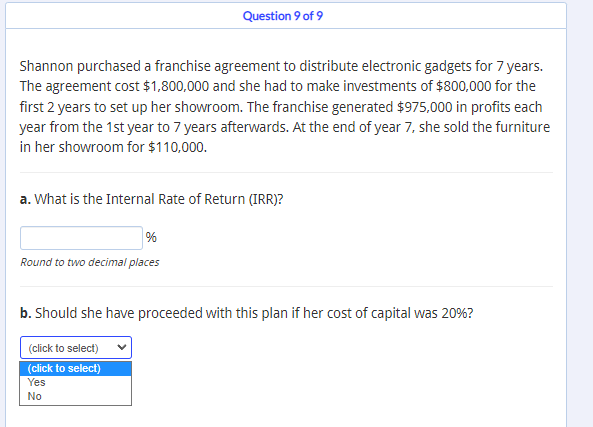

Shannon purchased a franchise agreement to distribute electronic gadgets for 7 years. The agreement cost $1,800,000 and she had to make investments of $800,000 for the first 2 years to set up her showroom. The franchise generated $975,000 in profits each year from the 1st year to 7 years afterwards. At the end of year 7, she sold the furniture in her showroom for $110,000. a. What is the Internal Rate of Return (IRR)? % Round to two decimal places b. Should she have proceeded with this plan if her cost of capital was 20%?

Shannon purchased a franchise agreement to distribute electronic gadgets for 7 years. The agreement cost $1,800,000 and she had to make investments of $800,000 for the first 2 years to set up her showroom. The franchise generated $975,000 in profits each year from the 1st year to 7 years afterwards. At the end of year 7, she sold the furniture in her showroom for $110,000. a. What is the Internal Rate of Return (IRR)? % Round to two decimal places b. Should she have proceeded with this plan if her cost of capital was 20%?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 7EB: Kenzie purchased a new 3-D printer for $450,000. Although this printer is expected to last for ten...

Related questions

Question

Please help me

Transcribed Image Text:Shannon purchased a franchise agreement to distribute electronic gadgets for 7 years.

The agreement cost $1,800,000 and she had to make investments of $800,000 for the

first 2 years to set up her showroom. The franchise generated $975,000 in profits each

year from the 1st year to 7 years afterwards. At the end of year 7, she sold the furniture

in her showroom for $110,000.

Question 9 of 9

a. What is the Internal Rate of Return (IRR)?

%

Round to two decimal places

b. Should she have proceeded with this plan if her cost of capital was 20%?

(click to select)

(click to select)

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College