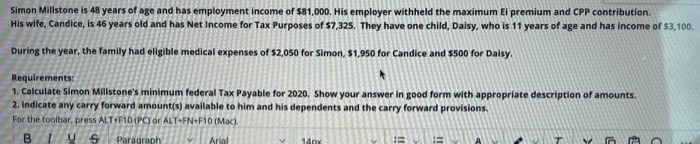

Simon Millstone is 48 years of age and has employment income of S81,000. His employer withheld the maximum Ei premium and CPP contribution. His wife, Candice, is 46 years old and has Net Income for Tax Purposes of $7,325. They have one child, Daisy, who is 11 years of age and has income of $3,100. During the year, the family had eligible medical expenses of $2,050 for Simon, $1,950 for Candice and $500 for Daisy. Requirements: 1. Calculate Simon Millstone's minimum federal Tax Payable for 2020. Show your answer in good form with appropriate description of amounts. 2. Indicate any carry forward amount(s) available to him and his dependents and the carry forward provisions.

Simon Millstone is 48 years of age and has employment income of S81,000. His employer withheld the maximum Ei premium and CPP contribution. His wife, Candice, is 46 years old and has Net Income for Tax Purposes of $7,325. They have one child, Daisy, who is 11 years of age and has income of $3,100. During the year, the family had eligible medical expenses of $2,050 for Simon, $1,950 for Candice and $500 for Daisy. Requirements: 1. Calculate Simon Millstone's minimum federal Tax Payable for 2020. Show your answer in good form with appropriate description of amounts. 2. Indicate any carry forward amount(s) available to him and his dependents and the carry forward provisions.

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 51P

Related questions

Question

100%

Transcribed Image Text:Simon Millstone is 48 years of age and has employment income of $81,000. His employer withheld the maximum Ei premium and CPP contribution.

His wite, Candice, is 46 years old and has Net Income for Tax Purposes of $7,325, They have one child, Daisy, who is 11 years of age and has Income of $3,100.

During the year, the family had eligible medical expenses of $2,050 for Simon, $1,950 for Candice and $500 for Daisy.

Requirements:

1. Calculate Simon Millstone's minimum federal Tax Payable for 2020. Show your answer in good form with appropriate description of amounts.

2. Indicate any carry forward amount(s) available to him and his dependents and the carry forward provisions.

For the toolbar, press ALTF10 (PC) or ALT+FN+F10 (Mac).

B.

Paragraph

Arial

14px

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you