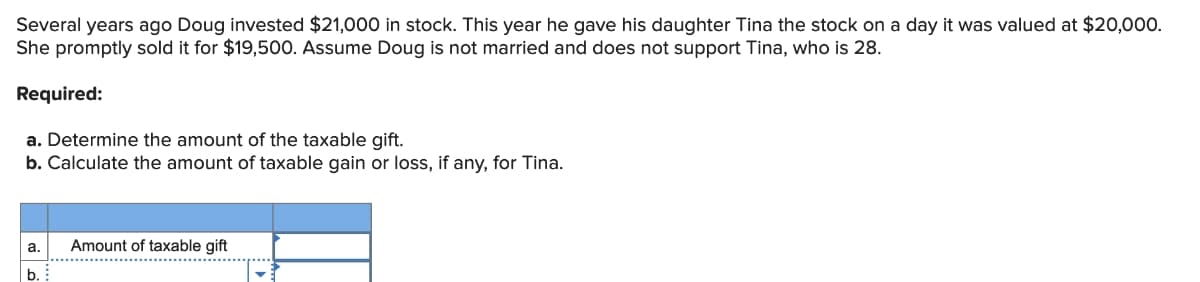

Several years ago Doug invested $21,000 in stock. This year he gave his daughter Tina the stock on a day it was valued at $20,000. She promptly sold it for $19,500. Assume Doug is not married and does not support Tina, who is 28. Required: a. Determine the amount of the taxable gift. b. Calculate the amount of taxable gain or loss, if any, for Tina.

Several years ago Doug invested $21,000 in stock. This year he gave his daughter Tina the stock on a day it was valued at $20,000. She promptly sold it for $19,500. Assume Doug is not married and does not support Tina, who is 28. Required: a. Determine the amount of the taxable gift. b. Calculate the amount of taxable gain or loss, if any, for Tina.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 39P

Related questions

Question

Please do not give image format

Transcribed Image Text:Several years ago Doug invested $21,000 in stock. This year he gave his daughter Tina the stock on a day it was valued at $20,000.

She promptly sold it for $19,500. Assume Doug is not married and does not support Tina, who is 28.

Required:

a. Determine the amount of the taxable gift.

b. Calculate the amount of taxable gain or loss, if any, for Tina.

a.

b.

Amount of taxable gift

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you