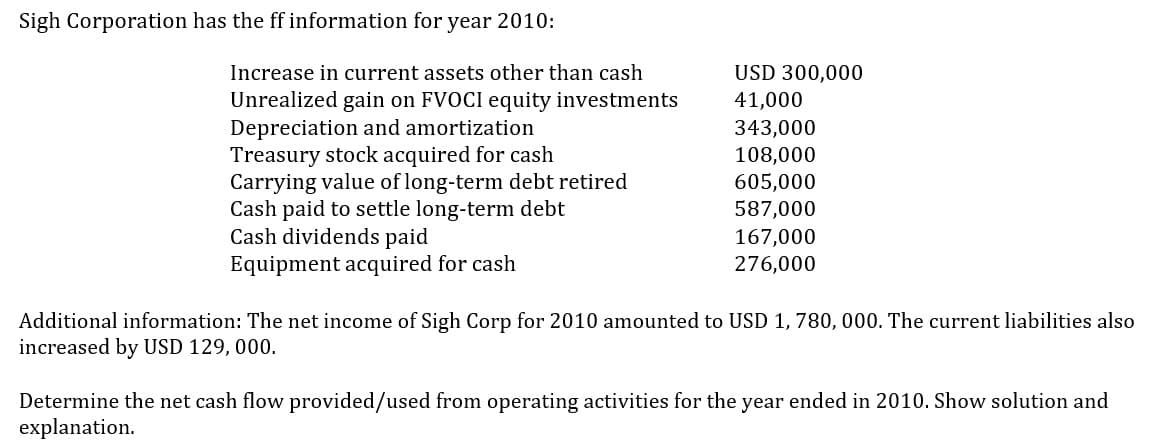

Sigh Corporation has the ff information for year 2010: Increase in current assets other than cash Unrealized gain on FVOCI equity investments Depreciation and amortization USD 300,000 41,000 343,000 Treasury stock acquired for cash 108,000 605,000 Carrying value of long-term debt retired Cash paid to settle long-term debt Cash dividends paid 587,000 167,000 Equipment acquired for cash 276,000 Additional information: The net income of Sigh Corp for 2010 amounted to USD 1,780, 000. The current liabilities also increased by USD 129,000. Determine the net cash flow provided/used from operating activities for the year ended in 2010. Show solution and explanation.

Sigh Corporation has the ff information for year 2010: Increase in current assets other than cash Unrealized gain on FVOCI equity investments Depreciation and amortization USD 300,000 41,000 343,000 Treasury stock acquired for cash 108,000 605,000 Carrying value of long-term debt retired Cash paid to settle long-term debt Cash dividends paid 587,000 167,000 Equipment acquired for cash 276,000 Additional information: The net income of Sigh Corp for 2010 amounted to USD 1,780, 000. The current liabilities also increased by USD 129,000. Determine the net cash flow provided/used from operating activities for the year ended in 2010. Show solution and explanation.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15GI: Jordan Company recognized a 5,000 unrealized holding gain on investment in Starbuckss common stock...

Related questions

Question

Show solution and explanation.

Transcribed Image Text:Sigh Corporation has the ff information for year 2010:

USD 300,000

Increase in current assets other than cash

Unrealized gain on FVOCI equity investments

Depreciation and amortization

41,000

343,000

Treasury stock acquired for cash

108,000

605,000

Carrying value of long-term debt retired

Cash paid to settle long-term debt

Cash dividends paid

587,000

167,000

Equipment acquired for cash

276,000

Additional information: The net income of Sigh Corp for 2010 amounted to USD 1, 780, 000. The current liabilities also

increased by USD 129, 000.

Determine the net cash flow provided/used from operating activities for the year ended in 2010. Show solution and

explanation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning