Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 Quarter 2 Quarter 3 $4,780,000 5,690,000 630,000 Quarter 4 8,200,000 in Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 bercent are never collected. Total sales for the third quarter of the current year are $5,080,000 and for the fourth quarter of the current year are $7,220,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. aler Crodit Sales

Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 Quarter 2 Quarter 3 $4,780,000 5,690,000 630,000 Quarter 4 8,200,000 in Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 bercent are never collected. Total sales for the third quarter of the current year are $5,080,000 and for the fourth quarter of the current year are $7,220,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. aler Crodit Sales

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 23BEA: Preparing a Direct Materials Purchases Budget Patrick Inc. makes industrial solvents sold in...

Related questions

Question

2.1

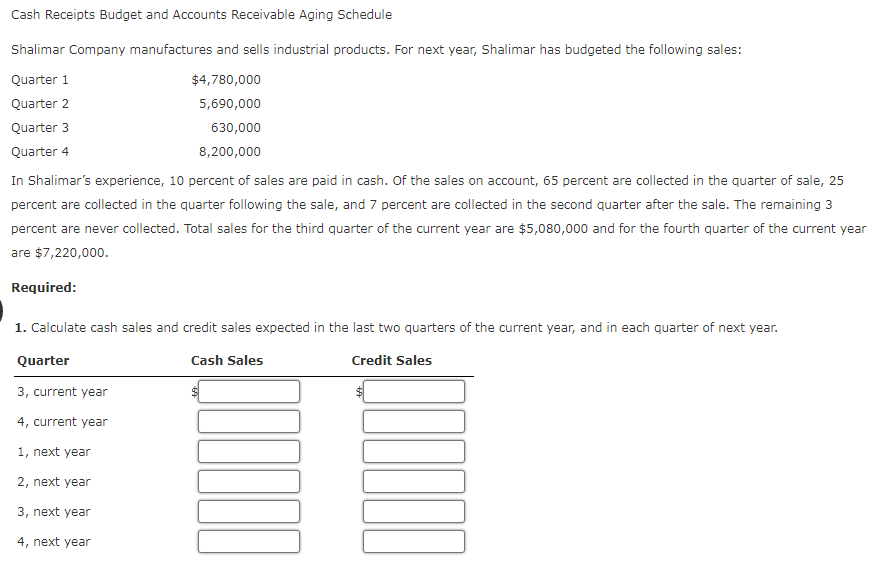

Transcribed Image Text:Cash Receipts Budget and Accounts Receivable Aging Schedule

Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales:

Quarter 1

$4,780,000

Quarter 2

5,690,000

Quarter 3

630,000

Quarter 4

8,200,000

In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25

percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3

percent are never collected. Total sales for the third quarter of the current year are $5,080,000 and for the fourth quarter of the current year

are $7,220,000.

Required:

1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year.

Quarter

Cash Sales

Credit Sales

3, current year

4, current year

1, next year

2, next year

3, next year

4, next year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning