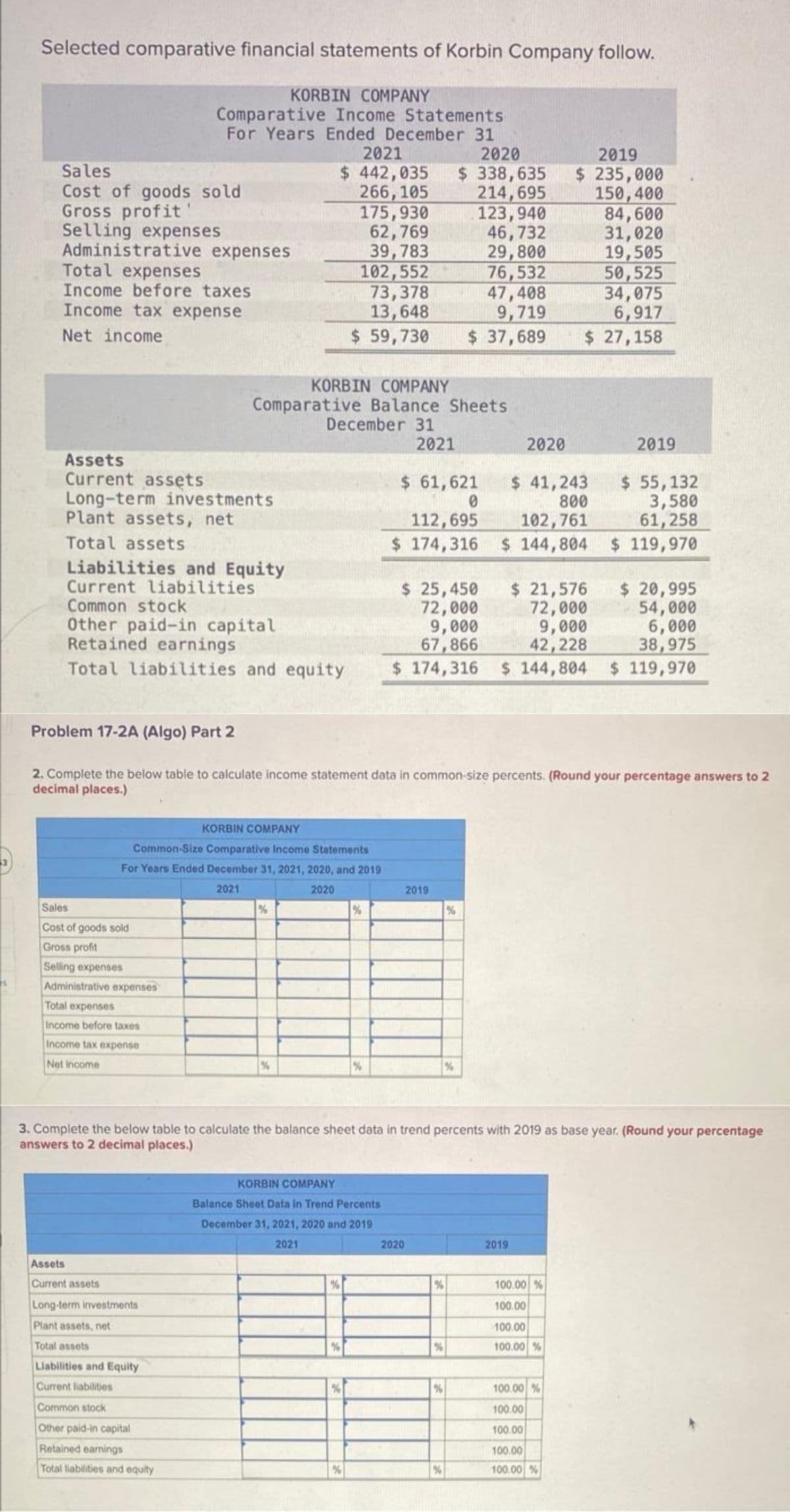

Selected comparative financial statements of Korbin Company follow. Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 $ 442,035 $ 338,635 $ 235,000 266,105 214,695 150,400 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 2019 2021 2020 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity December 31 175,930 62,769 39,783 102,552 73,378 13,648 $ 59,730 $ 37,689 % $ 25,450 $ 21,576 $ 20,995 72,000 54,000 72,000 9,000 9,000 6,000 67,866 42,228 38,975 Total liabilities and equity $ 174,316 $ 144,804 $ 119,970 % Problem 17-2A (Algo) Part 2 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) % % KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 % % 2021 $ 61,621 0 112,695 $ 174,316 2019 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as base year. (Round your percentage answers to 2 decimal places.) 2020 123,940 46,732 29,800 76,532 47,408 9,719 % % % % % 2020 $ 41,243 $ 55,132 800 102,761 3,580 61,258 $ 144,804 $ 119,970 2019 84,600 31,020 19,505 50,525 34,075 6,917 $ 27,158 100.00 % 100.00 100.00 100.00 % 2019 100.00 % 100.00 100.00 100.00 100.00 %

Selected comparative financial statements of Korbin Company follow. Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 $ 442,035 $ 338,635 $ 235,000 266,105 214,695 150,400 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 2019 2021 2020 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity December 31 175,930 62,769 39,783 102,552 73,378 13,648 $ 59,730 $ 37,689 % $ 25,450 $ 21,576 $ 20,995 72,000 54,000 72,000 9,000 9,000 6,000 67,866 42,228 38,975 Total liabilities and equity $ 174,316 $ 144,804 $ 119,970 % Problem 17-2A (Algo) Part 2 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) % % KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 % % 2021 $ 61,621 0 112,695 $ 174,316 2019 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as base year. (Round your percentage answers to 2 decimal places.) 2020 123,940 46,732 29,800 76,532 47,408 9,719 % % % % % 2020 $ 41,243 $ 55,132 800 102,761 3,580 61,258 $ 144,804 $ 119,970 2019 84,600 31,020 19,505 50,525 34,075 6,917 $ 27,158 100.00 % 100.00 100.00 100.00 % 2019 100.00 % 100.00 100.00 100.00 100.00 %

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Selected comparative financial statements of Korbin Company follow.

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31

2021

2020

$ 442,035 $ 338,635

266,105

214,695

123,940

46,732

29,800

76,532

47,408

9,719

Sales

Cost of goods sold

Gross profit!

Selling expenses

Administrative expenses

Total expenses

Income before taxes

Income tax expense

Net income

Assets

Current assets

Long-term investments

Plant assets, net

Total assets

Liabilities and Equity

Current liabilities

Common stock

Other paid-in capital

Retained earnings

KORBIN COMPANY

Comparative Balance Sheets

Sales

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

Income before taxes

Income tax expense

Net income

Assets

Current assets

KORBIN COMPANY

Common-Size Comparative Income Statements

For Years Ended December 31, 2021, 2020, and 2019

2021

2020

Long-term investments

Plant assets, net

Total assets

175,930

62,769

39,783

102,552

73,378

13,648

$ 59,730 $ 37,689

Liabilities and Equity

Current liabilities

Common stock

Other paid-in capital

Retained earnings

Total liabilities and equity

December 31

%

%

$ 20,995

$ 25,450

72,000

9,000

54,000

6,000

67,866

38,975

Total liabilities and equity $ 174,316 $144,804 $ 119,970

Problem 17-2A (Algo) Part 2

2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2

decimal places.)

%

%

2021

$ 61,621

0

KORBIN COMPANY

Balance Sheet Data in Trend Percents

December 31, 2021, 2020 and 2019

2021

112,695

$ 174,316

2020

2019

3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as base year. (Round your percentage

answers to 2 decimal places.)

%

%

%

2020

%

%

2019

$ 235,000

150,400

$ 55,132

3,580

61,258

$ 144,804 $ 119,970

$ 41,243

800

102,761

2019

84,600

31,020

19,505

50,525

34,075

6,917

$ 27,158

$ 21,576

72,000

9,000

42,228

2019

100.00 %

100.00

100.00

100.00 %

100.00 %

100.00

100.00

100.00

100.00 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning