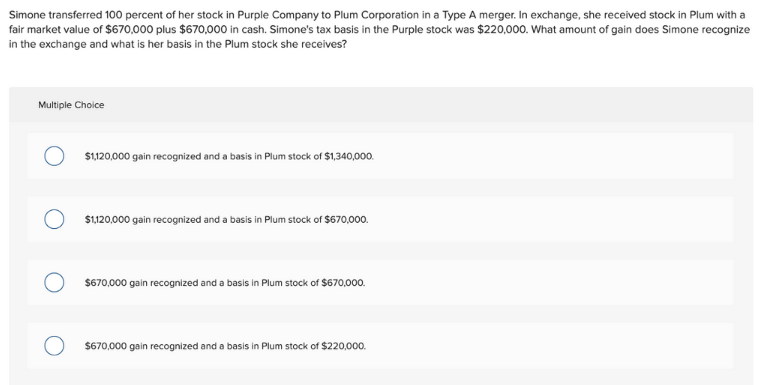

Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a fair market value of $670,000 plus $670,000 in cash. Simone's tax basis in the Purple stock was $220,000. What amount of gain does Simone recognize in the exchange and what is her basis in the Plum stock she receives? Multiple Choice $1,120,000 gain recognized and a basis in Plum stock of $1,340,000. $120,000 gain recognized and a basis in Plum stock of $670,000. $670,000 gain recognized and a basis in Plum stock of $670,000. $670,000 gain recognized and a basis in Plum stock of $220,000.

Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a fair market value of $670,000 plus $670,000 in cash. Simone's tax basis in the Purple stock was $220,000. What amount of gain does Simone recognize in the exchange and what is her basis in the Plum stock she receives? Multiple Choice $1,120,000 gain recognized and a basis in Plum stock of $1,340,000. $120,000 gain recognized and a basis in Plum stock of $670,000. $670,000 gain recognized and a basis in Plum stock of $670,000. $670,000 gain recognized and a basis in Plum stock of $220,000.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 43P

Related questions

Question

Transcribed Image Text:Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a

fair market value of $670,000 plus $670,000 in cash. Simone's tax basis in the Purple stock was $220,000. What amount of gain does Simone recognize

in the exchange and what is her basis in the Plum stock she receives?

Multiple Choice

$1,120,000 gain recognized and a basis in Plum stock of $1,340,000.

$120,000 gain recognized and a basis in Plum stock of $670,000.

$670,000 gain recognized and a basis in Plum stock of $670,000.

$670,000 gain recognized and a basis in Plum stock of $220,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you