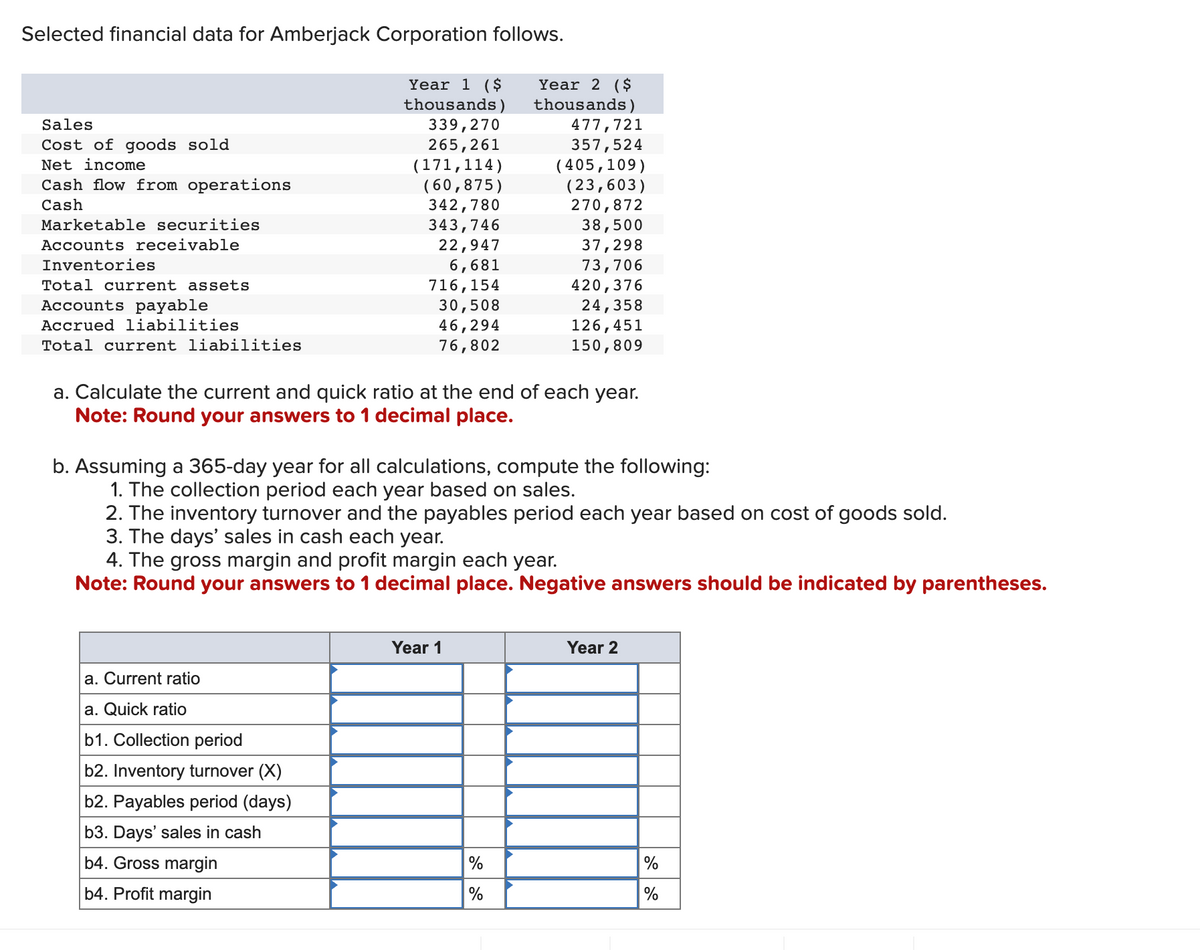

Selected financial data for Amberjack Corporation follows. Sales Cost of goods sold Net income Cash flow from operations Cash Marketable securities Accounts receivable Inventories Total current assets Accounts payable Accrued liabilities Total current liabilities. Year 1 ($ Year 2 ($ thousands) thousands) 339,270 265,261 (171,114) (60,875) 342,780 343,746 22,947 6,681 716,154 30,508 46,294 76,802 477,721 357,524 (405,109) (23,603) 270,872 38,500 37,298 73,706 420,376 24,358 126,451 150,809 a. Calculate the current and quick ratio at the end of each year. Note: Round your answers to 1 decimal place. b. Assuming a 365-day year for all calculations, compute the following: 1. The collection period each year based on sales. 2. The inventory turnover and the payables period each year based on cost of goods sold. 3. The days' sales in cash each year. 4. The gross margin and profit margin each year.

Selected financial data for Amberjack Corporation follows. Sales Cost of goods sold Net income Cash flow from operations Cash Marketable securities Accounts receivable Inventories Total current assets Accounts payable Accrued liabilities Total current liabilities. Year 1 ($ Year 2 ($ thousands) thousands) 339,270 265,261 (171,114) (60,875) 342,780 343,746 22,947 6,681 716,154 30,508 46,294 76,802 477,721 357,524 (405,109) (23,603) 270,872 38,500 37,298 73,706 420,376 24,358 126,451 150,809 a. Calculate the current and quick ratio at the end of each year. Note: Round your answers to 1 decimal place. b. Assuming a 365-day year for all calculations, compute the following: 1. The collection period each year based on sales. 2. The inventory turnover and the payables period each year based on cost of goods sold. 3. The days' sales in cash each year. 4. The gross margin and profit margin each year.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Selected financial data for Amberjack Corporation follows.

Year 1 ($

thousands)

339,270

265,261

Sales

Cost of goods sold

Net income

Cash flow from operations

Cash

Marketable securities

Accounts receivable

Inventories

Total current assets

Accounts payable

Accrued liabilities

Total current liabilities

(171,114)

(60,875)

342,780

343,746

22,947

6,681

716,154

30,508

46,294

76,802

a. Current ratio

a. Quick ratio

b1. Collection period

b2. Inventory turnover (X)

b2. Payables period (days)

b3. Days' sales in cash

b4. Gross margin

b4. Profit margin

Year 2 ($

thousands)

a. Calculate the current and quick ratio at the end of each year.

Note: Round your answers to 1 decimal place.

Year 1

477,721

357,524

b. Assuming a 365-day year for all calculations, compute the following:

1. The collection period each year based on sales.

2. The inventory turnover and the payables period each year based on cost of goods sold.

3. The days' sales in cash each year.

4. The gross margin and profit margin each year.

Note: Round your answers to 1 decimal place. Negative answers should be indicated by parentheses.

%

%

(405,109)

(23,603)

270,872

38,500

37,298

73,706

420,376

24,358

126,451

150,809

Year 2

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning