Shahrul is considering an investment that will generate cash flows of RM800 in the first year, RM500 in the second year, RM400 in the third year, and RM700 in the fourth year. His possible interest rate is 10 percent. What is the maximum amount he should be willing to pay for his investment? Answer O RM1852.52 O RM1919.10 O RM1959.52 O RM1724.32

Shahrul is considering an investment that will generate cash flows of RM800 in the first year, RM500 in the second year, RM400 in the third year, and RM700 in the fourth year. His possible interest rate is 10 percent. What is the maximum amount he should be willing to pay for his investment? Answer O RM1852.52 O RM1919.10 O RM1959.52 O RM1724.32

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter5: Time Value Of Money

Section: Chapter Questions

Problem 41SP

Related questions

Question

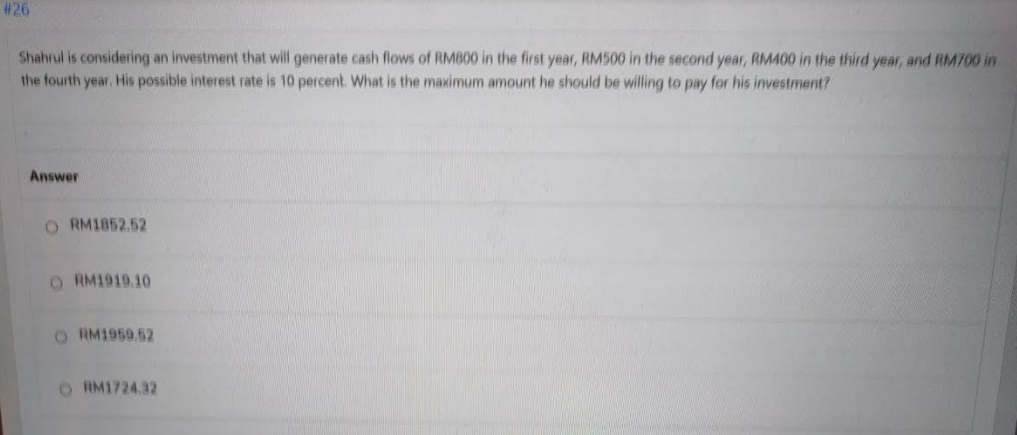

Transcribed Image Text:# 26

Shahrul is considering an investment that will generate cash flows of RMB00 in the first year, RM500 in the second year, RM400 in the third year, and RM700 in

the fourth year. His possible interest rate is 10 percent. What is the maximum amount he should be willing to pay for his investment?

Answer

O RM1852.52

O RM1919.10

O RM1959 52

O RM1724.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning