On January 1, 2023, the Balmond Company began construction of a building to be used as its office headquarters. The building was completed on December 31, 2024. Expenditures on the project were as follows: Expenditures for 2023 Expenditures for 2024 January 3 1,000,000 January 31 300,000 March 31 1,200,000 March 31 500,000 June 30 800,000 May 31 600,000 October 1 600.000 Florida had the following borrowings during 2023. The borrowings were made for specific and general purposes but the proceeds were used in part to finance the construction of a new building: Florida had the following borrowings during 2023. The borrowings were made for specific and general purposes but the proceeds were used in part to finance the construction of a new building: Principal Annual interest 12% Construction loan 2,000,000 240,000 7.6% Long-term note 5,000,000 380,000 6% Mortgage payable 3,000,000 180,000 All debts were outstanding during all of 2023 and 2024. The total interest expense at the end of December 31, 2023 is:

On January 1, 2023, the Balmond Company began construction of a building to be used as its office headquarters. The building was completed on December 31, 2024. Expenditures on the project were as follows: Expenditures for 2023 Expenditures for 2024 January 3 1,000,000 January 31 300,000 March 31 1,200,000 March 31 500,000 June 30 800,000 May 31 600,000 October 1 600.000 Florida had the following borrowings during 2023. The borrowings were made for specific and general purposes but the proceeds were used in part to finance the construction of a new building: Florida had the following borrowings during 2023. The borrowings were made for specific and general purposes but the proceeds were used in part to finance the construction of a new building: Principal Annual interest 12% Construction loan 2,000,000 240,000 7.6% Long-term note 5,000,000 380,000 6% Mortgage payable 3,000,000 180,000 All debts were outstanding during all of 2023 and 2024. The total interest expense at the end of December 31, 2023 is:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 29P

Related questions

Question

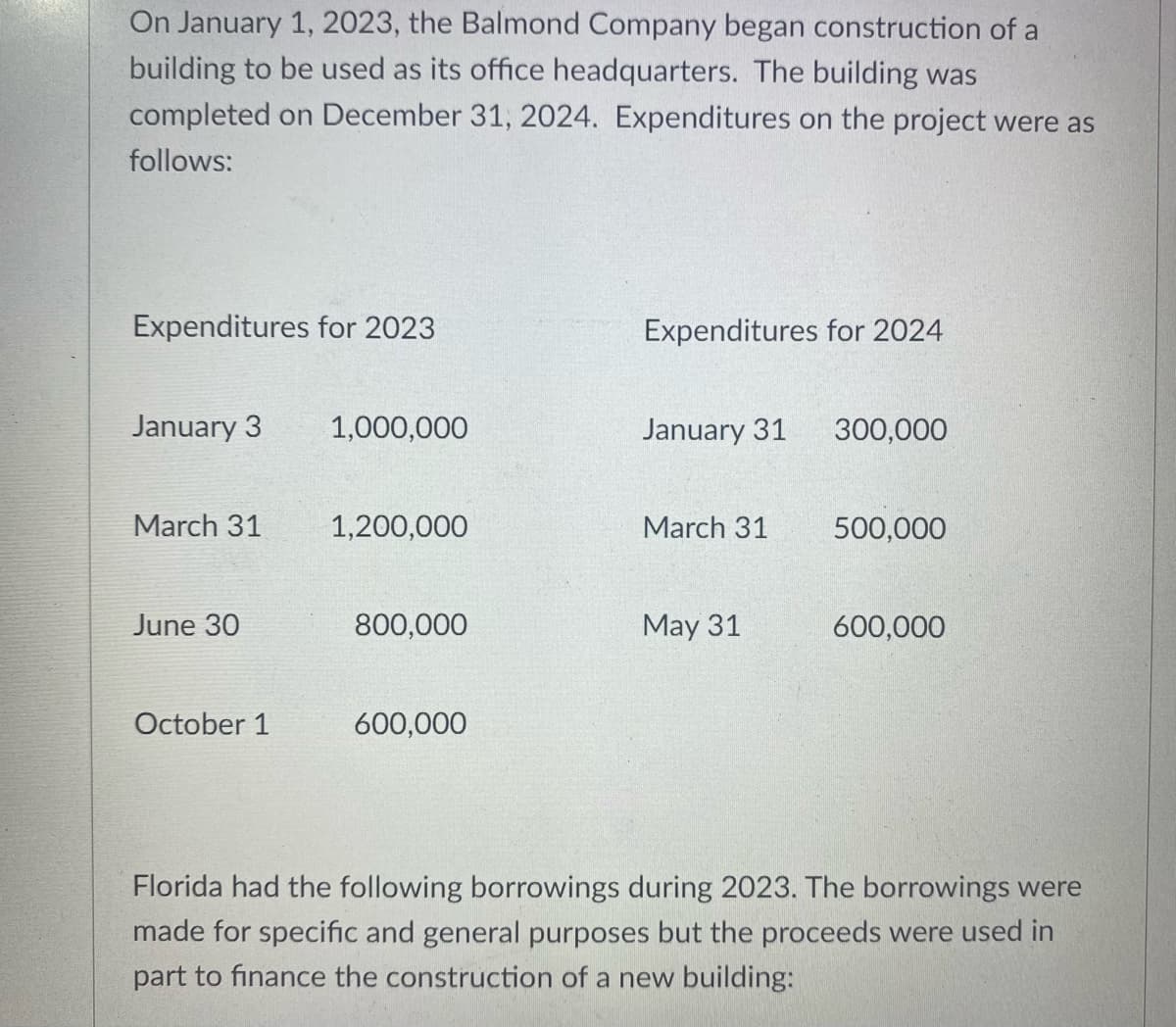

On January 1, 2023, the Balmond Company began construction of a

building to be used as its office headquarters. The building was

completed on December 31, 2024. Expenditures on the project were as

follows:

Expenditures for 2023

Expenditures for 2024

January 3

1,000,000

January 31

300,000

March 31

1,200,000

March 31

500,000

June 30

800,000

May 31

600,000

October 1

600.000

Florida had the following borrowings during 2023. The borrowings were

made for specific and general purposes but the proceeds were used in

part to finance the construction of a new building:

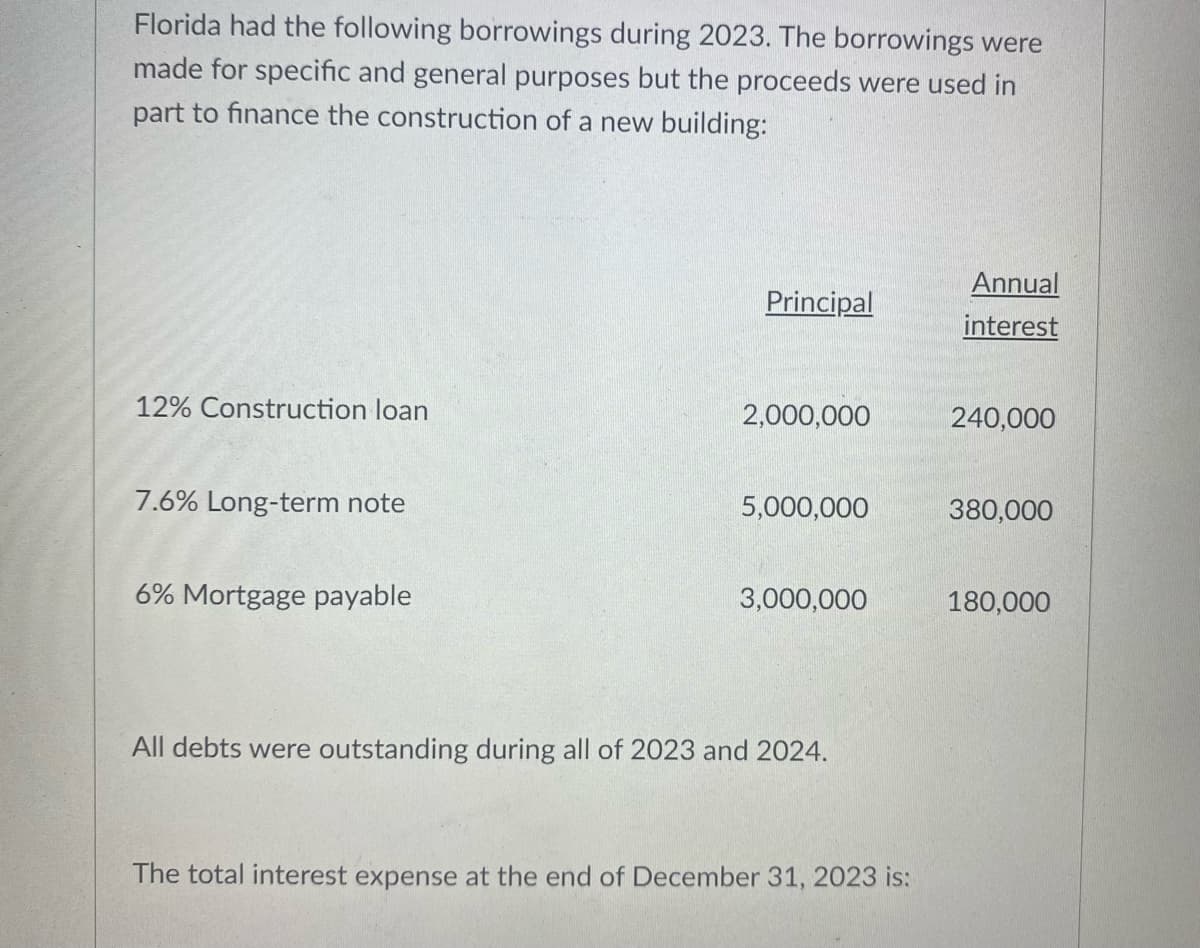

Florida had the following borrowings during 2023. The borrowings were

made for specific and general purposes but the proceeds were used in

part to finance the construction of a new building:

Principal

Annual

interest

12% Construction loan

2,000,000

240,000

7.6% Long-term note

5,000,000

380,000

6% Mortgage payable

3,000,000

180,000

All debts were outstanding during all of 2023 and 2024.

The total interest expense at the end of December 31, 2023 is:

Transcribed Image Text:On January 1, 2023, the Balmond Company began construction of a

building to be used as its office headquarters. The building was

completed on December 31, 2024. Expenditures on the project were as

follows:

Expenditures for 2023

Expenditures for 2024

January 3

1,000,000

January 31

300,000

March 31

1,200,000

March 31

500,000

June 30

800,000

May 31

600,000

October 1

600,000

Florida had the following borrowings during 2023. The borrowings were

made for specific and general purposes but the proceeds were used in

part to finance the construction of a new building:

Transcribed Image Text:Florida had the following borrowings during 2023. The borrowings were

made for specific and general purposes but the proceeds were used in

part to finance the construction of a new building:

Annual

Principal

interest

12% Construction loan

2,000,000

240,000

7.6% Long-term note

5,000,000

380,000

6% Mortgage payable

3,000,000

180,000

All debts were outstanding during all of 2023 and 2024.

The total interest expense at the end of December 31, 2023 is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you