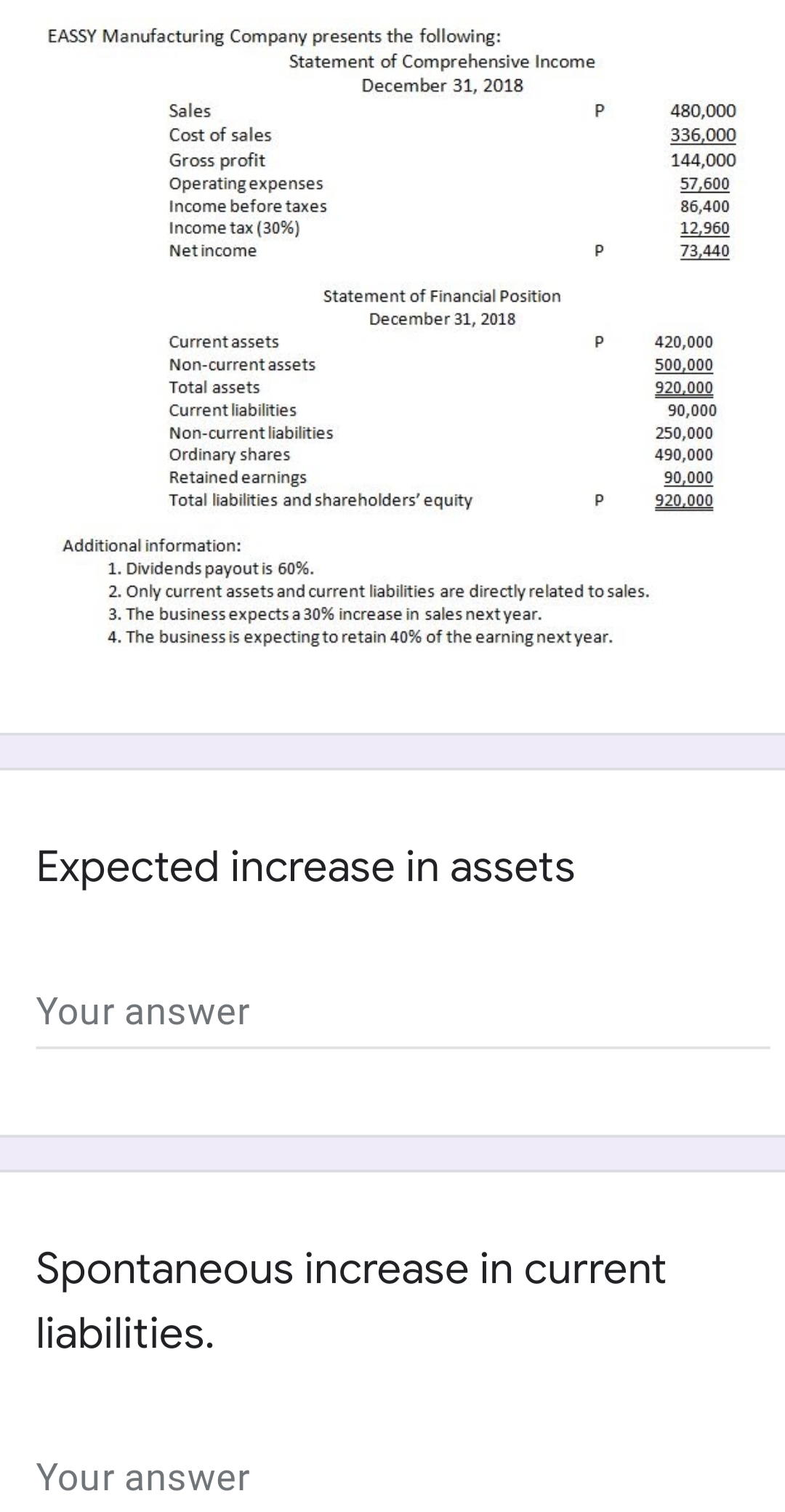

EASSY Manufacturing Company presents the following: Statement of Comprehensive Income December 31, 2018 Sales P 480,000 Cost of sales 336,000 Gross profit 144,000 Operating expenses 57,600 86,400 12,960 Income before taxes Income tax (30%) Net income 73,440 Statement of Financial Position December 31, 2018 Current assets P 420,000 Non-current assets 500,000 920,000 Total assets Current liabilities 90,000 250,000 490,000 Non-current liabilities Ordinary shares Retained earnings Total liabilities and shareholders' equity 90,000 P 920,000 Additional information: 1. Dividends payout is 60%. 2. Only current assets and current liabilities are directly related to sales. 3. The business expects a 30% increase in sales next year. 4. The business is expecting to retain 40% of the earning next year. Expected increase in assets Your answer Spontaneous increase in current iabilities.

EASSY Manufacturing Company presents the following: Statement of Comprehensive Income December 31, 2018 Sales P 480,000 Cost of sales 336,000 Gross profit 144,000 Operating expenses 57,600 86,400 12,960 Income before taxes Income tax (30%) Net income 73,440 Statement of Financial Position December 31, 2018 Current assets P 420,000 Non-current assets 500,000 920,000 Total assets Current liabilities 90,000 250,000 490,000 Non-current liabilities Ordinary shares Retained earnings Total liabilities and shareholders' equity 90,000 P 920,000 Additional information: 1. Dividends payout is 60%. 2. Only current assets and current liabilities are directly related to sales. 3. The business expects a 30% increase in sales next year. 4. The business is expecting to retain 40% of the earning next year. Expected increase in assets Your answer Spontaneous increase in current iabilities.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:EASSY Manufacturing Company presents the following:

Statement of Comprehensive Income

December 31, 2018

Sales

480,000

Cost of sales

336,000

Gross profit

Operating expenses

144,000

57,600

Income before taxes

86,400

Income tax (30%)

12,960

73,440

Net income

P

Statement of Financial Position

December 31, 2018

Current assets

420,000

Non-current assets

500,000

Total assets

920,000

Current liabilities

90,000

Non-current liabilities

250,000

490,000

Ordinary shares

Retained earnings

Total liabilities and shareholders' equity

90,000

P

920,000

Additional information:

1. Dividends payout is 60%.

2. Only current assets and current liabilities are directly related to sales.

3. The business expects a 30% increase in sales next year.

4. The business is expecting to retain 40% of the earning next year.

Expected increase in assets

Your answer

Spontaneous increase in current

liabilities.

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College