Sheridan Company purchased equipment on March 31, 2021, at a cost of $216,000. Management is considering the merits of using the diminishing-balance or units-of-production method of depreciation instead of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated residual value of $8,000 and an estimated useful life of either four years or 80,000 units. Demand for the products produced by the equipment is sporadic so the equipment will be used more in some years than in others. Assume the equipment produces the following number of units each year: 15,000 units in 2021; 20,600 units in 2022; 19,400 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Sheridan has a December 31 year end.

Sheridan Company purchased equipment on March 31, 2021, at a cost of $216,000. Management is considering the merits of using the diminishing-balance or units-of-production method of depreciation instead of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated residual value of $8,000 and an estimated useful life of either four years or 80,000 units. Demand for the products produced by the equipment is sporadic so the equipment will be used more in some years than in others. Assume the equipment produces the following number of units each year: 15,000 units in 2021; 20,600 units in 2022; 19,400 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Sheridan has a December 31 year end.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

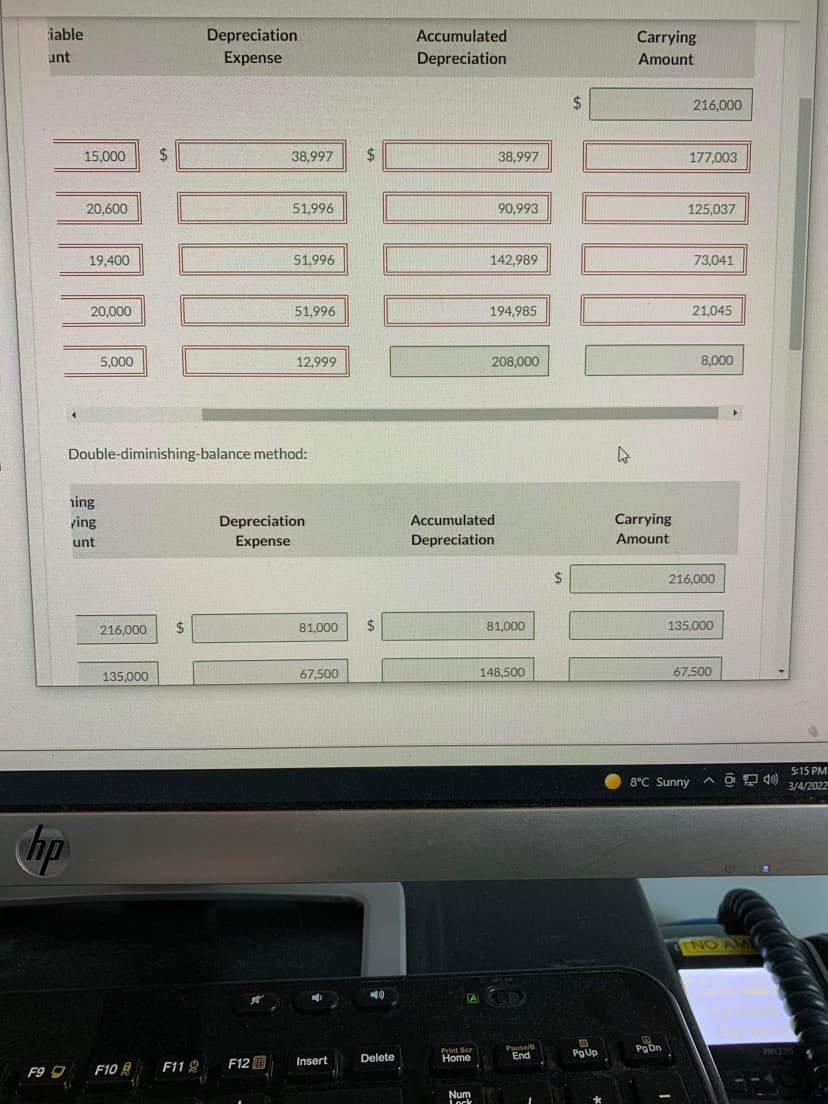

Transcribed Image Text:iable

Depreciation

Accumulated

Carrying

unt

Expense

Depreciation

Amount

2$

216,000

15,000

$

38,997

2$

38,997

177,003

20,600

51,996

90,993

125,037

19,400

51,996

142,989

73,041

20,000

51,996

194,985

21,045

5,000

12,999

208,000

8,000

Double-diminishing-balance method:

ing

ving

Depreciation

Expense

Accumulated

Carrying

unt

Depreciation

Amount

%24

216.000

216,000

81,000

24

81,000

135,000

67,500

148,500

67,500

135,000

5:15 PM

8°C Sunny

3/4/2022

hp

NO AM

10

Print Scr

Home

Pause/B

End

Pg Dn

PgUp

Delete

F11 8

F12 E

Insert

F9

F10 A

Num

Lock

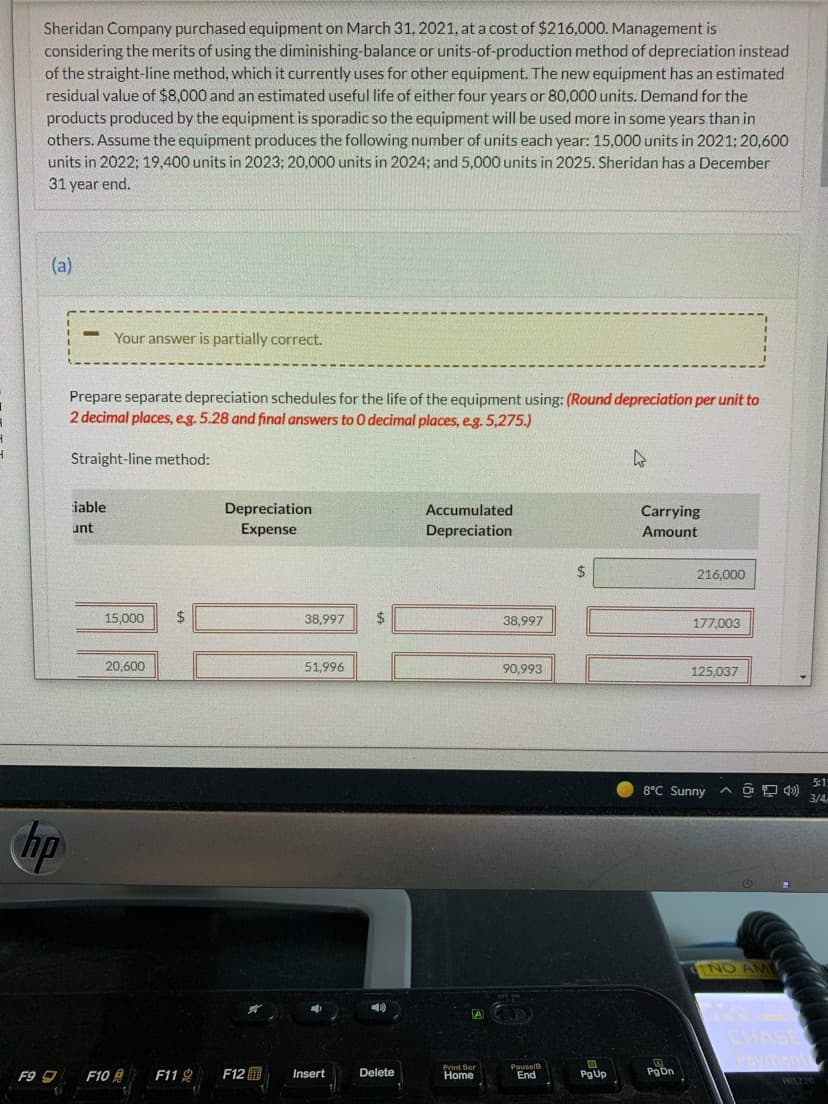

Transcribed Image Text:Sheridan Company purchased equipment on March 31, 2021, at a cost of $216,000. Management is

considering the merits of using the diminishing-balance or units-of-production method of depreciation instead

of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated

residual value of $8,000 and an estimated useful life of either four years or 80,000 units. Demand for the

products produced by the equipment is sporadic so the equipment will be used more in some years than in

others. Assume the equipment produces the following number of units each year: 15,000 units in 2021; 20,600

units in 2022; 19,400 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Sheridan has a December

31 year end.

(a)

Your answer is partially correct.

Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to

2 decimal places, e.g. 5.28 and final answers to 0 decimal places, e.g. 5,275.)

Straight-line method:

iable

Depreciation

Accumulated

Carrying

unt

Expense

Depreciation

Amount

216,000

15,000

2$

38,997

2$

38,997

177,003

20,600

51,996

90,993

125,037

5:1

8°C Sunny

A O O 4)

3/4

Cp

NO AM

CHASE

Payment

Print Sor

Home

Pause/B

F9 O

F10

F11

F12

Insert

Delete

PgUp

PgDn

End

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT