Shares own 3,000 5,000 9,000 6,000

Q: American Laser, incorporated, reported the following account balances on January 1. Debit Credit…

A: Dividends are declared from the retained earnings , hence declaring of dividends decrease the…

Q: On September 1, 2022, Darren Co. borrowed P150,000 from BPI by issuing 8% note due August 31, 2023,…

A: Note: Interest amount should be recognized on the amount borrowed. Accounts receivables pledged as…

Q: 39. Fixed costs of goods sold are allocated to each segment based on the number of employees. Fixed…

A: GIVEN . Fixed costs of goods sold are allocated to each segment based on the number of employees.…

Q: PTD Co. issued USD4,000,000 maturity value, 12% bonds for USD4,000,000 cash on January 1, 2014. The…

A: First interest payment will be made on July 1, 2014

Q: 1) Tappa Corp.'s current liabilities at December 31, 2020, totaled P1,600,000 before any necessary…

A: 2/10 net 30 means 2% discount will be there if payment is made with in 10 days and no discount after…

Q: what isAccumulated Depreciation-F&F, Accumulated Depreciation-Eqpt,, Depreciation Expense-F&F,…

A: Accumulated Depreciation - Accumulated Depreciation is the depreciation accumulated over the useful…

Q: An accounting policy requiring a corporation to capitalize any asset over $5,000 in value would be…

A: Accounting principles are the rules and guidelines that companies must follow when reporting…

Q: MON Co. Is a dealer in machinery. On January 1, 2016, a machinery was leased to another entity with…

A: GIVEN Annual rental payable at the end of each year 3,000,000 Lease term and useful life of…

Q: Cash-generating unit (adopted from Wiley publication) Sydney Ltd reported the following assets in…

A: Impairment loss is the reduction in the carrying value of assets that is mainly because of a decline…

Q: Total cost per barrel $60 $117 Manufacturing overhead cost in the Mining division is 25% fixed and…

A: The question is based on the concept of Cost Accounting.

Q: SLO-5.1. for a merchandising business is determined by subtracting the Cost of Goods Sold from the…

A: Operating Income: Operating Income is the income earned from Operating activities or Core activities…

Q: structions The cash account for Norwegian Medical Co. at April 30 indicated a balance of $82.726.…

A: The bank reconciliation statement is prepared to equate the balances of cash book and pass book with…

Q: Fanning Company, which expects to start operations on January 1, year 2, will sell digital cameras…

A: Total sales revenue for first quarter = Total budgeted sales revenue for January,February and…

Q: Tsing Company requires advance payments with special orders for machinery constructed to customer…

A: Note: Advance applied to orders canceled will be transferred to the income as mentioned in the…

Q: 3) Aira Company reported gross payroll of P600,000 for the month of January. The entity paid the…

A: Payroll It is important to maintain the payroll process by the management which is distributed to…

Q: Figure: A block rests against a spring. The spring, with the block against it, is then compressed a…

A: Based on the information provided in the previous question, 1) We need to calculate How much time…

Q: Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities…

A:

Q: Genaro Company sells 1 – and – 2 year subscription for its video of the month business.…

A: AN ENTITY RECOGNISES REVENUE WHEN IT SATISFIES A PERFORMANCE OBLIGATION BY TRANSFERRING A PROMISED…

Q: rporation bough ation is P6,800, executives, for

A: GIVEN Delata Corporation bought a condominium unit P6,000,0000. property per tax declaration is…

Q: XYZ Company manufactures picture frames of all sizes and shapes and uses job order costing system.…

A: Overhead means the amount of expenses incurred in factory which is not directly linked with…

Q: Zoe Corporation has the following information for the month of March. Cost of materials used in…

A: GIVEN Cost of direct materials used in production $16,958 Direct labor $27,539 Factory overhead…

Q: 10) Sansa Company has outstanding 7% 10-year P5,000,000 face value bond. The bond was issued and…

A:

Q: REQUIREMENTS: 1. What is the net lease receivable of the lessor at the commencement of the lease?

A: Lease refers to a contract between two parties under which one party who is the real owner of an…

Q: Problem 9-6 Estimated Payments (LO 9.2) Kana is a single wage earner with no dependents and taxable…

A: A tax is a governmental organization's mandatory financial obligation or other form of levy enforced…

Q: The payroll of Ruth Ltd. for September 2020 is as follows (amounts in thousands): total payroll was…

A: Under double entry system of bookkeeping one account is debited and other is credited. Assets and…

Q: Noid corp issues 1700 shares of 19$ par value common stock at23 per share when the transaction…

A: Cash received from issue of shares =1700 shares × $23 =$39100

Q: Prepare a monthly operating budget for the first quarter with the following schedule

A: Budget is a estimation for the forecast within a certain period of times. As there are various…

Q: Prepaid journal entries to record following transactions: Jan 10-issued shares of 10$ par common…

A: Cash received on issue of Common stock =$56

Q: Project A - Expected P5,000,000. Costs in

A: The total cost of production of a good comprises of the total fixed cost of production and the total…

Q: Carmelita Inc., has the following information available: Costs from Beginning Inventory Costs…

A: First, compute the equivalent units for direct materials and conversion costs. Then, compute the…

Q: Corporation under the e ow much is

A: Introduction: The benefits which are provided by the employer which acts as job satisfaction to…

Q: Essentials of Federal Income Taxation 9. Guaranteed Payments and Allocation of Partnership Income.…

A: The guaranteed payment is the payment like salary for service provided, return on time invested, and…

Q: What is standard cost ? Explain four purposes of standard costing. NB: This concept should be in…

A: Solution:- Standard cost means as follows under:-

Q: Suppose you started your own landscaping business. A customer paid you $120 in advance to mow his…

A: 1. Accounts Name Cash Unearned Service Revenue Accounts Receivables Service Revenue

Q: Rasheed works for Company A, earning $382,000 in salary during 2021. Assuming he is single and has…

A: The wage limit for social security tax for 2021 = $142800

Q: Tanner-UNF Corporation acquired as a long-term investment $200 million of 6% bonds, dated July 1, on…

A: During the course of economic activities of a company, it generally comes across, on occasions,…

Q: Sansa Company has outstanding 7% 10-year P5,000,000 face value bond. The bond was issued and dated…

A:

Q: Roush Inc. has 100,000 shares of $5 par value common stock issued and outstanding. On July 1, 2019…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: On December 31, 2021, Maroon Co. leased an equipment with a cost of P2,000,000 to Green Co. for…

A: Residual value is of two types-one is guaranteed residual value and the other is unguaranteed…

Q: 56. What is the gross profit to be reported by the Filipino entity for the year ended December 31,…

A: As per our protocol we provide solution to the one question only but you have asked two multiple…

Q: The management of Kunkel Company is considering the purchase of a $27,000 machine that would reduce…

A: Solution: Initial investment = $27,000 Annual cash inflows = $6,500 Useful life = 5 years Required…

Q: How would a Dividend that is declared but not yet paid be treated at year end for financial…

A: Dividends are the amounts which are paid in consideration to the amount contributed in the company.…

Q: gageNOWv2 | Online teachin X +…

A: Solution.. Finished goods = $326,200 Total manufacturing costs incurred = Finished goods +…

Q: A company has the following information available that was used to report inventory using the…

A: Most of ending inventory is to be reported at cost index 1.06

Q: Example 20.26) The employees of a textile mill have approached the management for a raise in their…

A: Ans. What is Real wage? Real wages means the wages have been adjusted for inflation. Real wage…

Q: Andy Company records its purchases at gross but wishes to change to recording purchases at net.…

A: WHEN PURCHASES ARE RECORDED USING THE NET METHOD , PURCHASES AND ACCOUNTS PAYABLE ARE RECORDED AT AN…

Q: Which of the following decreases total equity? A. A stock split B. Recording Revenue C. The…

A: A. A stock split: No change in total equity B. Recording Revenue: Increase in total equity C.…

Q: a. Compute and characterize any gain or loss Dave may have to recognize as a result of his admission…

A: Solution:- Computation and characterize any gain or loss Dave may have to recognize as a result of…

Q: Angel has a one-fourth and Brian has a three-fourths interest in a partnership that operates a toy…

A: The income statement shows the net income or net loss calculated by deducting the expenses from the…

Q: orporation purchased under the executive's a mot name w much is the fringe benefits

A: Introduction: The benefits which are provided by the employer which acts as job satisfaction to…

Step by step

Solved in 2 steps with 17 images

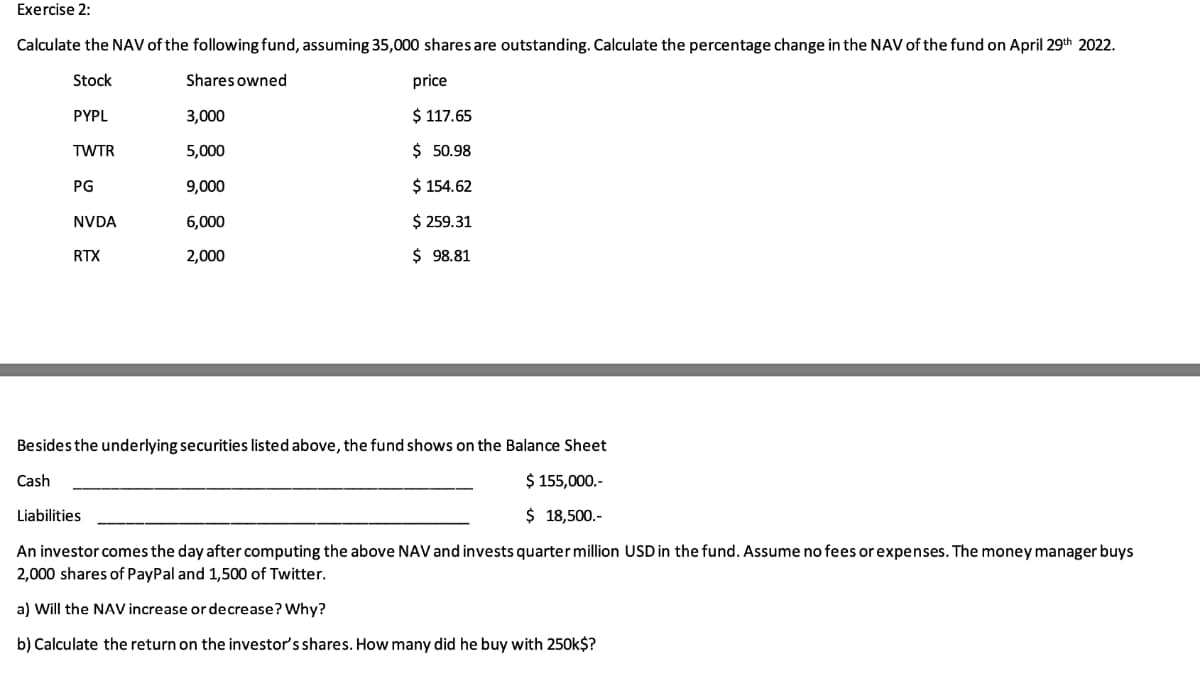

- 6. On December 31 a mutual fund has the following assets and prices at 4:00 p.m. Stock Shares owned Price 1 1,000 $ 1.97 2 5,000 $ 48.26 3 1,000 $ 26.44 4 10,000 $ 67.49 5 3,000 $ 2.59 Calculate the net asset value (NAV) for the fund. Assume that 8,000 shares are outstanding for the fund.1. A mutual fund company has the following assets and liabilities (31/12/2019): Equities at market value 160,000,000 Bonds at market value 60,000,000 Cash 40,000,000 Total value assets 260,000,000 Liabilities 30,000,000 Market value of funds 23,000,0000 Number of share outstanding 6,000,0000 a. Determine the NAV of this fundb. By the end of June 2020, the value of the equity stock fell 30% and the value of the bonds rose 10%. At the same time the value of the fund´sliabilities rose by 10%. The cash position and the number of shares outstanding remained unchanged. Calculate the new NAV?8. On January 2 the prices at 4:00 p.m. are as follows: Stock Shares Owned Price 1 1,000 $ 2.03 2 5,000 $ 51.37 3 2,800 $ 29.08 4 10,000 $ 67.19 5 3,000 $ 4.42 Cash n.a. $ 2,408 Calculate the net asset value (NAV) for the fund.

- Consider an index fund that contains the following four stocks: American Campus Communities, Inc. (ACC), Global Net Lease, Inc. (GNL), Jones Lang LaSalle Incorporated (JLL), and Merck & Co., Inc. (MRK). On March 30, 2022, the stock prices at close were: ACC $56.73 GNL $15.65 JLL $243.22 MRK $82.40 The mutual fund held the following numbers of shares in these companies: Shares (million) ACC 2.087 GNL 1.558 JLL 0.748 MRK 37.950 On March 30, the mutual fund had 25 million shares outstanding. Calculate the net asset value per mutual fund share (in dollars). During the day on March 30, the fund had a net cash inflow of $250 million. How many shares of MRK did the index fund manager have to purchase in order to maintain a portfolio with the same portfolio weights as at the start of the day? You should assume that the fund manager invests all net inflows in securities at market close prices on March 30. She holds no cash balance.Consider the following trading and performance data for four different equity mutual funds: Fund W Fund X Fund Y Fund Z Assets Under Management, $ 289.40 $ 653.70 $ 1,298.40 $ 5,567.30 Avg. for Past 12 Months (mil) Security Sales, Past 12 Months (mil) $ 37.20 $ 569.30 $ 1,453.80 $ 437.10 Expense Ratio 0.33% 0.71% 1.13% 0.21% Pretax Return, 3-Year Avg. 9.98% 10.65% 10.12% 9.83% Tax-Adjusted Return, 3-Year Avg. 9.43% 8.87% 9.34% 9.54% a. Calculate the portfolio turnover ratio for each fund. b. Which two funds are most likely to be actively managed and which two are most likely passive funds? Explain. c. Calculate the tax cost ratio for each fund. d. Which funds were the most and least tax efficient in the operations? Why?The Husky Fund’s portfolio consists of the following stocks at the beginning of the year: 500 Shares Stock IBM Price $ 180.00 4,000 Shares MSFT $ 30.00 There are 5000 shares outstanding. The fund charges 6% front-end load. The first year, the fund’s assets’ value increases by 10% and the fund pays out $10,000 as distributions to its investors. The fund charges management fees of .5% and 12b-1 fees of .5%. a) What is the fund’s NAV at the beginning and at the end of the first year? b) What is the reported return of the mutual fund in the first year? c) Suppose the mutual fund’s return stays the same each year. What is the return to an investor investing in the fund for 10 years?

- Consider a no-load mutual fund with $457 million in assets and 12 million shares at the start of the year, and $520 million in assets and 13.21 million shares at the end of the year. During the year investors have received income distributions of $2.25 per share, and capital gains distributions of $1.57 per share. Assume that the fund carries no debt. What is the NAV at the START of the year? Group of answer choices 36.11 33.07 39.47 38.08 37.78Consider the following trading and performance data for four different equity mutual funds: Fund W Fund x Fund y Fund z Assets under Management, $284.4 $662.1 $1,286.4 $5,564.6 Avg. for Past 12 months (mil) Security Sales, $44.6 $566.1 $1,455.6 $438.8 Past 12 months (mil) Expense Ratio 0.33% 0.75% 1.19% 0.24% Pretax Return, 3-year avg. 9.85% 10.65% 10.44% 9.73% Tax-adjusted Return, 3-year avg. 8.84% 8.84% 9.10% 9.04% Calculate the portfolio turnover ratio for each fund. Do not round intermediate calculations. Round your answers to two decimal places. Fund W: % Fund X: % Fund Y: % Fund Z: %1. A fund is set up to charge a load. Its net asset value is P16.50 and its offer price is P17.30. A. Assume the fund increased in value by .30 the first month after you purchased 100 shares. What is the total gain or loss? Compare the total current value with the total purchase amount. B. By what percentage would the net asset value of the shares have to increase for you to break even?

- 3. The composition of a "BestFund" is as follows: Shares Share price 200,000 300,000 400,000 600,000 Stock A B C D 35 40 20 25 a. The fund's accrued management fee with the portfolio manager currently totals $30,000. There are 4 million shares outstanding. What is the net asset value of the fund? b. If during the year the portfolio manager sells all of the holdings of stock D and replaces it with 200,000 shares of stock E at $50 per share and 200,000 shares of stock F at $25 per share, what is the portfolio turnover rate?On February 9, 2020, the market value of the investments contained in the All Star Stock Fund, a mutual fund, was $21,200,000. Liabilities for the fund were $2,544,000.If the fund had 970,000 shares outstanding, calculate the net asset value per share. Round your answer to the nearest cent.15)Consider the following data on two mutual funds: Fund A Fund B Total net assets (assets less Liabilities) at beginning of year ¢ 1,000,000 ¢ 1,000,000 Number of shares outstanding at 100,000 100,000 beginning of year Annual operating expenses ¢ 10,000 ¢ 12,000 Value of securities sold during year ¢ 500, 000 ¢ 800,000 Value of securities purchased during ¢ 400,000 ¢ 900,000 year Brokerage fees for the year ¢ 9,000 ¢ 17,000 Number of shares outstanding at 110,000…