Search or type a command gement Accounting for KUBIM) O $1.00 49. If the National Division of American Products Company had a turnover ratio of 4.2 and a margin of 0.10, the return on investment would be * (1 Point) O 42.0%. O 23.8%. O 238.0%. O 420.0%. 50. Seaside Company produces picture frames. During the year 190,000 picture frames were produced. Materials and labor standards for producing the picture frames are as follows: Direct materials (2 pieces of wood @ $2.25) $4.50 Direct labor (2 hours @ $10) Seaside purchased and used 400,000 pieces of wood at $2.00 each and its actual labor hours were 360,000 hours at a wage rate of $10.50. What is the materials usage variance? * (1 Point) $20.00 O $45,000 U O $112,500 U O $112,500 F O $45,000 F 51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The firm owns four machines that together provide 18,000 hours of machine time per year. The classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine time. What is the contribution margin per hour of machine time for a fancy lamp? * (1 Dein Search or type a command gement Accounting for KUBIM) 51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The firm owns four machines that together provide 18,000 hours of machine time per year. The classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine time. What is the contribution margin per hour of machine time for a fancy lamp? * (1 Point) O $8 O $42 O $13 O $6 O $21 52. Which of the following is not an advantage of ROI? * (1 Point) It encourages managers of departments with high ROIS to invest in average ROI projects. It encourages cost efficiency. It discourages excessive investment in operating assets. It encourages managers to pay careful attention to the relationships among sales, expenses, and investment. 53. The manager of Stock Division projects the following for next year: Sales $185,000 Operating income Operating assets The manager can invest in an additional project that would require $40,000 investment in additional assets and would generate $6,000 of additional income. The company's minimum rate $60,000 $375,000

Search or type a command gement Accounting for KUBIM) O $1.00 49. If the National Division of American Products Company had a turnover ratio of 4.2 and a margin of 0.10, the return on investment would be * (1 Point) O 42.0%. O 23.8%. O 238.0%. O 420.0%. 50. Seaside Company produces picture frames. During the year 190,000 picture frames were produced. Materials and labor standards for producing the picture frames are as follows: Direct materials (2 pieces of wood @ $2.25) $4.50 Direct labor (2 hours @ $10) Seaside purchased and used 400,000 pieces of wood at $2.00 each and its actual labor hours were 360,000 hours at a wage rate of $10.50. What is the materials usage variance? * (1 Point) $20.00 O $45,000 U O $112,500 U O $112,500 F O $45,000 F 51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The firm owns four machines that together provide 18,000 hours of machine time per year. The classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine time. What is the contribution margin per hour of machine time for a fancy lamp? * (1 Dein Search or type a command gement Accounting for KUBIM) 51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The firm owns four machines that together provide 18,000 hours of machine time per year. The classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine time. What is the contribution margin per hour of machine time for a fancy lamp? * (1 Point) O $8 O $42 O $13 O $6 O $21 52. Which of the following is not an advantage of ROI? * (1 Point) It encourages managers of departments with high ROIS to invest in average ROI projects. It encourages cost efficiency. It discourages excessive investment in operating assets. It encourages managers to pay careful attention to the relationships among sales, expenses, and investment. 53. The manager of Stock Division projects the following for next year: Sales $185,000 Operating income Operating assets The manager can invest in an additional project that would require $40,000 investment in additional assets and would generate $6,000 of additional income. The company's minimum rate $60,000 $375,000

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:Search or type a command

gement Accounting for KUBIM)

O $1.00

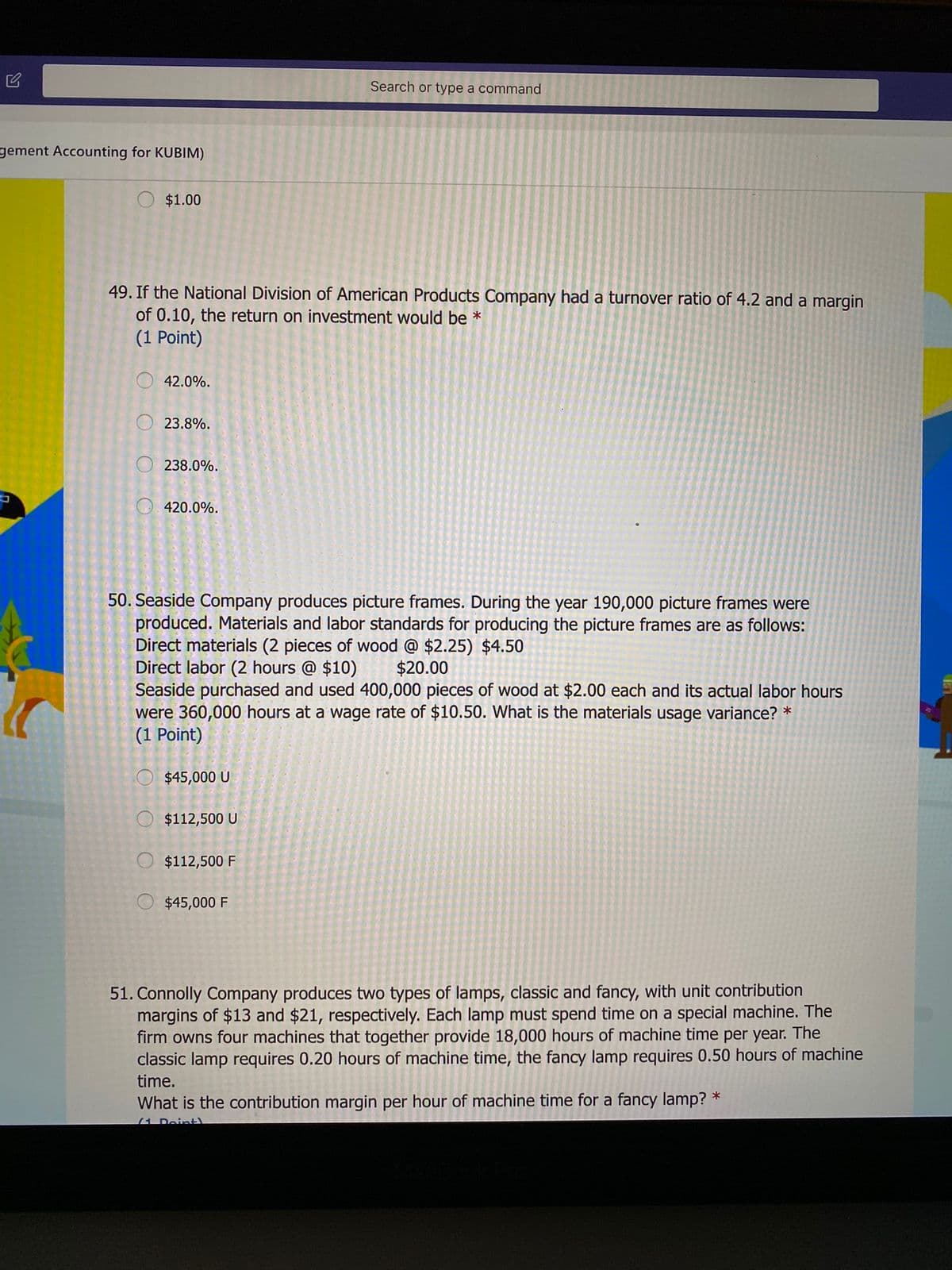

49. If the National Division of American Products Company had a turnover ratio of 4.2 and a margin

of 0.10, the return on investment would be *

(1 Point)

O 42.0%.

O 23.8%.

O 238.0%.

O 420.0%.

50. Seaside Company produces picture frames. During the year 190,000 picture frames were

produced. Materials and labor standards for producing the picture frames are as follows:

Direct materials (2 pieces of wood @ $2.25) $4.50

Direct labor (2 hours @ $10)

Seaside purchased and used 400,000 pieces of wood at $2.00 each and its actual labor hours

were 360,000 hours at a wage rate of $10.50. What is the materials usage variance? *

(1 Point)

$20.00

O $45,000 U

O $112,500 U

O $112,500 F

O $45,000 F

51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution

margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The

firm owns four machines that together provide 18,000 hours of machine time per year. The

classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine

time.

What is the contribution margin per hour of machine time for a fancy lamp? *

(1 Dein

Transcribed Image Text:Search or type a command

gement Accounting for KUBIM)

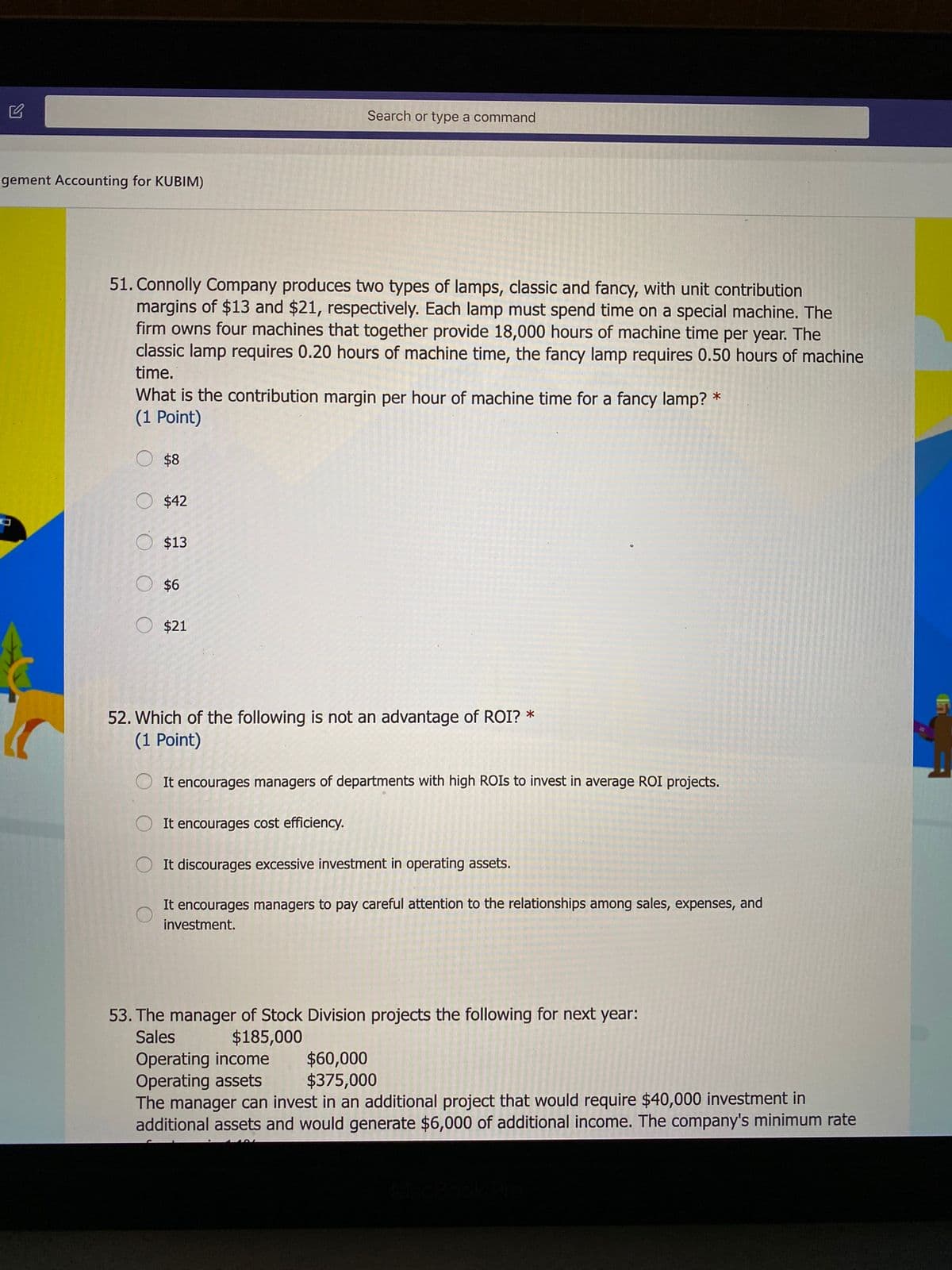

51. Connolly Company produces two types of lamps, classic and fancy, with unit contribution

margins of $13 and $21, respectively. Each lamp must spend time on a special machine. The

firm owns four machines that together provide 18,000 hours of machine time per year. The

classic lamp requires 0.20 hours of machine time, the fancy lamp requires 0.50 hours of machine

time.

What is the contribution margin per hour of machine time for a fancy lamp? *

(1 Point)

O $8

O $42

O $13

O $6

O $21

52. Which of the following is not an advantage of ROI? *

(1 Point)

It encourages managers of departments with high ROIS to invest in average ROI projects.

It encourages cost efficiency.

It discourages excessive investment in operating assets.

It encourages managers to pay careful attention to the relationships among sales, expenses, and

investment.

53. The manager of Stock Division projects the following for next year:

Sales

$185,000

Operating income

Operating assets

The manager can invest in an additional project that would require $40,000 investment in

additional assets and would generate $6,000 of additional income. The company's minimum rate

$60,000

$375,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning