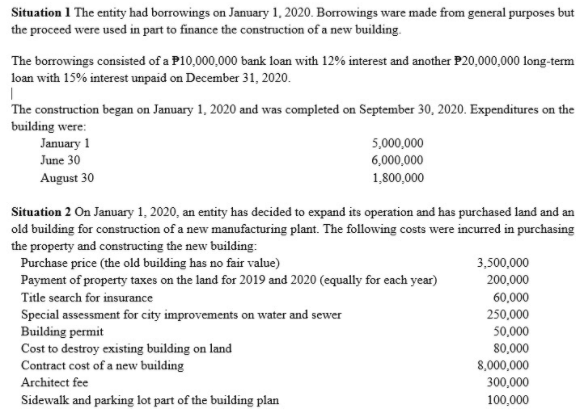

Situation 1 The entity had borrowings on January 1, 2020. Borrowings ware made from general purposes but the proceed were used in part to finance the construction of a new building. The borrowings consisted of a P10,000,000 bank loan with 12% interest and another P20,000,000 long-term loan with 15% interest unpaid on December 31, 2020. The construction began on January 1, 2020 and was completed on September 30, 2020. Expenditures on the building were: January 1 5,000,000 June 30 6,000,000 August 30 1,800,000 Situation 2 On January 1, 2020, an entity has decided to expand its operation and has purchased land and an old building for construction of a new manufacturing plant. The following costs were incurred in purchasing the property and constructing the new building: Purchase price (the old building has no fair value) 3,500,000 Payment of property taxes on the land for 2019 and 2020 (equally for each year) 200,000 Title search for insurance 60,000 Special assessment for city improvements on water and sewer Building permit Cost to destroy existing building on land Contract cost of a new building 250,000 50,000 80,000 8,000,000 Architect fee 300,000 Sidewalk and parking lot part of the building plan 100,000

Situation 1 The entity had borrowings on January 1, 2020. Borrowings ware made from general purposes but the proceed were used in part to finance the construction of a new building. The borrowings consisted of a P10,000,000 bank loan with 12% interest and another P20,000,000 long-term loan with 15% interest unpaid on December 31, 2020. The construction began on January 1, 2020 and was completed on September 30, 2020. Expenditures on the building were: January 1 5,000,000 June 30 6,000,000 August 30 1,800,000 Situation 2 On January 1, 2020, an entity has decided to expand its operation and has purchased land and an old building for construction of a new manufacturing plant. The following costs were incurred in purchasing the property and constructing the new building: Purchase price (the old building has no fair value) 3,500,000 Payment of property taxes on the land for 2019 and 2020 (equally for each year) 200,000 Title search for insurance 60,000 Special assessment for city improvements on water and sewer Building permit Cost to destroy existing building on land Contract cost of a new building 250,000 50,000 80,000 8,000,000 Architect fee 300,000 Sidewalk and parking lot part of the building plan 100,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 13C

Related questions

Question

What is the total cost of the land?

What is the total cost of the new building?

Transcribed Image Text:Situation 1 The entity had borrowings on January 1, 2020. Borrowings ware made from general purposes but

the proceed were used in part to finance the construction of a new building.

The borrowings consisted of a P10,000,000 bank loan with 12% interest and another P20,000,000 long-term

loan with 15% interest unpaid on December 31, 2020.

The construction began on January 1, 2020 and was completed on September 30, 2020. Expenditures on the

building were:

January 1

5,000,000

6,000,000

June 30

August 30

1,800,000

Situation 2 On January 1, 2020, an entity has decided to expand its operation and has purchased land and an

old building for construction of a new manufacturing plant. The following costs were incurred in purchasing

the property and constructing the new building:

Purchase price (the old building has no fair value)

Payment of property taxes on the land for 2019 and 2020 (equally for each year)

3,500,000

200,000

Title search for insurance

60,000

Special assessment for city improvements on water and sewer

Building permit

Cost to destroy existing building on land

Contract cost of a new building

250,000

50,000

80,000

8,000,000

300,000

Architect fee

Sidewalk and parking lot part of the building plan

100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning