Sullivan Equipment Sales showed the following. 2020 Jan. 15 Sold $25,000 of nerchandise for $29, e00 to JanCo; terms 3/5, n/15. 16 krote off Fedun's account in the anount of $15,000. 20 Collected the anount owing tron the January 15 sale. 1 Accepted a $12,000, 68-day, 7% note dated this day in granting Parker Holdings a tine extension on its past-due account. Mar. Apr. 15 Sold nerchandise costing $62,000 for $71,000 to custoners who used their Visa credit cards. Assune Visa charges a 1% fee and deposits the cash electronically into the retaller's account innediately at the time of sale. ? Parker Holdings honoured the note dated March 1. 1 Accepted a $24,e00, three-nonth, 6X note dated this day in granting Grant Conpany a time extension on its past-due Nov. account. Dec. 31 Sullivan's year-end. Interest was accrued on outstanding notes receivable. 31 Bad debts are based on an aging analysis that estinated $9,700 of accounts receivable are uncollectible. Allowance for Doubtful Accounts showed an unad justed credit balance of $1,600 on this date. 2021 ? Grant Company dishonoured its note dated November 1, 2020. 5 Recovered $1, 5ee fron Derek Holston that was previously written off. 14 Wrote off the Grant Conpany account. Mar.

Sullivan Equipment Sales showed the following. 2020 Jan. 15 Sold $25,000 of nerchandise for $29, e00 to JanCo; terms 3/5, n/15. 16 krote off Fedun's account in the anount of $15,000. 20 Collected the anount owing tron the January 15 sale. 1 Accepted a $12,000, 68-day, 7% note dated this day in granting Parker Holdings a tine extension on its past-due account. Mar. Apr. 15 Sold nerchandise costing $62,000 for $71,000 to custoners who used their Visa credit cards. Assune Visa charges a 1% fee and deposits the cash electronically into the retaller's account innediately at the time of sale. ? Parker Holdings honoured the note dated March 1. 1 Accepted a $24,e00, three-nonth, 6X note dated this day in granting Grant Conpany a time extension on its past-due Nov. account. Dec. 31 Sullivan's year-end. Interest was accrued on outstanding notes receivable. 31 Bad debts are based on an aging analysis that estinated $9,700 of accounts receivable are uncollectible. Allowance for Doubtful Accounts showed an unad justed credit balance of $1,600 on this date. 2021 ? Grant Company dishonoured its note dated November 1, 2020. 5 Recovered $1, 5ee fron Derek Holston that was previously written off. 14 Wrote off the Grant Conpany account. Mar.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PB: Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following...

Related questions

Question

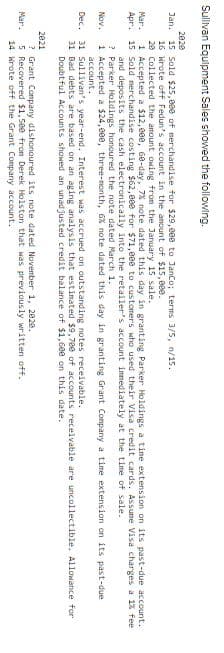

Transcribed Image Text:Sullivan Equipment Sales showed the following.

2020

Jan. 15 Sold $25,000 of nerchandise for $29, e00 to JanCo; terms 3/5, n/15.

16 krote off Fedun's account in the anount of $15,000.

20 Collected the anount owing tron the January 15 sale.

1 Accepted a $12,000, 68-day, 7% note dated this day in granting Parker Holdings a tine extension on its past-due account.

Mar.

Apr. 15 Sold nerchandise costing $62,000 for $71,000 to custoners who used their Visa credit cards. Assune Visa charges a 1% fee

and deposits the cash electronically into the retaller's account innediately at the time of sale.

? Parker Holdings honoured the note dated March 1.

1 Accepted a $24,e00, three-nonth, 6X note dated this day in granting Grant Conpany a time extension on its past-due

Nov.

account.

Dec. 31 Sullivan's year-end. Interest was accrued on outstanding notes receivable.

31 Bad debts are based on an aging analysis that estinated $9,700 of accounts receivable are uncollectible. Allowance for

Doubtful Accounts showed an unad justed credit balance of $1,600 on this date.

2021

? Grant Company dishonoured its note dated November 1, 2020.

5 Recovered $1, 5ee fron Derek Holston that was previously written off.

14 Wrote off the Grant Conpany account.

Mar.

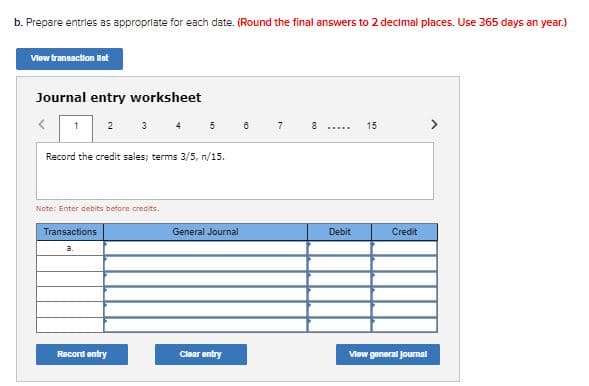

Transcribed Image Text:b. Prepare entries as approprlate for each date. (Round the final answers to 2 decimal places. Use 365 days an year.)

View transaction lat

Journal entry worksheet

2

3

4

5

8

15

.....

Record the credit sales; terms 3/5, n/15.

Note: Enter debits before credits.

Transactions

General Journal

Debit

Credit

a.

Record entry

Clear entry

View general Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Sullivan’s receivable turnovers at December 31, 2020 and 2021 were 7 and 7.5, respectively. Select the correct option for whether the change in the ratio for Sullivan was favourable or unfavourable.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning