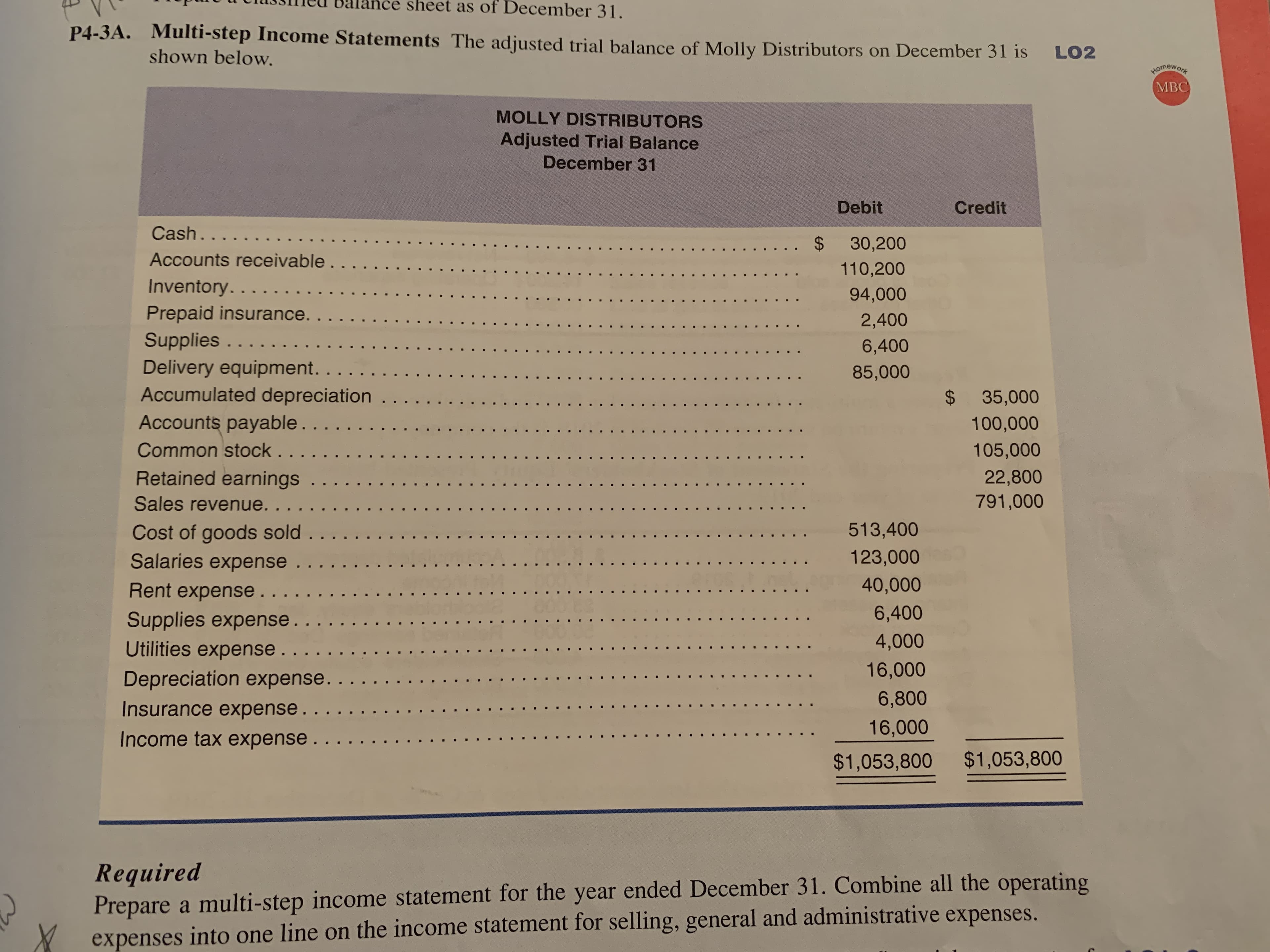

sheet as of December 31. P4-3A. Multi-step Income Statements The adjusted trial balance of Molly Distributors on December 31 is LO2 shown below. HOmework MBC MOLLY DISTRIBUTORS Adjusted Trial Balance December 31 Debit Credit Cash.... Accounts receivable.... .. $ 30,200 110,200 Inventory..... 94,000 Prepaid insurance. Supplies ... Delivery equipment. ... Accumulated depreciation.. . 2,400 6,400 85,000 $ 35,000 Accounts payable. . . .. Common stock.. . . Retained earnings . .. 100,000 105,000 22,800 791,000 Sales revenue. . Cost of goods sold. . . . Salaries expense.. . . Rent expense. . . Supplies expense . . .. Utilities expense. . . . 513,400 123,000 40,000 ... 6,400 4,000 16,000 Depreciation expense . Insurance expense. ... Income tax expense. .. 6,800 16,000 $1,053,800 $1,053,800 Required Prepare a multi-step income statement for the year ended December 31. Combine all the operating expenses into one line on the income statement for selling, general and administrative expenses.

sheet as of December 31. P4-3A. Multi-step Income Statements The adjusted trial balance of Molly Distributors on December 31 is LO2 shown below. HOmework MBC MOLLY DISTRIBUTORS Adjusted Trial Balance December 31 Debit Credit Cash.... Accounts receivable.... .. $ 30,200 110,200 Inventory..... 94,000 Prepaid insurance. Supplies ... Delivery equipment. ... Accumulated depreciation.. . 2,400 6,400 85,000 $ 35,000 Accounts payable. . . .. Common stock.. . . Retained earnings . .. 100,000 105,000 22,800 791,000 Sales revenue. . Cost of goods sold. . . . Salaries expense.. . . Rent expense. . . Supplies expense . . .. Utilities expense. . . . 513,400 123,000 40,000 ... 6,400 4,000 16,000 Depreciation expense . Insurance expense. ... Income tax expense. .. 6,800 16,000 $1,053,800 $1,053,800 Required Prepare a multi-step income statement for the year ended December 31. Combine all the operating expenses into one line on the income statement for selling, general and administrative expenses.

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 12PB: The following is the adjusted trial balance data for Elm Connections as of December 31, 2019. A. Use...

Related questions

Question

Transcribed Image Text:sheet as of December 31.

P4-3A. Multi-step Income Statements The adjusted trial balance of Molly Distributors on December 31 is

LO2

shown below.

HOmework

MBC

MOLLY DISTRIBUTORS

Adjusted Trial Balance

December 31

Debit

Credit

Cash....

Accounts receivable....

.. $ 30,200

110,200

Inventory.....

94,000

Prepaid insurance.

Supplies ...

Delivery equipment. ...

Accumulated depreciation.. .

2,400

6,400

85,000

$ 35,000

Accounts payable. . . ..

Common stock.. . .

Retained earnings . ..

100,000

105,000

22,800

791,000

Sales revenue. .

Cost of goods sold. . . .

Salaries expense.. . .

Rent expense. . .

Supplies expense . . ..

Utilities expense. . . .

513,400

123,000

40,000

...

6,400

4,000

16,000

Depreciation expense .

Insurance expense. ...

Income tax expense. ..

6,800

16,000

$1,053,800 $1,053,800

Required

Prepare a multi-step income statement for the year ended December 31. Combine all the operating

expenses into one line on the income statement for selling, general and administrative expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage