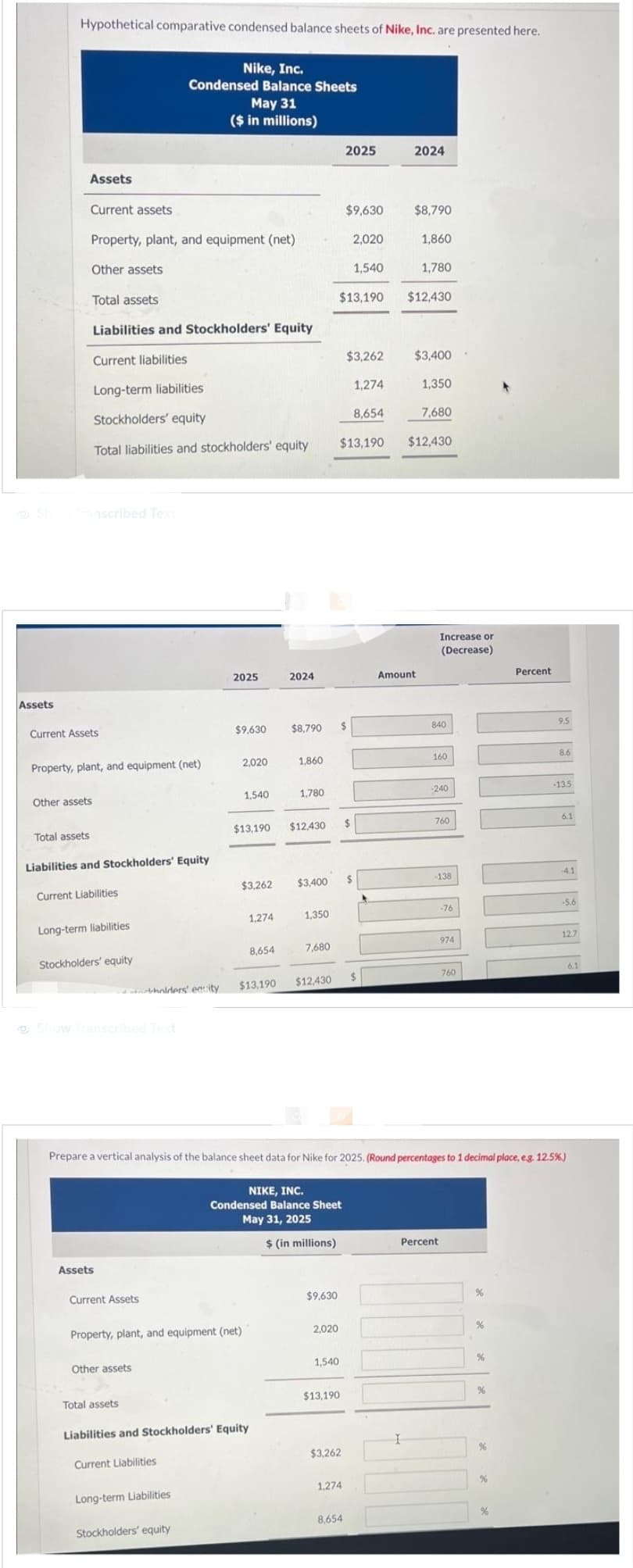

Show Transcribed Text Assets Current Assets Total liabilities and stockholders' equity Property, plant, and equipment (net) Other assets Total assets Liabilities and Stockholders' Equity Current Liabilities Long-term liabilities Stockholders' equity Assets Current Assets Other assets Total assets 2025 $9,630 Long-term Liabilities 2,020 Property, plant, and equipment (net) Stockholders' equity 1,540 $13,190 $3,262 holders' entity $13,190 1.274 Liabilities and Stockholders' Equity Current Liabilities 8,654 2024 $8,790 1,860 1,780 $12,430 $3,400 1,350 7,680 $12,430 NIKE, INC. Condensed Balance Sheet May 31, 2025 $ (in millions) $9,630 2,020 1,540 $13,1 $13,190 $ $3,262 1.274 $ 8,654 S $ Amount Prepare a vertical analysis of the balance sheet data for Nike for 2025. (Round percentages to 1 decimal place, e.g. 12.5%) Increase or (Decrease) 840 160 -240 760 -138 Percent -76 974 760 % % % % % % Percent % 9.5 8.6 -13.5 6.1 -4.1 -5.6 12.7 6.1

Show Transcribed Text Assets Current Assets Total liabilities and stockholders' equity Property, plant, and equipment (net) Other assets Total assets Liabilities and Stockholders' Equity Current Liabilities Long-term liabilities Stockholders' equity Assets Current Assets Other assets Total assets 2025 $9,630 Long-term Liabilities 2,020 Property, plant, and equipment (net) Stockholders' equity 1,540 $13,190 $3,262 holders' entity $13,190 1.274 Liabilities and Stockholders' Equity Current Liabilities 8,654 2024 $8,790 1,860 1,780 $12,430 $3,400 1,350 7,680 $12,430 NIKE, INC. Condensed Balance Sheet May 31, 2025 $ (in millions) $9,630 2,020 1,540 $13,1 $13,190 $ $3,262 1.274 $ 8,654 S $ Amount Prepare a vertical analysis of the balance sheet data for Nike for 2025. (Round percentages to 1 decimal place, e.g. 12.5%) Increase or (Decrease) 840 160 -240 760 -138 Percent -76 974 760 % % % % % % Percent % 9.5 8.6 -13.5 6.1 -4.1 -5.6 12.7 6.1

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 2PEA

Related questions

Question

Oo.52.

Subject:- Account

Transcribed Image Text:Assets

Hypothetical comparative condensed balance sheets of Nike, Inc. are presented here.

Assets

Current assets

Total assets

Property, plant, and equipment (net)

Other assets

Other assets

Total assets

y Transcribed Text

Current Assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term liabilities

Stockholders' equity

Total liabilities and stockholders' equity

Property, plant, and equipment (net)

Liabilities and Stockholders' Equity

Current Liabilities

Long-term liabilities

Stockholders' equity

Show Transcribed Text

Assets

Current Assets

Nike, Inc.

Condensed Balance Sheets

May 31

($ in millions)

holders' entity

Other assets

Total assets

Current Liabilities

2025

Long-term Liabilities

$9,630

Stockholders' equity

Property, plant, and equipment (net)

2,020

1,540

$13,190

Liabilities and Stockholders' Equity

1,274

$13,190

8,654

2024

$3,262 $3,400

1,860

1,780

$12,430

$8,790 $

1,350

7,680

$12,430

NIKE, INC.

Condensed Balance Sheet

May 31, 2025

$ (in millions)

$9,630

2,020

1,540

$13,190

1,540

$13,190

2025

$9,630

$3,262

1.274

$13,190

8,654

2,020

$

1,274

8,654

$3,262 $3,400

1,350

$

2024

$

$8,790

1,860

1,780

$12,430

Amount

7,680

$12,430

Prepare a vertical analysis of the balance sheet data for Nike for 2025. (Round percentages to 1 decimal place, e.g. 12.5%)

Increase or

(Decrease)

840

160

-240

760

138

Percent

-76

974

760

%

%

%

%

%

Percent

%

9.5

8.6

-13.5

6.1

4.1

-5.6

12.7

6.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning