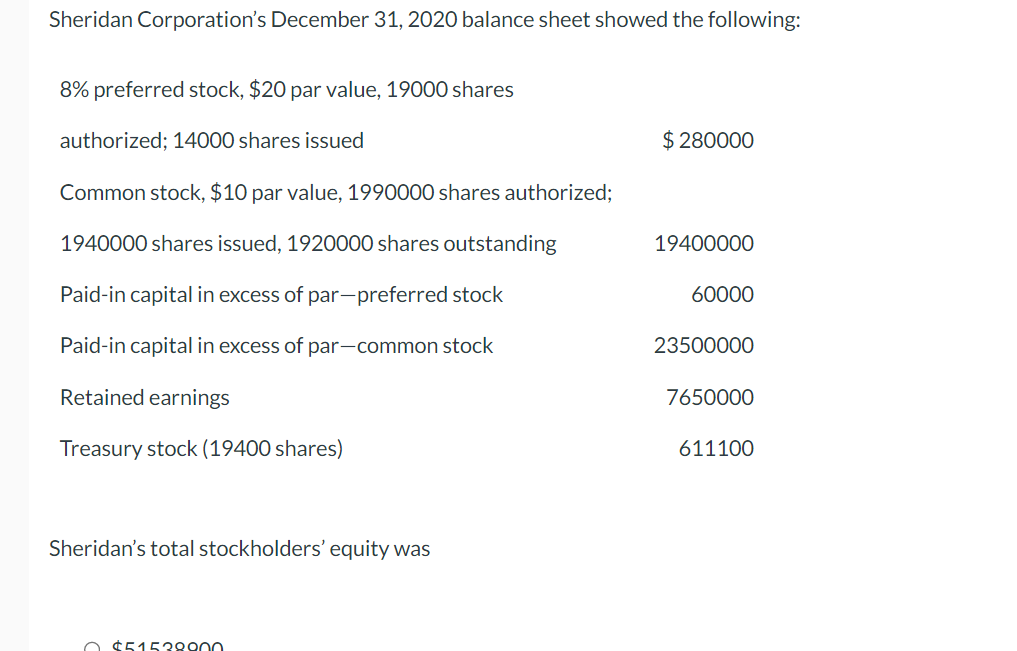

Sheridan Corporation's December 31, 2020 balance sheet showed the following: 8% preferred stock, $20 par value, 19000 shares authorized; 14000 shares issued Common stock, $10 par value, 1990000 shares authorized; 1940000 shares issued, 1920000 shares outstanding Paid-in capital in excess of par-preferred stock Paid-in capital in excess of par-common stock Retained earnings Treasury stock (19400 shares) Sheridan's total stockholders' equity was $ 280000 19400000 60000 23500000 7650000 611100

Q: Assume the following information for a company that produced 10,000 units and sold 9,000 units…

A: Variable costing: It implies to a costing method whereby only variable expenses are assigned or…

Q: A B C D In auditing a non-public company, the auditor will test the internal control under which of…

A: AR = Audit Risk (Risk that auditor gives the wrong opinion) IR = Inherent Risk (Risk that material…

Q: Yarrow County engaged in the following debt-related transactions during the year. REQUIRED: Assume…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: Master Designs Decorators issued a 180-day, 6% note for $75,000, dated May 14, 2019, to Morgan…

A: Notes Receivable - Notes is Promissory notes issued by the payer to the receiver. Notes is an…

Q: Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current…

A: Variance is defined as the amount that causes distinction between the actual number or figures and…

Q: Unearned revenues Example Assume that on September 30, 2022, Iberia sells 500 tickets from Madrid to…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: chell Company manufactures automobile floor mats. It currently has two product lines, the Standard…

A: Under Activity based costing, the cost for each activity is assigned on the basis of its…

Q: April 5 April 10 April 15 April 20 April 22 ne unit is sold on April 25. The c entify the cost of…

A: Answer : Ending inventory = Total number of unit purchase - Unit sold Ending inventory = 5 - 1 = 4…

Q: member LLC, and single taxpayer had taxable income of $85,000. this amount included short term…

A: Loss incurred from capital transactions can be carry forward to later tax years. It includes short…

Q: If a firm has a cash cycle of 32 days and an operating cycle of 52 days, what is its payables…

A:

Q: The Allowance for Doustful Accounts account is a Contru-account that offsets: A. Cost of Goods Seld…

A: "Allowance for doubtful accounts" is a provision for upcoming estimated bad debts, prepared to…

Q: Carlise has identified the following information about its overhead activity pools and the two…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: E7.1 (LO 2) (Inventoriable Goods and Costs) Presented below is a list of items that may or may not…

A: Every company uses assets to run its business. The company keeps records about its assets and…

Q: Trey Monson starts a merchandising business on December 1 and enters into the following three…

A: FIFO Method :— It is one of the method of inventory valuation in which beginning inventory and old…

Q: X Company makes Chicken nuggets, a mass-market high- volume product, and Unicorn nuggets, a premium…

A: Given the company is using traditional cost allocation with single cost pool for both high volume…

Q: Regarding the issuance of stock, which of the following statements is incorrect? O Large…

A: Regarding the issuance of stocks, the following statements are an analysed: (1) Large corporations…

Q: The following information is available from the current period financial statements: Net income…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Q: Walter is a used car dealer. He has the chance to buy a used car that he thinks he can resell for…

A: Mark-up is the desired margin on a product. It is the value added above cost of the product. The…

Q: QS 1-21 (Static) Computing and interpreting return on assets LO A2 Home Demo reported the following…

A: RETURN ON ASSETS Return of Assets is a Profitability ratio. Return of Assets is one of the…

Q: On 1 July 2020 Jane Ltd (lessor) leased equipment to Austin Ltd (Lessee). The equipment had a fair…

A: The expression "Lease Payment" is similar to the term "Rental Payment." It describes the payment…

Q: Confucius Bookstore's inventory is destroyed by a fire on September 5. The following data for the…

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method. The…

Q: Intercontinental, Incorporated, uses a perpetual inventory system. Consider the following…

A: Inventory valuation method includes: FIFO Method LIFO Method Weighted average cost method FIFO…

Q: The following data relate to the operations of Shilow Company, a wholesale distributor of consumer…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: E9-8 (Algo) Computing and Recording Double-Declining-Balance Depreciation [LO 9-3] Yazzie…

A: Depreciation Expense - Depreciation is an operating Expense incurred due to use, wear and tear,…

Q: March 1 March 3 March 10 March 21 March 29 Previous Balance Payment Purchases June 1 June 5 June 20…

A: Credit Card is the card which are been issued by financial institution or Bank through which a card…

Q: How would the SCF indicate to an investor that the company is experiencing a "cash crunch?"

A: A statement which is prepared for the purpose of finding out where the company stands from the cash…

Q: ernal control purposes, which of the following individual should preferably be responsible for…

A: Internal Control - Internal control is a procedure implemented by a company's management, board of…

Q: Warren Exploration Company reported these figures for 2024 and 2023: (Click the icon to view the…

A: Average total assets = (Beginning total assets + Ending total assets)/2 Rate of return on total…

Q: Which of the following is a potential cost or benefit of positive leverage? A interest tax shield

A: Leverage represents the changes in the earnings per share of the company. The earnings per share is…

Q: During the current year, Robby's Camera Shop had sales revenue of $164,000, of which $67,000 was on…

A: Working :- 1) Calculation of bad debt expense for the year :- Credit sales * 2.5% = $67,000 *…

Q: Make journal entry using cash count sheet. BE7.7 (LO 2), AP While examining cash receipts…

A: Journal entry is defined as the recording of transactions in the books of a company. When a journal…

Q: Which of the following is TRUE of a written partnership agreement? O It is an agreement in which the…

A: Partnership is legal agreement between two or more person in which they writes about the;- profit…

Q: A car dealer acquires a used car for $7,000, with terms FOB shipping point. Compute total inventory…

A: All costs related to placing orders, maintaining inventories, and controlling stock levels in a…

Q: Godhi's 2024 financial statements reported the following items-with 2023 figures given for…

A: In order to determine the rate of return on total assets the net income and interest expense are…

Q: 19.

A: Date/s.no. Particulars Debit Credit 1. Cash Dr. 20,000 Land in Indiana. Dr. 60,000…

Q: Sheridan Company acquired Ranger Company for $44016000 cash on August 1, 2026. The fair value of…

A: Goodwill Goodwill is one of the intangible assets that an organization holds. This type of assets…

Q: Maria Company uses both standards and budgets. For the year, estimated production of Product X is…

A: A normal expense is one that has been budgeted or scheduled. Engineering designs and production…

Q: The Silversword Company produces widgets. The sales forecast for 2022 is as follows: Quarter 1 3000…

A: Sales budget is the statement prepared by an entity to forecast the future sales. It is prepared on…

Q: Use the given conditions to write an equation for the line in point-slope form and in…

A: Demand Demand in economics refers to a consumer's readiness to pay a particular price for goods and…

Q: A company reports the following financial information: Inventory, December 31, 2021 Inventory,…

A: Days inventory in sale is ratio which is used to measure the efficiency of the entity in selling off…

Q: Here is Jim's credit card statement for the month of August. Date August 1 August 4 August 8…

A: Credit cards are provided by banks to customers or credit card holders. It's a credit facility. In…

Q: Calculate James net pay for the week.

A: Given in the question: Normal Working Hours per day 8 Hours Any overtime of a day the…

Q: Product X is obtained after it passes through three distinct processes. The following cost…

A: Some manufacturing units manufacture products that cannot be completed in one process and require…

Q: Inglewood industries has net sales of $936,600 and average net receivables of $223,000 for the which…

A: The accounts receivable turnover ratio is a financial indicator that shows how effectively a…

Q: BES-2 Prepare the journal entries to record the following transactions on Rowen Company's books: (a)…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Carlise has identified the following information about its overhead activity pools and the two…

A: Working :- 1) Calculation of total number of moves :- Consumed by indoor lines + outdoor lines =…

Q: Susan, Preston, and Roman are partners in a firm with the following capital account balances: Susan…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: 5. A loan L is repaid with twenty annual payments. The total amount of each payment is $1,200. The…

A: Introduction Payments paid yearly are payments required by law. Similar to savings and investment…

Q: Alpha and Beta companies produce the same product with different technology. The selling price (T)…

A: Break-Even Point: The Break-even point is the point of sale at which an organization does not earn…

Q: n the manufacture of 9,800 units of a product, direct materials cost incurred was $174,800, direct…

A: Conversion cost is the manufacturing cost incurred to covert the raw material into the finished…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.

- Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Calculating the Number of Shares Issued Castalia Inc. issued shares of its $0.80 par value common stock on September 4, 2019, for $8 per share. The Additional Paid-In Capital-Common Stock account was credited for 5612,000 in the journal entry to record this transaction. Required: How many shares were issued on September 4, 2019?Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.