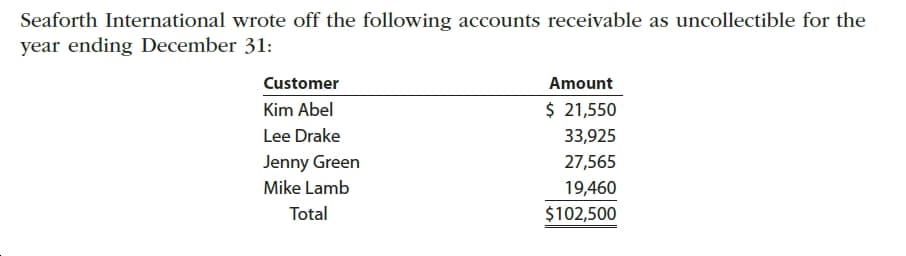

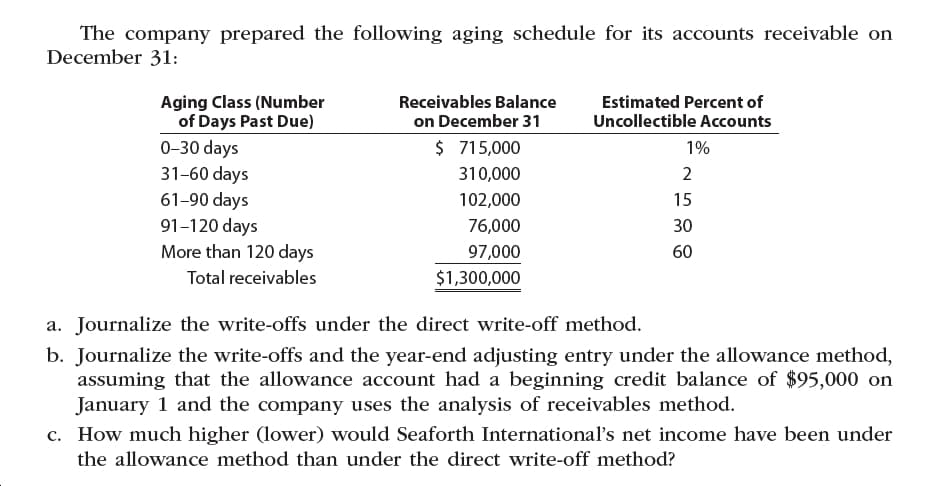

Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount $ 21,550 Kim Abel Lee Drake 33,925 Jenny Green 27,565 Mike Lamb 19,460 Total $102,500 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Estimated Percent of Uncollectible Accounts Receivables Balance on December 31 $ 715,000 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days 1% 310,000 102,000 15 76,000 30 97,000 60 Total receivables $1,300,000 a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning credit balance of $95,000 on January 1 and the company uses the analysis of receivables method. c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method?

Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount $ 21,550 Kim Abel Lee Drake 33,925 Jenny Green 27,565 Mike Lamb 19,460 Total $102,500 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Estimated Percent of Uncollectible Accounts Receivables Balance on December 31 $ 715,000 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days 1% 310,000 102,000 15 76,000 30 97,000 60 Total receivables $1,300,000 a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning credit balance of $95,000 on January 1 and the company uses the analysis of receivables method. c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method?

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 5EB: Catherines Cookies has a beginning balance in the Accounts Receivable control total account of...

Related questions

Question

100%

Transcribed Image Text:Seaforth International wrote off the following accounts receivable as uncollectible for the

year ending December 31:

Customer

Amount

$ 21,550

Kim Abel

Lee Drake

33,925

Jenny Green

27,565

Mike Lamb

19,460

Total

$102,500

Transcribed Image Text:The company prepared the following aging schedule for its accounts receivable on

December 31:

Aging Class (Number

of Days Past Due)

Estimated Percent of

Uncollectible Accounts

Receivables Balance

on December 31

$ 715,000

0-30 days

31-60 days

61-90 days

91-120 days

More than 120 days

1%

310,000

102,000

15

76,000

30

97,000

60

Total receivables

$1,300,000

a. Journalize the write-offs under the direct write-off method.

b. Journalize the write-offs and the year-end adjusting entry under the allowance method,

assuming that the allowance account had a beginning credit balance of $95,000 on

January 1 and the company uses the analysis of receivables method.

c. How much higher (lower) would Seaforth International's net income have been under

the allowance method than under the direct write-off method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub