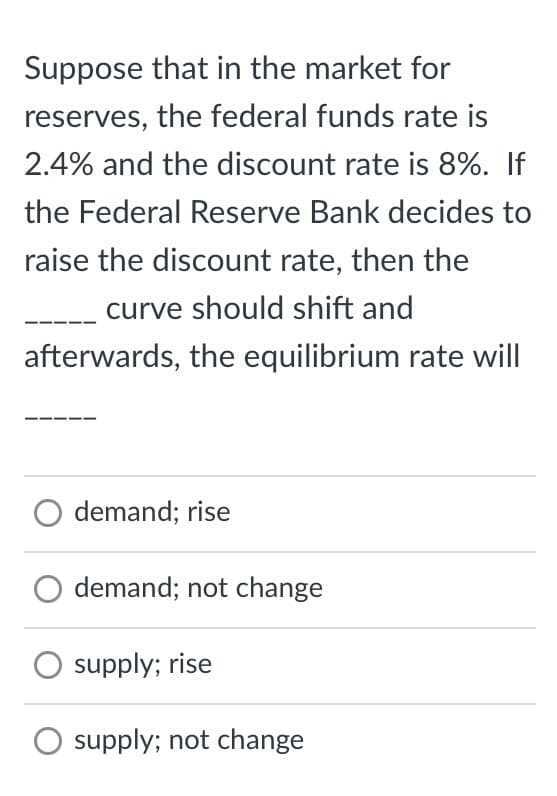

Suppose that in the market for reserves, the federal funds rate is 2.4% and the discount rate is 8%. If the Federal Reserve Bank decides to raise the discount rate, then the curve should shift and

Q: You are making a proposal to start a corporation that would require invested capital of P9,000,000…

A: Goodwill: When one firm is acquired by another, an intangible asset known as goodwill is transferred…

Q: What are budgets used for?

A: Management accounting is one of the branches of accounting. Unlike financial accounting, the…

Q: Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporated-a company…

A: Journal entries are the initial reporting of the business transactions in the books of an entity.…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The cashier line of a canteen can facilitate up to 60 customers an hour. Frequenters of the canteen…

A: Introduction:- The following basic information as follows under:- Cashier line of a canteen can…

Q: Data table Year Plan Alpha Plan Beta $ 1,600,000 $ 1,600,000 1,600,000 1,600,000 1,600,000 1,600,000…

A: Net Present Value (NPV): The difference between the present value of cash inflows and the present…

Q: On June 10, Sunland Company purchased $7,800 of merchandise from Blossom Company, terms 4/10, n/30.…

A: Journal Entries - Journal Entries are the primary record of the transaction entered into by the…

Q: Assume that Pawn has sufficient capacity to fill the order. What price should Pawn charge to make a…

A: Selling price = Total Cost + Profit Here required to find Firstly Total Profit. Then use the below…

Q: (a) Compute the profitability index for each project. (b) Based on the profitability index, which…

A: It's a method of capital Budgeting. It helps us to know whether a project must be accepted or…

Q: Prepare the entries for transaction below and indicate what journal it is 19 august sold…

A: Journal entries to record the transaction Given : Cost of merchandize old = $,3600 Account…

Q: The following balances were obtained from the books of Tim Curry plc as at December 31,…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Journal entry worksheet < 1 2 Record the payment of the note and interest on the maturity date. Date…

A:

Q: Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Luxury Cruise Lines incurs employee…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: will it be worthwhile to purchase the new machine using the present worth.

A: In the present scenario only costs are given , so, the costs are discounted to the present value in…

Q: On July 9, 2006, Twovens Ltd. purchased a used spindle machine at a bankruptcy sale for $56,151.…

A: Capital cost allowance (CCA) is the amount of amortization expense that the government allows to a…

Q: During the year, an entity had net purchases of P100. If inventories had a net decrease of P20…

A: in order to find the cost of good sold the equation can be taken as opening stock and then in such…

Q: During the year ended 30 September 2021 Hanlon Plc entered into two lease transactions. On 1…

A: Leases are agreements whereby the owner of a property or asset grants another party the right to use…

Q: Employer journal entry for Defined Benefit Pension

A: In a defined benefit (DB) pension plan, an employer guarantees a certain pension payment, lump-sum…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: >Partnership Income (Loss) is allocated based on the partnership agreement. >The Net…

Q: On January 1, the company purchased equipment that cost $10,000. The equipment is expected to be…

A: Depreciation expense is the non-cash expense which is reported in the books to report the regular…

Q: On January 1, 2024, Jackson purchased ABC Company for $900,000. At the time, ABC Company had assets…

A: In case of analysis of valency it is important to understand the assets value and liabilities value…

Q: Waterways Corporation mass-produces a simple water control and timer set. To produce these units,…

A: As per the honor code of Bartleby we are bound to give the answer of first three sub part only, we…

Q: Diego Company manufactures one product that is sold for $77 per unit in two geographic regions—the…

A: Using absorption Costing, both variable and fixed manufacturing cost are included in the product…

Q: QS 13-5 Retained earnings LO² Benson Inc. had a credit balance in Retained Earnings on December 31,…

A: Lets understand the basics. Retained earning shows how much earning is retained in the business over…

Q: Botosan Factory has budgeted factory overhead for the year at $13,500,000, and budgeted direct labor…

A: Introduction:- The following formula used to calculate Actual factory overhead applied as follows…

Q: Problem 2 Southeast Soda Pop, Inc., has a new fruit drink for which it has high hopes. John…

A: Introduction Beginning inventory and Ending inventory: Beginning inventory, also known as opening…

Q: [7:57 PM, 7/23/2022] Veron Walker Uwi: You are the audit senior on the audit engagement of Brown’s…

A: Here discuss about the details of Audit Procedures which can be used to examine the subsequent…

Q: The following balances were obtained from the books of Tim Curry plc as at December 31,…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Calculate the net present value and profitability index of each machine. Assume a 9% discount rate.…

A: Net present value Net Present Value (NPV) is calculated by deducting the initial investment required…

Q: Prepare the entries for transaction below and indicate what journal it is 21 august issued a $600…

A: The primary and foremost reporting of the business transactions is to be done in the journal entry…

Q: Prepare the entries for transaction below and indicate what journal it is 2 Aug business sold…

A: Journal entries are used to record the financial transactions in the books of accounts. It is the…

Q: Required information [The following information applies to the questions displayed below.] On July…

A: The depletion expense is charged on natural resources such as mineral, ores, etc. The depreciation…

Q: Diego Company manufactures one product that is sold for $77 per unit in two geographic regions—the…

A: Variable costing system is the one which estimates the cost of product based on variable costs only…

Q: (a) If Pena Company requires a 9% return on its investments, what is the net present value of this…

A: Net Present Value(NPV) is a financial metric that is used to evaluate the potential investment…

Q: Diego Company manufactures one product that is sold for $77 per unit in two geographic regions—the…

A: Variable costing is the technique of measuring cost that do not include the fixed overhead as a part…

Q: The city of Belle collects property taxes for other local governments—Beau County and the Landis…

A: Journal Entry Here incurred the journal entry for the use of custodial fund to the three different…

Q: left 0:3 Fraser Company has forecast purchases on account to be $210,000 in March, $270,000 in…

A: The budgeted cash payment indicates the amount of expected cash payment it makes. The company makes…

Q: 1. In December 2027. Taguan Bank reported a net income of P900,000, net of trading loss of P50,000.…

A: You have asked three questions under a single answerable question kindly resubmit remaining two…

Q: QS 13-8 Issuance of common shares LO³ On February 1, Excel Corporation issued 37,500 common shares…

A: Introduction Issuance of common share: Common shares are offered to business owners and other…

Q: Can you please help me to find solution to question 2

A: Here asked for multi sub part question we will solve for first three sub part question for you. If…

Q: Benton County includes an independent school district and two individually chartered towns within…

A: Introduction Tax agency fund: The demand of investors to reduce the amount of taxes paid on…

Q: Why does Apple Operations International (AOI)— the Irish subsidiary that captures most of Apple’s…

A: The company is liable to pay taxes. The tax liability may also be determined on the basis of the…

Q: Financial information is presented below: Operating expenses $ 55000 Sales returns and…

A: Sales - Sales are the revenue earned by the company from the selling inventory to the customer at…

Q: A. Companies need to keep records and books of account for a year for review by the Inland Revenue…

A: Tax On Incomes : It is the amount which is deducted from the income of the individual / corporate /…

Q: Diego Company manufactures one product that is sold for $77 per unit in two geographic regions—the…

A: Solution: Contribution margin is the difference between sales revenue and variable costs. Total…

Q: Required information [The following information applies to the questions displayed below.] At the…

A: A material requisition form outlines the goods that must be taken out of stock and utilized in a…

Q: d traceable fixed expenses of $31,000. During the same month, the West business segment had sales…

A: contribution margin is an important concept in modern costing methods as it help the business to…

Q: The consideration was settled as follows: Cash payment, Issue of 100 000 shares to the seller Issue…

A: Acquisition OF Assets / Business : It is the purchase of assets / business by one company of another…

Q: At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three…

A: Solution: Finished goods inventory refers to those inventory items which has been finished all its…

Q: Part a and b are wrong ?

A: Depreciation - It is the reduction in the value of fixed asset due to normal wear and tear and…

Step by step

Solved in 2 steps

- which one is correct please confirm? QUESTION 21 If the return on U.S. Treasury bills is 7.02%, the risk premium is 2.32%, and the inflation rate is 4.16%, then the real rate of return is ____. a. 7.02% b. 6.48% c. 4.70% d. 2.86%Which of the following statements is TRUE regarding the Fisher Effect? A. The Fisher Effect illustrates the inverse relationship between inflation and nominal interest rates. B. Nominal interest rates are directly related to expected inflation in part because borrowers want to protect their purchasing power reward from being wiped out by lower inflation. C. If prices rise by 7% and your salary increases by 9%, you will experience a gain of purchasing power D. Ceteris paribus, the higher the inflation, the higher the real interest rate Explain all optionsIf the risk-free rate is 2.2 percent, the inflation rate is 1.9 percent, and the market rate of return is 6.8 percent, what is the amount of the risk premium on a U.S. Treasury bill?

- Suppose that the Treasury bill rate is 6% rather than 3%, as we assumed in Table 12.1, and the expected return on the market is 9%. Use the betas in that table to answer the following questions. a. When you assume this higher risk-free interest rate, what makes sense for how you should modify your assumption about the rate of return on the market portfolio? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) b. Recalculate the expected return on the stocks in Table 12.1. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) c. Suppose now that you continued to assume that the expected return on the market remained at 9%. Now what would be the expected returns on each stock? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)d. Ford offer a higher or lower expected return if the interest rate is 6% rather than 3%? e. Walmart offer a higher or…The Treasury bill rate is 3%, and the expected return on the market portfolio is 14%. According to the capital asset pricing model: a. What is the risk premium on the market?b. What is the required return on an investment with a beta of 1.8? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)c. If an investment with a beta of 0.8 offers an expected return of 8.2%, does it have a positive or negative NPV?d. If the market expects a return of 12.9% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer to 2 decimal places.)The market has an expected rate of return of 8.0 percent. The long-term government bond is expected to yield 4.8 percent and the U.S. Treasury bill is expected to yield 1.1 percent. The inflation rate is 3.2 percent. What is the market risk premium? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

- Suppose the real risk-free rate is 3.50% and the future rate of inflation is expected to be constant at 4.80%. What rate of return would you expect on a 1-year Treasury security, assuming the pure expectations theory is valid? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. Select one: a. 8.80% b. 8.30% c. 9.38% d. 9.79% e. 8.38%The following question illustrates the APT. Imagine that there are only two pervasive macroeconomic factors. Investments X, Y, and Z have the following sensitivities to these two factors: Investment b1 b2 X 1.75 0 Y −1.00 2.00 Z 2.00 1.00 We assume that the expected risk premium is 7.8% on factor 1 and 11.8% on factor 2. Treasury bills obviously offer zero risk premium. According to the APT, what is the risk premium on each of the three stocks? Suppose you buy $500 of X and $125 of Y and sell $375 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? Suppose you buy $200 of X and $150 of Y and sell $100 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? Finally, suppose you buy $400 of X and $50 of Y and sell $200 of Z. What is your portfolio's sensitivity now to each of the two factors? And what is the expected risk premium?The Treasury bill rate is 6% and the market risk premium is 7%. Which of the capital investments shown above have positive (non-zero) NPV's? Project Beta Internal Rate of Return, % P 1.00 14 Q 0.00 10 R 2.00 20 S 0.40 11 T 1.70 22

- Which of the following statements is false? A. Basel II use the value at risk (VaR) with a one-year time horizon and a 99.9% confidence level for calculating capital for credit risk and operational risk. B. 20 BP = 0.2% C. Basel I is increasing the amount of capital that banks are required to hold and the proportion of that capital that must be equity. D. Model-building approach is a model for the joint distribution of changes in market variables and using historical data to estimate the model parameters.Suppose the real risk-free rate is 4.20%, the average expected future inflation rate is 4.20%, and a maturity risk premium of 0.10% per year to maturity applies, i.e., MRP = 0.10%(t), where t is the number of years to maturity, hence the pure expectations theory is NOT valid. What rate of return would you expect on a 4-year Treasury security? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. Group of answer choicesSuppose the real risk-free rate is 3.00%, the average expected future inflation rate is 6.60%, and a maturity risk premium of 0.10% per year to maturity applies, i.e., MRP = 0.10%(t), where t is the number of years to maturity. What rate of return would you expect on a 1-year Treasury security, assuming the pure expectations theory is NOT valid? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average.