siness income g expenses inclu tions to governr

Q: Spouse A Spouse B Market wages 80,000/year 20,000/year Home production 12,000/year 40,000/year…

A: ANSWER This household has two children and wants to have them financially provided for over the…

Q: Utilities expense 2,180 Equipment 66,600 Accounts payable 17,520 Cash 11,460 Salaries and wages…

A: Formula: Net income = Total Revenues - Total Expenses Deduction of total expenses from Total…

Q: 5. Given the following information, what is the amount of Equity. Buildings £30,000, Inventory…

A: IN THE GIVEN QUESTION WE HAVE TO CALCULATE AMOUNT OF EQUITY AMOUNT OF EQUITY = TOTAL ASSETS - (TRADE…

Q: ABC Company acquired all of XYZ Corporation's assets and liabilities on June 30, 20X1. XYZ reported…

A: An asset is an expense that will be helpful in future accounting periods. If an expenditure does not…

Q: 4. Skate Along, Inc has fixed costs of $740,000. They sell each pair of roller skates for $80 a…

A: Break even point means a point where there is no profit or loss incurred. in other words Break even…

Q: Taxable income Marginal tax rate 0-12.000 € 0% 12.001-30.000€ 29% 30.001-75.000 € 39% άνω 75.000 €…

A: on the taxable income the tax recharge by the government on the basis of income . generally as the…

Q: Santino is to withdraw

A: The sharing of profit and loss in accordance with the profit and loss sharing ratio.it completely…

Q: Sandpiper Company has 20,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of…

A: >Dividends are the payment to investors of stock or shares. >Usually, preferred…

Q: Customers' current ac bank.

A: Liabilities are accumulated financial obligations that result from past events that are expected to…

Q: need

A: Answer: The solution is based on the MACRS general depreciation system (GDS), and all assets are…

Q: The unified estate and gift tax credit exempts people with taxable estates under $11.7 million from…

A: The unified tax credit, also called the unified transfer tax, combines two separate lifetime tax…

Q: Lorrimer Company has a job-order cost system. The following debits (credits) appeared in…

A: Answer) Calculation of amount of direct materials charged to Job 83 Direct materials cost of Job 83…

Q: 6 Which of the following will increase the cash conversion cycle? say3 an increase in inventory…

A: As per Bartleby norms, in case of a question with multiple sub parts been asked, only first three…

Q: What is the maximum amount of new loans that this bank can make? Show in columns 3 and 3' how the…

A: the Maximum Amount of new loans that this bank made is $12000 The money supply has changed by…

Q: A rise in unemployment will increase employment rents. Select one: O True O False

A: If a labour market is in equilibrium means supply equal to demand. All persons who are looking for…

Q: For the period just ended, LAMBANA CO. budgeted its variable overhead at P40 per direct labor hour…

A: The variable overheads are the costs that are affected by the change in the level of production, the…

Q: Use the following question set for practice. For each transaction, tell whether the assets,…

A: Assets = Owner's Equity + Liabilities These are the possible cases: 1. Increase in an Asset and a…

Q: Numbers 22-24 (Purchase Commitment) During 2022, Tartarus Company signed a noncancellable contract…

A: The purchase of material is recorded at the cost. price may rise or fall accordingly the value of…

Q: The comparative statements of Coronado Company are presented here. Coronado Company Income…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: ameter capturing technology

A: Given as, Y= z.f (K, N, L)

Q: 24 - 25Sales for the year amount to PHP100.000, Accounts receivable amount to PHPT2,000. What is the…

A: As per the guidelines, only one question is allowed to be solved so I am answering question 24-25.…

Q: lance of Esplanade's ending inventory account was P750,000, and the allowance for ventory write down…

A: Basic Concept of Valuation of Inventory

Q: On January 1, 2022 Romano Company purchased a machine for $180,000. It is estimated that the machine…

A: The declining balance method is a method of depreciation that calculates depreciation on a reduced…

Q: 7. Canary Ltd. owns a yacht that is in need of repair and which was purchased for £6,800. The…

A: Buying and selling are usual activities in the course of carrying out a business. Often assets will…

Q: In a standard cost system, an unfavorable overhead volume variance would result if there is an…

A: The question is related to Standard Costing and is related to overhead variance.

Q: Make the journal entry (debit and credits) for recording the payroll.

A: Payroll accounting is known as the recording of all the payroll transactions in the books of the…

Q: 55,200 P 155,200 P 173,200 P 86,400 P 86,400 P 98,400 P 48,000 P 41,600 P 41,600 P 47,600 P 32,000 P…

A: Here asked for multi question we will solve for first question accordance with the guidelines if you…

Q: he partners Ma

A: The sharing of profit and loss in accordance with the profit and loss sharing ratio.it completely…

Q: Sweet Sixteen has two classes of stock authorized: $10 par preferred, and $1 par value common. As of…

A: The shareholders' equity section represents the total equity that belongs to the owners or…

Q: On December 31, 2019, Oriole Company leased machinery from Terminator Corporation for an agreed upon…

A: The lease liability is a total of the present value discounted at incremental borrowing rate, in…

Q: An advantage of the weighted average inventory method is that it smooths out erratic changes in…

A: Inventory accounting is the branch of accounting concerned with the valuation and accounting for…

Q: Listed below is the inventory, purchases and sales for the month of July 2021: Units RM per unit…

A: Under perpetual inventory system cost of goods sold is recorded simultaneously whereas under…

Q: On April 1, Kang Corporation purchased back 250 shares of $1 par value common stock for $20 per…

A: Treasury stock: When shares are purchased from the open market by the company then these shares are…

Q: Toronto Corporation wants to raise $1,210,000 via a rights offering. The company currently has…

A: a) Right shares offered : 1: 5 Therefore: Total shares : 220,000* 1/5 = 44,000 rights shares Ex…

Q: Jonathan manufactures a product which was sold in the market for P165 per unit. Its variable cost…

A: Contribution margin per unit =Sales - Variable cost Contribution margin ratio =Contribution margin…

Q: Trane Corporation has the following stockholders' equity accounts: Preferred Stock, Paid-in Capital…

A: Capital Stock: Capital stock refers to the total number of common and preferred shares that a…

Q: 5. The Goldielocks company produces 3 products - Hot Product, Cold Product, Just Right Product. The…

A: The break even sales are the sales where business earns no profit no loss during the period.

Q: 47. Under this inventory system, a physical count is necessary before profit is determined a.…

A: Introduction:- There are different types of inventory systems used in the business Inventory systems…

Q: Journalize the following transactions using the allowance method of accounting for uncollectible…

A: Working Note: Amount of account written off = Total accounts receivable - amount Received = $6,300…

Q: “Budgeting is the same across different organisations and industries, so organisational strategy,…

A: Introduction: Budgeting is the process of forecasting a company's predicted income (the money that…

Q: The City of Greenville condemned 300 acres of Kayla's farmland. Kayla's land was worth $250,000 and…

A: Unrealized Gain- An unrealized gain is the amount of profit earned by an investor simply by holding…

Q: FILL - UP THE MISSING AMOUNTS: Sales CGS 40% GP 479,400 Expenses Net Profit (140,600)

A: The gross profit percentage is calculated as gross profit divided by net sales revenue.

Q: Territory and Product Profitability Analysis Coast to Coast Surfboards Inc. manufactures and sells…

A: Solution:- Calculation of a contribution margin by sales territory report as follows under:-

Q: On January 1, 2022 Romano Company purchased a machine for $180,000. It is estimated that the machine…

A: Units of Activity Depreciation: Units of activity method of depreciation is a technique of…

Q: Current Attempt in Progress Selected transactions for Swifty's Dog Care are as foll ows during the…

A: Double entry system of bookkeeping Under double entry system of bookkeeping one account is debited…

Q: oring costs (COGS) A CD E F G 2 B J U KL Statement of Comprhensive Income for Year Ended Dec.31 M N…

A: 1| Operating margin: = (Operating income ÷ Revenue)×100 2| Return on total long term capital…

Q: Total Current assets value to be reported in Balance sheet?

A: Introduction: Current Assets: Current Assets are the most liquid Assets like cash and cash…

Q: Suppose the 2020 adidas financial statements contain the following selected data (in millions).…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: Calculate labor rate and efficiency variances and the controllable overhead variance and the…

A: 1. Labor Rate Variance: = (Actual Hours x Standard Rate) - (Actual Hours x Actual Rate) 2. Labor…

Q: Support your answer using at least two concrete examples.

A: Today we live in a smart world. The banking sector is also becoming smart. Earlier people use to go…

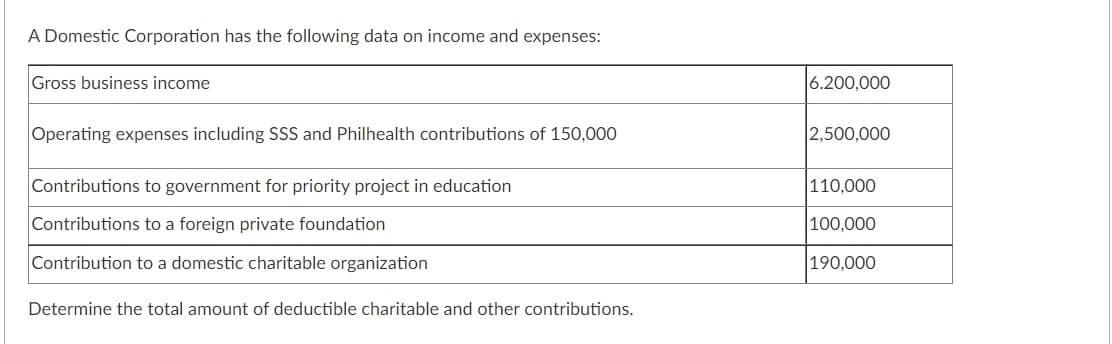

PHILIPPINES - Income Tax

A. Determine the total amount of deductible charitable and other contributions.

Step by step

Solved in 3 steps with 1 images

- A nongovernmental, not-for-profit organization received the following donations of corporate stock during the year: Donation 1 Donation 2 Donation 3 Number of shares 2,000 3,000 1, 000 Adjusted basis $8,000 $5,500 $3,000 Fair market value at time of donation 8,500 6,000 $4,000 Fair market value at year end 10,000 2,000 $2,500 What net value of investments will the organization report at the end of the year? A.) $14,500 B.) $14,000 C.) $13,500 D.) $12,000All of the listed features or obligations differentiate a registered charity from a private corporation except one. Which one? Ability to issue donors official tax receipts Required to file Form T3010 Charity can incorporate like a private company Requirement to meet annual spending quotaP Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Private Proprietary Educational Institution majority of its income is from related activities. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was incurred in connection with non-related activities. Compute the income tax due if all the income of Qalvin is used for educational purposes. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was…

- Make the appropriate calculations in each of the following independent situations presented below. In its first year of operation, the MFG Corporation, a regular corporation contributes $35,000 cash to a qualified charitable organization during the current tax year. The corporation has net operating income of $145,000 before deducting the contributions, and dividends received from domestic corporations, of $25,000. What is the amount of MFG’s allowable deduction for charitable contribution? Gloria, in forming a new corporation transfers land to the corporation in exchange for 100% of the stock of the corporation. Gloria’s basis in land is $275,000 and the corporation assumes a liability on the property in the amount of $300,000. The stock received by Gloria has a fair market value of $550,000. Give the amount of gain or loss that must be recognized by Gloria on this transaction. Kingdom Corporation is a manufacturing corporation that has accumulated earnings of $975,000. It can…Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Non-profit Entity.A taxpayer registered in 2010 made available the following financial information for TY2021 Balance Sheet:Asset – Php 50,000,000Liability – Php 30,000,000Stockholders' Equity – Php 20,000.000 Income StatementGross sales – Php 100,000,000Cost of sales – Php 60,000,000 Operating Expenses – Php 50,000,000 How much is the income tax payable under CREATE Law if the taxpayer is a domestic corporation?a. 800,000b. 400,000c. 2,500,000d. 0

- The Income Statement of the ABC Corporation in Puerto Rico, prepared on a tax basis, presents the following results: ABC Corporation Income Statement (Tax Base) For the year ended December 31, 20X1 Income $ 1,500,000 Cost of sale (600,000) Gross margin 900,000 Salaries (100,000) Donations to non-profit entities (40,000) Other operational expenses (200,000) Net income $ 560,000 Determine the deduction for donations that the ABC Corporation may claim in tax year 20X1. a. $ 56,000 b. $ 10,000 c. $ 40,000 d. $ 4,000Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation. (depends if it need the tabel)A Charity institution capital fund of the non profit organization has OMR 900,000. The income earning @ OMR 250,000 and OMR60,000 expenses. What is the excess value of income statement?Select one:a. OMR 160,000b. OMR 650,000c. OMR 190,000d. OMR 590,000

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation.The following information was taken from the accounts and records of the Helping HandsFoundation, a private, not-for-profit organization classified as a VHWO. All balances are as ofJune 30, 2014, unless otherwise noted.Unrestricted Support - Contributions $2,000,000Unrestricted Support - Membership Dues 640,000Unrestricted Revenues - Investment Income 80,000Temporarily restricted gain on sale of investments 25,000Expenses - Program Services 1,860,000Expenses - Supporting Services 350,000Expenses - Supporting Services 550,000Temporarily Restricted Support - Contributions 640,000Temporarily Restricted Revenues - Investment Income 60,000Permanently Restricted Support - Contributions 100,000Unrestricted Net Assets, July 1, 2013 450,000Temporarily Restricted Net Assets, July 1, 2013 2,100,000Permanently Restricted Net Assets, July 1, 2013 60,000 The unrestricted support from contributions was received in cash during the year. The expensesincluded $1,350,000 paid from temporarily-restricted…A domestic corporation, adopted a public elementary school and contributed P500,000 for the acquisition of computer equipment and software. The corporation has an operating income of P1,000,000 before this contribution expense.Compute the corporations’ net income, if the “adopt-a school project” is no longer a government priority program.