Short- Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 9% nominal rate; (b) borrow on a 3- month, but renewable, loan basis at an 11.6% nominal rate; (c) borrow on an installment loan basis at a 7% add-on rate with 12 end-of-month payments, assuming you borrowed $100; (d) obtain the needed funds by no longer taking discounts and thus increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of each type of credit, assuming 360 days per year? Do not round intermediate calculations. Round your answers to two decimal places. Credit A: Credit B: 9% 12.1 % 7 % Credit C: Credit D: 8% What is the least expensive type of credit? Credit DV

Short- Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 9% nominal rate; (b) borrow on a 3- month, but renewable, loan basis at an 11.6% nominal rate; (c) borrow on an installment loan basis at a 7% add-on rate with 12 end-of-month payments, assuming you borrowed $100; (d) obtain the needed funds by no longer taking discounts and thus increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of each type of credit, assuming 360 days per year? Do not round intermediate calculations. Round your answers to two decimal places. Credit A: Credit B: 9% 12.1 % 7 % Credit C: Credit D: 8% What is the least expensive type of credit? Credit DV

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 7P: Effective Cost of Short-Term Credit Yonge Corporation must arrange financing for its working capital...

Related questions

Question

Qd 59.

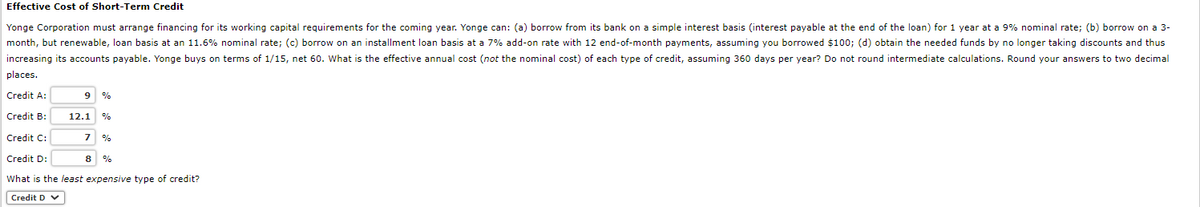

Transcribed Image Text:Effective Cost of Short-Term Credit

Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 9% nominal rate; (b) borrow on a 3-

month, but renewable, loan basis at an 11.6% nominal rate; (c) borrow on an installment loan basis at a 7% add-on rate with 12 end-of-month payments, assuming you borrowed $100; (d) obtain the needed funds by no longer taking discounts and thus

increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of each type of credit, assuming 360 days per year? Do not round intermediate calculations. Round your answers to two decimal

places.

Credit A:

9 %

Credit B:

12.1 %

Credit C:

7 %

Credit D:

8 %

What is the least expensive type of credit?

Credit D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning