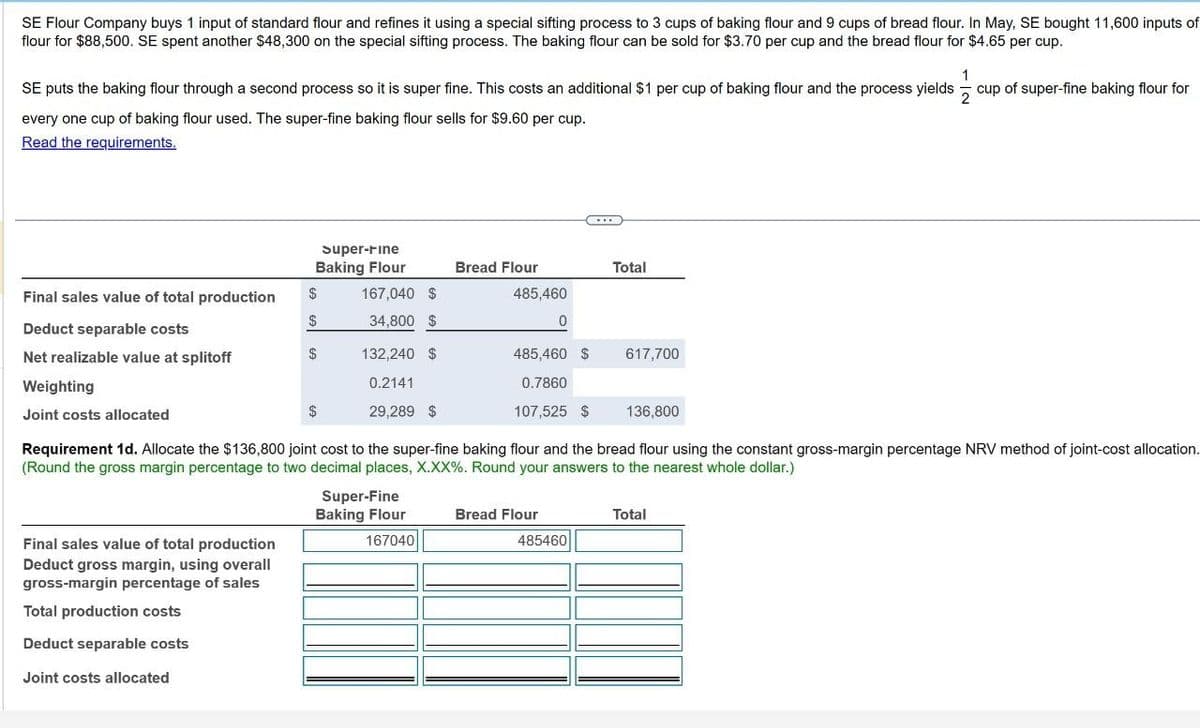

SE Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May, SE bought 11,600 inputs of flour for $88,500. SE spent another $48,300 on the special sifting process. The baking flour can be sold for $3.70 per cup and the bread flour for $4.65 per cup. 1 2 SE puts the baking flour through a second process so it is super fine. This costs an additional $1 per cup of baking flour and the process yields ½ ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Read the requirements. Super-rine Baking Flour Bread Flour Total Final sales value of total production $ 167,040 $ 485,460 $ 34,800 $ 0 Deduct separable costs Net realizable value at splitoff $ 132,240 $ 485,460 $ 617,700 Weighting 0.2141 0.7860 Joint costs allocated 29,289 $ 107,525 $ 136,800 Requirement 1d. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the constant gross-margin percentage NRV method of joint-cost allocation. (Round the gross margin percentage to two decimal places, X.XX%. Round your answers to the nearest whole dollar.) Final sales value of total production Deduct gross margin, using overall gross-margin percentage of sales Total production costs Deduct separable costs Joint costs allocated Super-Fine Baking Flour Bread Flour Total 167040 485460

SE Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May, SE bought 11,600 inputs of flour for $88,500. SE spent another $48,300 on the special sifting process. The baking flour can be sold for $3.70 per cup and the bread flour for $4.65 per cup. 1 2 SE puts the baking flour through a second process so it is super fine. This costs an additional $1 per cup of baking flour and the process yields ½ ½ cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Read the requirements. Super-rine Baking Flour Bread Flour Total Final sales value of total production $ 167,040 $ 485,460 $ 34,800 $ 0 Deduct separable costs Net realizable value at splitoff $ 132,240 $ 485,460 $ 617,700 Weighting 0.2141 0.7860 Joint costs allocated 29,289 $ 107,525 $ 136,800 Requirement 1d. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the constant gross-margin percentage NRV method of joint-cost allocation. (Round the gross margin percentage to two decimal places, X.XX%. Round your answers to the nearest whole dollar.) Final sales value of total production Deduct gross margin, using overall gross-margin percentage of sales Total production costs Deduct separable costs Joint costs allocated Super-Fine Baking Flour Bread Flour Total 167040 485460

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 4BE: Blakes Blacksmith Co. produces two types of shotguns, a 12-gauge and 20-gauge. The shotguns are made...

Related questions

Question

None

Transcribed Image Text:SE Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May, SE bought 11,600 inputs of

flour for $88,500. SE spent another $48,300 on the special sifting process. The baking flour can be sold for $3.70 per cup and the bread flour for $4.65 per cup.

1

2

SE puts the baking flour through a second process so it is super fine. This costs an additional $1 per cup of baking flour and the process yields ½ ½ cup of super-fine baking flour for

every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup.

Read the requirements.

Super-rine

Baking Flour

Bread Flour

Total

Final sales value of total production

$

167,040 $

485,460

$

34,800 $

0

Deduct separable costs

Net realizable value at splitoff

$

132,240 $

485,460 $

617,700

Weighting

0.2141

0.7860

Joint costs allocated

29,289 $

107,525 $

136,800

Requirement 1d. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the constant gross-margin percentage NRV method of joint-cost allocation.

(Round the gross margin percentage to two decimal places, X.XX%. Round your answers to the nearest whole dollar.)

Final sales value of total production

Deduct gross margin, using overall

gross-margin percentage of sales

Total production costs

Deduct separable costs

Joint costs allocated

Super-Fine

Baking Flour

Bread Flour

Total

167040

485460

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,