable

Salaries Payable

Sales Tax Payable

Note Payable-Long Term

Common Stock, $10 par

46,000

15,600

63,000

47,000

59,000

21,000

21,000

16,000

11,200

16,800

2,600

2,700

2,000

4,000

31,000

22,100

240,000

160,000

Retained Earnings

28,600

28,600

Dividends

10,000

Sales Revenue

Cost of Goods Sold

Rent Expense

Salaries Expense

235,000

127,600

20,000

36,000

Insurance Expense

11,800

Advertising Expense

Depreciation Expense

Interest Expense

6,000

5,000

1,800

Income Tax Expense

3,000

$

571,400 $

571,400 $

250,200

250,200

Transaction Data for 2020 (Note, these transactions were included in the trial balance numbers above.)

Cash paid for purchase of office equipment

$

6,000

Cash paid for purchase of tools

Acquisition of Machinery with Notes Payable-Long-term

10,000

38,000

Payment on Long Term Debt

Cash payment of dividends

?

10,000

Cash receipt from issuance of 10,000 shares of common stock

80,000

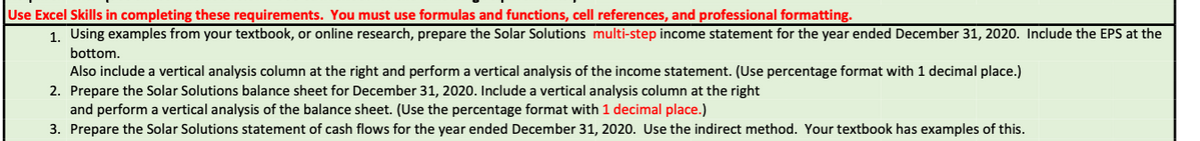

Transcribed Image Text:Use Excel Skills in completing these requirements. You must use formulas and functions, cell references, and professional formatting.

1. Using examples from your textbook, or online research, prepare the Solar Solutions multi-step income statement for the year ended December 31, 2020. Include the EPS at the

bottom.

Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 1 decimal place.)

2. Prepare the Solar Solutions balance sheet for December 31, 2020. Include a vertical analysis column at the right

and perform a vertical analysis of the balance sheet. (Use the percentage format with 1 decimal place.)

3. Prepare the Solar Solutions statement of cash flows for the year ended December 31, 2020. Use the indirect method. Your textbook has examples of this.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Could you provide the formulas for each of the bold answers?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning