Serendipity is a company that produces shoes and currently applies a cy. In this new year's holiday season, the company is considering changir s policy to a net 45-day credit. The new credit policy is expected to iner ) units per month to 1350 units per month. The current selling price per u per unit are IDR 175.000 and IDR 100.000, respectively. However, if the credit, the selling price per unit and the variable cost per unit will remai ired return is 3% per month.

Serendipity is a company that produces shoes and currently applies a cy. In this new year's holiday season, the company is considering changir s policy to a net 45-day credit. The new credit policy is expected to iner ) units per month to 1350 units per month. The current selling price per u per unit are IDR 175.000 and IDR 100.000, respectively. However, if the credit, the selling price per unit and the variable cost per unit will remai ired return is 3% per month.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 35P

Related questions

Question

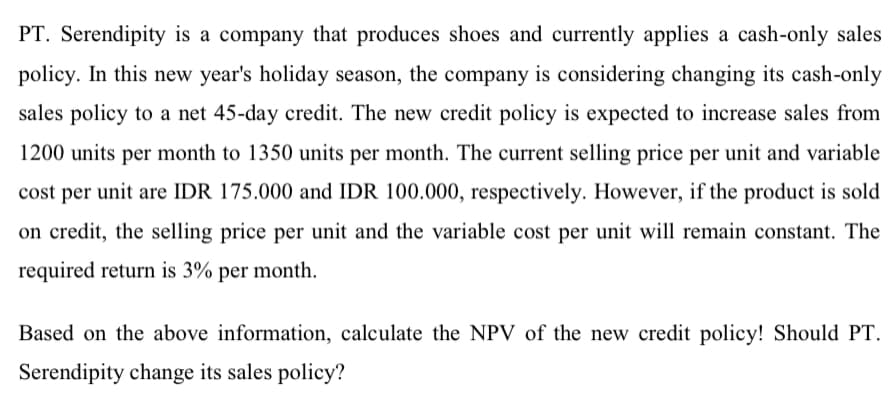

Transcribed Image Text:PT. Serendipity is a company that produces shoes and currently applies a cash-only sales

policy. In this new year's holiday season, the company is considering changing its cash-only

sales policy to a net 45-day credit. The new credit policy is expected to increase sales from

1200 units per month to 1350 units per month. The current selling price per unit and variable

cost per unit are IDR 175.000 and IDR 100.000, respectively. However, if the product is sold

on credit, the selling price per unit and the variable cost per unit will remain constant. The

required return is 3% per month.

Based on the above information, calculate the NPV of the new credit policy! Should PT.

Serendipity change its sales policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning