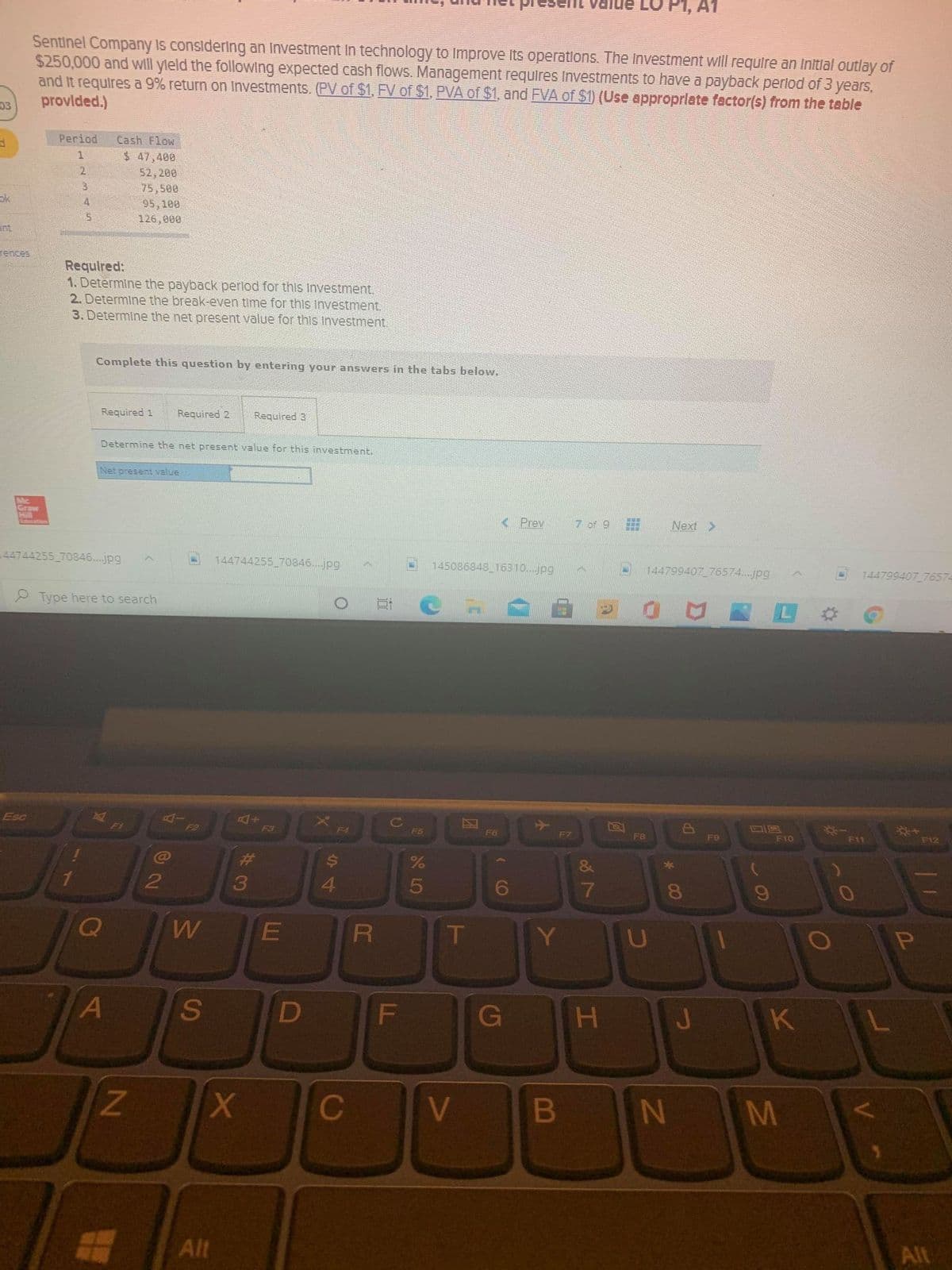

Sentinel Company Is considering an Investment In technology to Improve Its operations. The Investment will require an Initlal outlay of $250,000 and will yleld the following expected cash flows. Management requires Investments to have a payback perlod of 3 years, and It requlres a 9% return on Investments. (PV of $1. FV of $1, PVA of $1, and FVA of $1) (Use approprlete factor(s) from the table provlded.) Period Cash Flow $ 47,400 52,200 75, 500 95,100 126,000 1 2. in nces Requlred: 1. Determine the payback perlod for this Investment. 2. Determine the break-even time for this Investment. 3. Determine the net present value for this Investment.

Sentinel Company Is considering an Investment In technology to Improve Its operations. The Investment will require an Initlal outlay of $250,000 and will yleld the following expected cash flows. Management requires Investments to have a payback perlod of 3 years, and It requlres a 9% return on Investments. (PV of $1. FV of $1, PVA of $1, and FVA of $1) (Use approprlete factor(s) from the table provlded.) Period Cash Flow $ 47,400 52,200 75, 500 95,100 126,000 1 2. in nces Requlred: 1. Determine the payback perlod for this Investment. 2. Determine the break-even time for this Investment. 3. Determine the net present value for this Investment.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

Transcribed Image Text:Sentinel Company is considering an Investment In technology to Improve Its operatlons. The Investment wll require an Initlal outlay of

$250,000 and will yleld the following expected cash flows. Management requires Investments to have a payback perlod of 3 years,

and It requires a 9% return on Investments. (PV of $1, FV of $1, PVA of $1, and EVA of $1) (Use approprlate factor(s) from the table

provlded.)

03

Period

Cash Flow

1.

$ 47,400

2.

52,200

75,500

95,100

126,000

ok

ant

rences

Requlred:

1. Determine the payback perlod for this Investment.

2. Determine the break-even time for this Investment.

3. Determine the net present value for this Investment.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Determine the net present value for this investment.

Net present value

Mc

Graw

Hill

< Prev

7 of 9

Next >

44744255 70846...jpg

144744255 70846..jpg

145086848_16310.jpg

144799407 76574..jpg

144799407 7657-

Type here to search

Esc

F1

F2

DP

**

F12

F3

F5

F6

F7

F8

F9

F10

F11

$4

4.

%23

&

7

8.

E

Y

D

G

H.

K

Z'

CV

N M

Alt

Alt

LL

A)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College