selling for $48 per share. Paid the cash dividend in "a." when the preferred was selling for $21.75 per share. Paid the stock dividend in "b." when the common was selling for $47 per share. Called in 1,000 shares of preferred stock at the call price of S23. Sold 3,000 shares of the treasury stock for $49 per share in cash. Discovered a mistake in calculating depreciation back in 2019. The amount of depreciation was too high by $50,000. The tax rate in 2019 was 28% and the tax rate for c. d. e. f. g. 2021 was 30%. INSTRUCTIONS: Prepare journal entries for the above events Prepare the updated stockholders' equity section of the balance sheet in good form on December 31, 2021, including the effects of the entries above assuming that net income 1. 2. for 2021 was $600,000.

selling for $48 per share. Paid the cash dividend in "a." when the preferred was selling for $21.75 per share. Paid the stock dividend in "b." when the common was selling for $47 per share. Called in 1,000 shares of preferred stock at the call price of S23. Sold 3,000 shares of the treasury stock for $49 per share in cash. Discovered a mistake in calculating depreciation back in 2019. The amount of depreciation was too high by $50,000. The tax rate in 2019 was 28% and the tax rate for c. d. e. f. g. 2021 was 30%. INSTRUCTIONS: Prepare journal entries for the above events Prepare the updated stockholders' equity section of the balance sheet in good form on December 31, 2021, including the effects of the entries above assuming that net income 1. 2. for 2021 was $600,000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 69E:

Stock Dividends

Crystal Corporation has the following information regarding its common stock: S10...

Related questions

Question

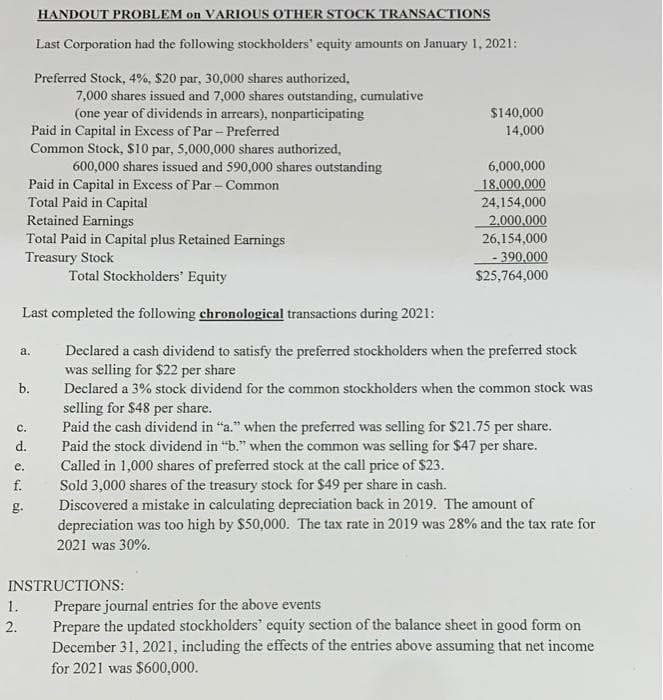

Transcribed Image Text:HANDOUT PROBLEM on VARIOUS OTHER STOCK TRANSACTIONS

Last Corporation had the following stockholders' equity amounts on January 1, 2021:

Preferred Stock, 4%, $20 par, 30,000 shares authorized,

7,000 shares issued and 7,000 shares outstanding, cumulative

(one year of dividends in arrears), nonparticipating

$140,000

14,000

Paid in Capital in Excess of Par - Preferred

Common Stock, S10 par, 5,000,000 shares authorized,

600,000 shares issued and 590,000 shares outstanding

6,000,000

Paid in Capital in Excess of Par – Common

Total Paid in Capital

Retained Earnings

Total Paid in Capital plus Retained Earnings

Treasury Stock

18.000,000

24,154,000

2.000,000

26,154,000

- 390.000

Total Stockholders' Equity

$25,764,000

Last completed the following chronological transactions during 2021:

Declared a cash dividend to satisfy the preferred stockholders when the preferred stock

was selling for $22 per share

Declared a 3% stock dividend for the common stockholders when the common stock was

а.

b.

selling for $48 per share.

Paid the cash dividend in "a." when the preferred was selling for $21.75 per share.

Paid the stock dividend in "b." when the common was selling for $47 per share.

Called in 1,000 shares of preferred stock at the call price of $23.

Sold 3,000 shares of the treasury stock for $49 per share in cash.

Discovered a mistake in calculating depreciation back in 2019. The amount of

depreciation was too high by $50,000. The tax rate in 2019 was 28% and the tax rate for

c.

d.

е.

f.

2021 was 30%.

INSTRUCTIONS:

Prepare journal entries for the above events

Prepare the updated stockholders' equity section of the balance sheet in good form on

December 31, 2021, including the effects of the entries above assuming that net income

1.

2.

for 2021 was $600,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning