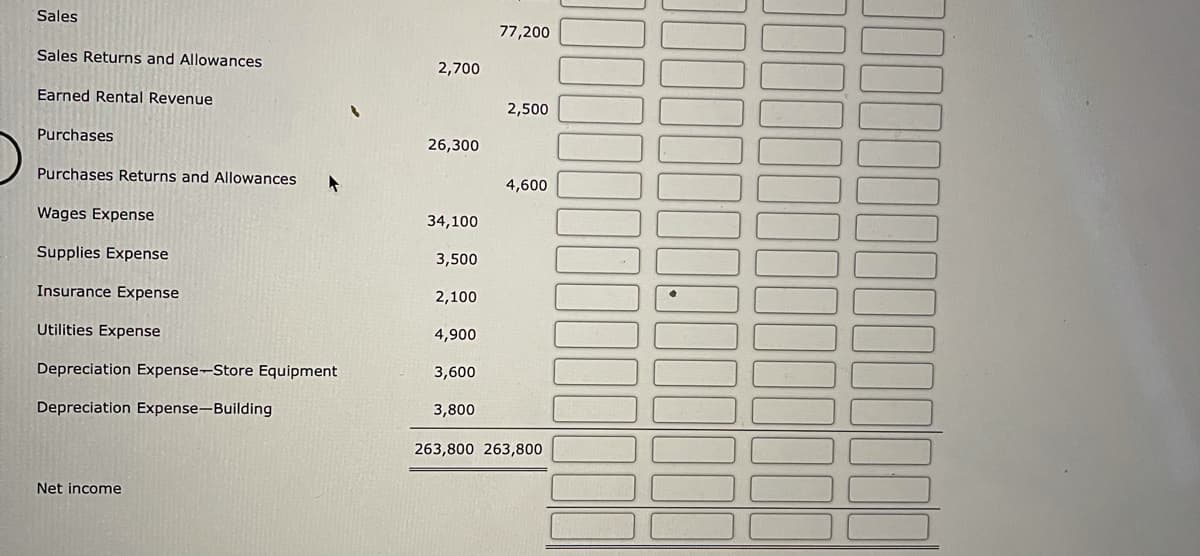

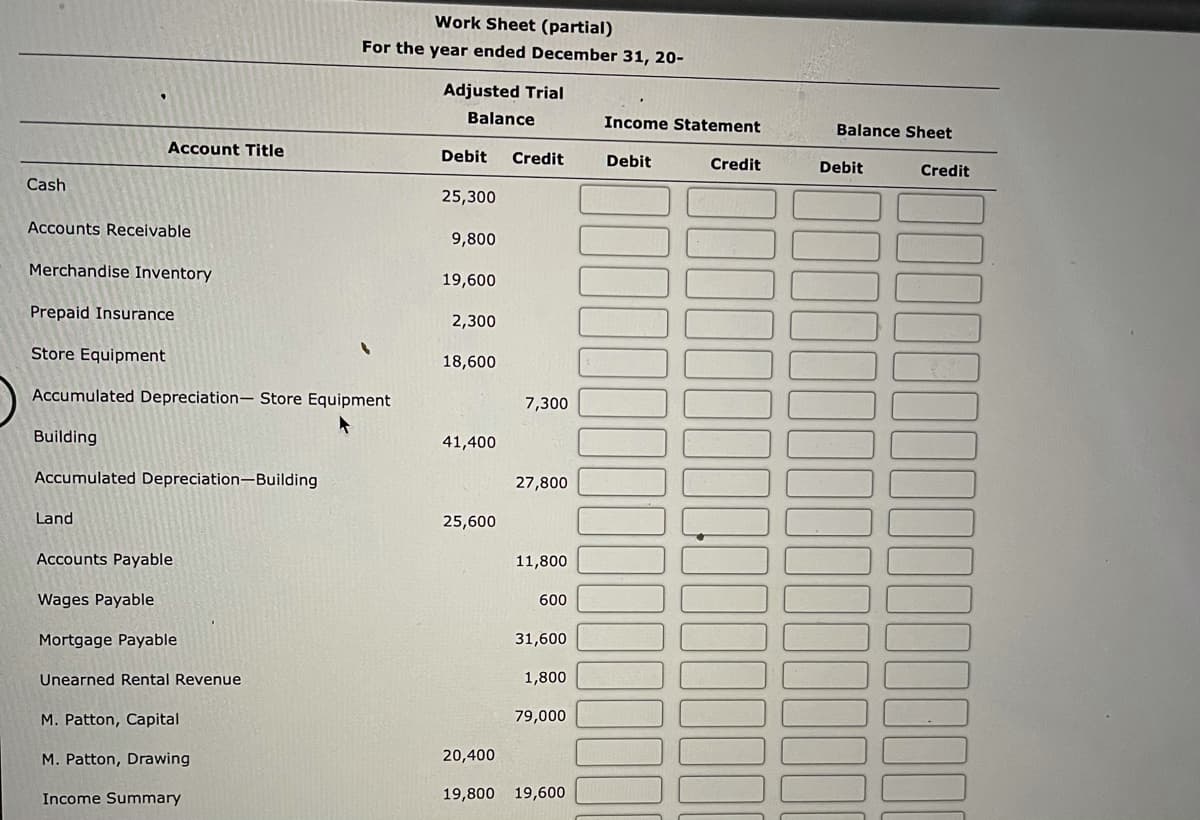

For the year ended December 31, 20- Adjusted Trial Balance Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Cash 25,300 Accounts Receivable 9,800 Merchandise Inventory 19,600 Prepaid Insurance 2,300 Store Equipment 18,600 Accumulated Depreciation- Store Equipment 7,300 Building 41,400 Accumulated Depreciation-Building 27,800 Land 25,600 Accounts Payable 11,800 Wages Payable 600 Mortgage Payable 31,600 Unearned Rental Revenue 1,800 M. Patton, Capital 79,000 M. Patton, Drawing 20,400 Income Summary 19,800 19,600

Q: The adjusted trial balance for Chiara Company as of December 31 follows. Debit Credit $ 30,000…

A: Financial statements are prepared at the end of the accounting year. These are the essential part of…

Q: Required: Prepare the necessary closing entries at December 31, 2016.

A:

Q: The adjusted trial balance for Chiara Company as of December 31 follows. Debit Credit Cash $ 127,000…

A: Income statement refers to the total of income less expenses.

Q: Required information [The following information applies to the questions displayed below.] The…

A: Closing entries: All revenues are closed by crediting the income summary account and expenses are…

Q: The following adjusted year-end trial balance at December 31 of Wilson Trucking Company. Account…

A: 1) Income statement for the year ended December 31 Revenues: Trucking fees earned…

Q: For the Month Ended April 30, 2022 Adjusted Trial Balance Income Statement Balance Sheet Account…

A: The closing entries are prepared to close the temporary accounts of the business. The post closing…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Closing entries: All revenues are closed by crediting the income summary account and expenses are…

Q: Using the adjusted trial balance data below for the Rollins Company, prepare a Multi-step Income…

A: The income statement can be prepared using various approaches as single step income statement or…

Q: ORIOLE COMPANY Worksheet (partial) For the Month Ended April 30, 2020 Adjusted Trial Balance Income…

A: A trial balance is a list of all the ledger accounts with their closing balances reflecting on the…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The closing entries are prepared at year end to close the temporary accounts of the business…

Q: The following adjusted year-end trial balance at December 31 of Wilson Trucking Company. Account…

A: Solution Retained earning are the amount of profit of a company has left over after paying all its…

Q: Use the following selected accounts and amounts with normal balances from Andrea Company's adjusted…

A: The balance sheet is one of the financial statements of the business which tells about the financial…

Q: A portion of the work sheet of Sadie’s Flowers for the year ended December 31 is as follows:…

A: The rule of financial accounting specifies that every transaction involves at least two accounts…

Q: Use the following information in the adjusted trial balance for Stockton Company to answer the…

A: Formula to calculateTotal assets:Total assets = Current assets + Non-current assets

Q: ADJUSTED TRIAL BALANCE INCOME STATEMENT Adjusted Trial Balance "For the Month Ending 31/8/2021"…

A: Balance Sheet: It is one of the financial statement of a company and report a company's assets,…

Q: Preparing closing entries from an adjusted trial balance The adjusted trial balance of Stone Sign…

A: 1. Date Account Title and Explanation Debit Credit January 31 Service Revenue $17,300…

Q: Adjusted Trial Balance Company A July 31, 2020 Account Debit Credit Cash 14,000 Accounts Receivable…

A: Adjusting entries are prepared at the end of reporting period to record accrued expenses and…

Q: The following trial balance has been adjusted as of December 31, 20XX Debits Credits…

A: Journal entries refer to the recording of transactions in an appropriate way. With the help of…

Q: Use the following selected accounts and amounts with normal balances from Andrea Company's adjusted…

A: Closing entries involve the temporary accounts which include the revenues, expenses and dividends.…

Q: The Gorman Group End-of-Period Spreadsheet For the Year Ended October 31, 2019 Adjusted Trial…

A: As per the equation Owner's equity = Total assets - Total liabilities Working

Q: DESOUSA COMPANY Worksheet (partial) For the Month Ended April 30, 2014 Adjusted Trial Balance Income…

A: Financial Statements are prepared by the management for reporting purposes. These are the essential…

Q: Following is a partial set of accounts as of December 31. Equipment Accounts receivable Land…

A: Balance sheet indicates the financial position of an organization. The assets are split into current…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Since we answer up to 3 sub-parts, we'll answer the first 3. Please resubmit the question and…

Q: SHERIDAN COMPANY Worksheet (partial) For the Month Ended April 30, 2020 Adjusted Trial Balance…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Adjusted Trial Balance Company A July 31, 2020 Account Debit Credit Cash 14,000 Accounts Receivable…

A: Introduction Closing journal entries: Closing journal entries are prepared at the end of the fiscal…

Q: King Company had the following adjusted trial balance: Account Titles Debit Cash $28,050 Accounts…

A: Closing entries are used to close the temporary accounts to the permanent account. Further, the…

Q: BestValue Corporation's Trial Balance at December 31, 20XX is presented below. All 20XX…

A: Financial Statements: Financial statements are the business transaction records that depicts the…

Q: Covid Resources Student Services Use the information in the adjusted trial balance presented below…

A: Liabilities means the amount payable to an outside by the business entity. Current liability means…

Q: The following adjusted year-end trial balance at December 31 of Wilson Trucking Company. Account…

A: Income statement of wilson Trucking Company as under

Q: The adjusted trial balance of C.S. Financial Planners appears below. C.S. Financial Planners…

A: 1. Financial Statements - Financial Statements includes Income Statement, Balance sheet and Cash…

Q: Blossom Company ended its fiscal year on July 31, 2020. The company’s adjusted trial balance as of…

A: The trial balance is prepared with posting of accounting transactions to particular accounts and…

Q: Systems for the year ended Dec. 31, 2018: lce of the Moises Dondoyano Information Moises Dondoyano…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: The following is the adjusted trial balance of Sierra Company. Sierra Company Adjusted Trial Balance…

A: A balance sheet is a financial statement that shows the assets, liabilities, and shareholder equity…

Q: The December 31, 2021 (pre-closing) adjusted trial balance for Kline Enterprises was as follows:…

A: State holders equity = Net income + retained earnings + common stock

Q: Need help please. Thank you

A: An income statement is a financial statement that represents the financial performance of the…

Q: Here is the partial work sheet for Eckland Stereo. Eckland Stereo Work Sheet For Year Ended…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: mpany Worksheet For the month ended 31, March 20A Adjusted Statement of Comprehensive Income…

A: The financial statements of the business include the income statement, balance sheet and cash flow…

Q: Sierra Company Adjusted Trial Balance December 31 Account Title Debit Credit Cash $ 33,000 Prepaid…

A: Income statement is one of the important financial statements used to evaluate the operational…

Q: Adjusted Trial Balance December 31 Account Title Debit Credit $ 41,000 2,300 Cash Prepaid insurance…

A: The balance sheet shows the financial position of the company. It shows the assets, liabilities, and…

Q: The adjusted trial balance for Chiara Company as of December 31 follows. Debit $ 30,000 52,000…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: The following adjusted trial balance at December 31 of Wilson Trucking Company. Account Title Debit…

A: Closing entries are used to close the temporary accounts to the permanent account. The income…

Q: Sierra Company Adjusted Trial Balance December 31 Account Title Debit Credit Cash $ 33,000 Prepaid…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: Based on the accounts shown below in the Partial Adjusted Trial Balance dated 12/31/20xx, what is…

A: Amounts of debits are the sum of expenses and assets

Q: Following are accounts and year-end adjusted balances of Cruz Company as of December 31. Number…

A: Owner's capital account is increased by the net income and new investment and decreased by net loss…

Q: eet For the month ended 31, March 20A Adjusted Statement of Comprehensive Income Statement of…

A: The financial statements of the business include the income statement, balance sheet and cash flow…

Q: The December 31, 2021 (pre-closing) adjusted trial balance for Kline Enterprises was as follows:…

A: Current Liabilities are short term liabilities which will be due for repayment within a year .

Q: For the Month Ended April 30, 2022 Adjusted Trial Balance Income Statement Balance Sheet Account…

A: The income statement is prepared to find the profitability of the business. The balance sheet…

Q: Concord Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: The adjusted trial balance for Chiara Company as of December 31 follows. Debit Credit Cash $…

A: INTRODUCTION: A financial statement is the balance sheet. It displays an entity's assets,…

Step by step

Solved in 2 steps

- Using the following information: A. make the December 31 adjusting journal entry for depreciation B. determine the net book value (NBV) of the asset on December 31 Cost of asset, $250,000 Accumulated depreciation, beginning of year, $80,000 Current year depreciation, $25,000The adjusted trial balance for Tybalt Construction on December 31 of the current year follows. TYBALT CONSTRUCTIONAdjusted Trial BalanceDecember 31No.Account TitleDebit Credit101Cash$5,000 104Short-term investments 23,000 126Supplies 8,100 128Prepaid insurance 7,000 167Equipment 40,000 168Accumulated depreciation—Equipment $20,000 173Building 150,000 174Accumulated depreciation—Building 50,000 183Land 55,000 201Accounts payable 16,500 203Interest payable 2,500 208Rent payable 3,500 210Wages payable 2,500 213Property taxes payable 900 236Unearned revenue 7,500 244Current portion of long-term note payable 7,000 251Long-term notes payable 60,000 307Common stock 5,000 318Retained earnings 121,400 319Dividends 13,000 404Services revenue 97,000 406Rent revenue 14,000 407Dividends revenue 2,000 409Interest revenue 2,100 606Depreciation expense—Building 11,000 612Depreciation expense—Equipment 6,000 623Wages expense 32,000 633Interest expense 5,100 637Insurance expense 10,000 640Rent expense…How to do the post-adjustment trial balance of Fling Incorporated for the financial year ended 31 December 2021. Motor vehicles50 000 DtAccumulated depreciation on motor vehicles5 000 CrDebtors control45 000 DtBank: one 7 550 DtBank two:650 CrEquipment25 000 DtAccumulated depreciation on equipment2 100 CrCreditors control15 600 CrShare capital3 000 CrRetained earnings31 800 CrRental income13 000 CrInventory: Finished products8 500 DtSale of goods135 000 CrWater and electricity8 800 DtSalaries and wages55 000 CrPrinting and stationery6 300 Cr206 150(206 150) Adjustments:1. Rental income earned monthly amounts to R1 000.2. Printing and stationery on hand as at 31 December 2021 amounted to R800.3. Cleaning expenses of R250 was incorrectly posted to the salaries and wages account.4. Discount of R150 was given to a debtor who…

- Use the trial balance, adjustments and additional information to prepare the Statement ofComprehensive Income for the year ended 28 February 2022.Liat TradersPRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022Balance sheet accounts section Debit CreditR RCapital 550 854Drawings 75 150Land and buildings 477 164Vehicles at cost 91 000Equipment at cost 67 000Accumulated depreciation on vehicles 31000Accumulated depreciation onequipment 23800Trading inventory 68 800Debtors control 45 850Provision for bad debts 1900Bank 15 560Cash float 1 250Petty cash 250Creditors control 38 860Loan: MUFG Bank (15%) 21600Nominal accounts sectionSales 498 000Cost of sales 244 000Sales returns 8 000Wages 42 500Bank charges 2 300Rent income 26000Packing materials 12 000Advertising 8 500Rates 3 000Bad debts 900Discount allowed 750Discount received 980Stationery 8 500Interest on loan 2 970Water and electricity 5 550Insurance 5 000Telephone 7 0001 192 994 1 192 994Adjustments and additional information1. A…Prepare the Statement of Comprehensive Income as at: 28 February 2021.Embassy TradersPre-adjustment Trial Balance as at: 28 February 2021Debit CreditBalance Sheet Accounts SectionCapital 1 651 100Drawings 132 900Land and buildings 1 254 800Vehicles at cost 925 000Equipment 662 000Accumulated depreciation on vehicles 528 000Accumulated depreciation on equipment 369 000Fixed deposit: Bob-bank (9% p.a.) 200 000Trading inventory 152 000Debtors control 174 800Provision for bad debts 10 000Bank 127 800Creditors control 184 800Mortgage loan: Bob-bank (18% p.a.) 330 000Nominal Accounts SectionSales 2 075 000Cost of sales 795 000Sales returns 15 000Salaries and wages 586 000Bad debts 18 000Stationary 30 000Rates and taxes 58 000Motor expenses 32 000Advertising 23 000Telephone 44 000Electricity and water 66 000Bank charges 8 000Insurance 5 000Interest on mortgage loan 26 000Interest on fixed deposit 15 000Rent income 171 6005 334 500 5 334 500Adjustments and additional information1.Trading…The following trial balance was extracted from the ledger of Juliana at 31 December 2020.JulianaTrial Balance as at 31 December 2020RMRMLand at cost26,000Plant at cost83,000Accumulated Depreciation at 1 January 2020- Plant13,000Office Equipment33,000Accumulated Depreciation at 1 January 2020Office Equipment8,000Receivables198,000Payables52,000Sales763,000Purchases516,000Returns inwards47,000Discount allowed4,000Capital at 1st January 2020230,000Drawings14,000Provision for doubtful debts at 1 January 202023,000Salaries Expense44,000Administration costs38,000Bank75,000Bad debts written off77,000Inventory at 1 January 202084,0001,164,0001,164,000Additional information: Closing inventory is RM74,000. Depreciation on plant is charged at 10% per annum on cost. Depreciation on office equipment is charged at 20% per annum using the reducing balance method. Administration costs include insurance prepaid of RM3,000. Salary accrued amount to RM2,000. The allowance for receivables is to…

- Prepare the Statement of Comprehensive Income of Royal Traders for the year ended 28February 2021.INFORMATIONThe trial balance, adjustments and additional information given below were extracted from the accounting records ofRoyal Traders on 28 February 2021, the end of the financial year.ROYAL TRADERSPRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2021Balance sheet accounts sectionCapital 301 000Drawings 134 720Vehicles at cost 360 000Equipment at cost 240 000Accumulated depreciation on vehicles 186 000Accumulated depreciation on equipment 62 000Trading inventory 140 000Debtors control 62 000Provision for bad debts 8 000Bank 42 800Cash float 1 000 Creditors control 82 800Mortgage loan: Leo Bank (18% p.a.) 160 000 Nominal accounts section Sales 1 000 000Cost of sales 480 000Sales returns 8 000Salaries and wages 178 000Bad debts 2 000Stationery 4 000Rent expense 42 880Motor expenses 34 000Bad debts recovered 2 000Telephone 14 000Electricity and water 24 000Bank charges 6 000Insurance 12…Preparing and Journalizing Adjusting Entries For each of the following separate situations, prepare the necessary adjustments (a) using the finan- cial statement effects template, and (b) in journal entry form. 1. Unrecorded depreciation on equipment is $610. 2.Onthedateforpreparingfinancialstatements,anestimatedutilitiesexpenseof$390hasbeen incurred, but no utility bill has yet been received or paid. 3.Onthefirstdayofthecurrentperiod,rentforfourperiodswaspaidandrecordedasa$2,800 debit to Prepaid Rent and a $2,800 credit to Cash. 4.Ninemonthsago,the Hartford Financial Services Group soldaone-yearpolicytoacustomer andrecordedthereceiptofthepremiumbydebitingCashfor$624andcreditingContract Liabilitiesfor$624.Noadjustingentrieshavebeenpreparedduringthenine-monthperiod. Hartford’s annual financial statements are now being prepared. 5.Attheendoftheperiod,employeewagesof$965havebeenincurredbutnotyetpaidor recorded. 6. At the end of the period, $300 of interest income has been earned but not…Depreciation by Units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $426,700 and the balance in Accumulated Depreciation—Trucks is $132,940. Details of the subsidiary ledger are as follows: TruckNo. Cost EstimatedResidualValue EstimatedUsefulLife AccumulatedDepreciationat Beginningof Year MilesOperatedDuringYear 1 $77,000 $11,550 200,000 miles — 30,000 miles 2 117,200 14,064 370,000 $23,440 37,000 3 105,000 14,700 202,000 84,000 20,200 4 127,500 15,300 240,000 25,500 28,800 Question Content Area a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Truck No. Rate per…

- At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $30,000 andzero balances in Accumulated Depreciation—Equipment and Depreciation Expense. Depreciationfor the period is estimated to be $6,000. Prepare the adjusting journal entry on December 31. Inseparate T-accounts for each account, enter the unadjusted balances, post the adjusting journalentry, and report the adjusted balanceDepreciation by units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $404,300 and the balance in Accumulated Depreciation—Trucks is $118,560. Details of the subsidiary ledger are as follows: TruckNo. Cost EstimatedResidualValue EstimatedUsefulLife AccumulatedDepreciationat Beginningof Year MilesOperatedDuringYear 1 $84,500 $12,675 230,000 miles — 34,500 miles 2 116,300 13,956 320,000 $23,260 32,000 3 91,000 12,740 200,000 $72,800 20,000 4 112,500 13,500 350,000 $22,500 42,000 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Enter all values as positive amounts.…Depreciation by units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $385,500 and the balance in Accumulated Depreciation—Trucks is $115,400. Details of the subsidiary ledger are as follows: TruckNo. Cost EstimatedResidualValue EstimatedUsefulLife AccumulatedDepreciationat Beginningof Year MilesOperatedDuringYear 1 $78,500 $11,775 240,000 miles — 36,000 miles 2 114,500 13,740 320,000 $22,900 32,000 3 90,000 12,600 213,000 $72,000 21,300 4 102,500 12,300 370,000 $20,500 44,400 a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Enter all values as positive amounts. Truck…