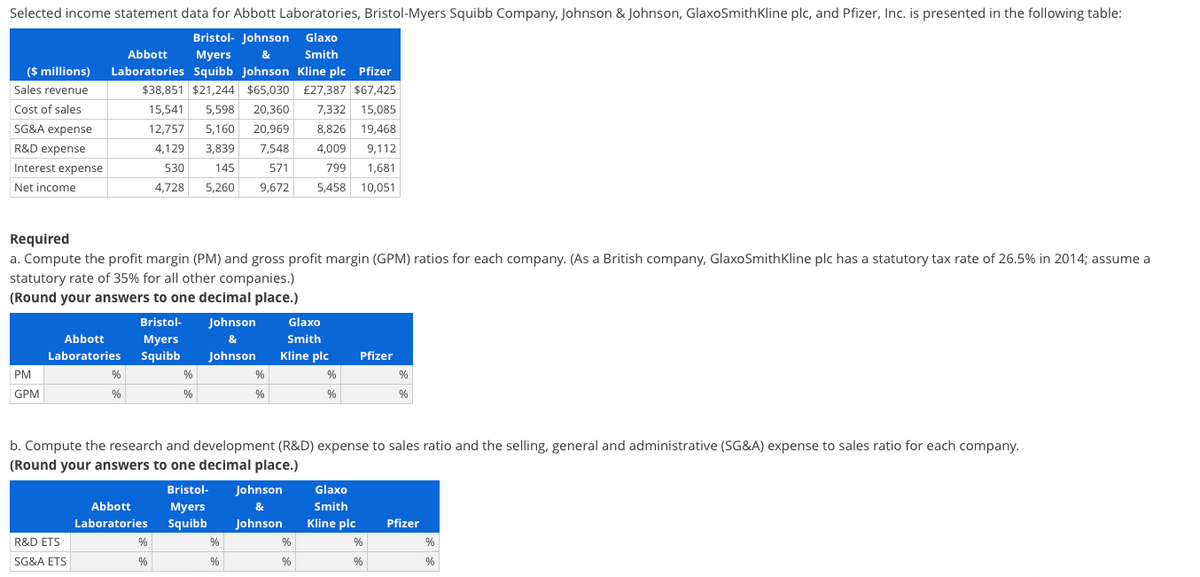

Selected income statement data for Abbott Laboratories, Bristol-Myers Squibb Company, Johnson & Johnson, GlaxoSmithKline plc, and Pfizer, Inc. is presented in the following table: Bristol- Johnson Glaxo Аbbott Мyers & Smith ($ millions) Laboratories Squibb Johnson Kline plc Pfizer Sales revenue Cost of sales $38,851 $21,244 $65,030 £27,387 $67,425 15,541 5,598 20,360 7,332 15,085 SG&A expense 12,757 5,160 20,969 8,826 19,468 R&D expense 4,129 3,839 7,548 4,009 9,112 Interest expense 530 145 571 799 1,681 Net income 4,728 5,260 9,672 5,458 10,051 Required a. Compute the profit margin (PM) and gross profit margin (GPM) ratios for each company. (As a British company, GlaxoSmithKline plc has a statutory tax rate of 26.5% in 2014; assume a statutory rate of 35% for all other companies.) (Round your answers to one decimal place.) Bristol- Johnson Glaxo Abbott Myers & Smith Laboratories Squibb Johnson Kline plc Pfizer PM GPM % % b. Compute the research and development (R&D) expense to sales ratio and the selling, general and administrative (SG&A) expense to sales ratio for each company. (Round your answers to one decimal place.)

Selected income statement data for Abbott Laboratories, Bristol-Myers Squibb Company, Johnson & Johnson, GlaxoSmithKline plc, and Pfizer, Inc. is presented in the following table: Bristol- Johnson Glaxo Аbbott Мyers & Smith ($ millions) Laboratories Squibb Johnson Kline plc Pfizer Sales revenue Cost of sales $38,851 $21,244 $65,030 £27,387 $67,425 15,541 5,598 20,360 7,332 15,085 SG&A expense 12,757 5,160 20,969 8,826 19,468 R&D expense 4,129 3,839 7,548 4,009 9,112 Interest expense 530 145 571 799 1,681 Net income 4,728 5,260 9,672 5,458 10,051 Required a. Compute the profit margin (PM) and gross profit margin (GPM) ratios for each company. (As a British company, GlaxoSmithKline plc has a statutory tax rate of 26.5% in 2014; assume a statutory rate of 35% for all other companies.) (Round your answers to one decimal place.) Bristol- Johnson Glaxo Abbott Myers & Smith Laboratories Squibb Johnson Kline plc Pfizer PM GPM % % b. Compute the research and development (R&D) expense to sales ratio and the selling, general and administrative (SG&A) expense to sales ratio for each company. (Round your answers to one decimal place.)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 1MAD

Related questions

Question

Transcribed Image Text:Selected income statement data for Abbott Laboratories, Bristol-Myers Squibb Company, Johnson & Johnson, GlaxoSmithKline plc, and Pfizer, Inc. is presented in the following table:

Bristol- Johnson

Glaxo

Abbott

Мyers

&

Smith

($ millions)

Laboratories Squibb Johnson Kline plc Pfizer

Sales revenue

$38,851 $21,244 $65,030

£27,387 $67,425

Cost of sales

15,541

5,598

20,360

7,332

15,085

SG&A expense

12,757

5,160

20,969

8,826 19,468

R&D expense

4,129

3,839

7,548

4,009

9,112

Interest expense

530

145

571

799

1,681

Net income

4,728

5,260

9,672

5,458

10,051

Required

a. Compute the profit margin (PM) and gross profit margin (GPM) ratios for each company. (As a British company, GlaxoSmithKline plc has a statutory tax rate of 26.5% in 2014; assume a

statutory rate of 35% for all other companies.)

(Round your answers to one decimal place.)

Bristol-

Johnson

Glaxo

Abbott

Myers

&

Smith

Laboratories

Squibb

Johnson

Kline plc

Pfizer

PM

%

GPM

%

b. Compute the research and development (R&D) expense to sales ratio and the selling, general and administrative (SG&A) expense to sales ratio for each company.

(Round your answers to one decimal place.)

Bristol-

Johnson

Glaxo

Abbott

Мyers

&

Smith

Laboratories

Squibb

Johnson

Kline plc

Pfizer

R&D ETS

SG&A ETS

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning