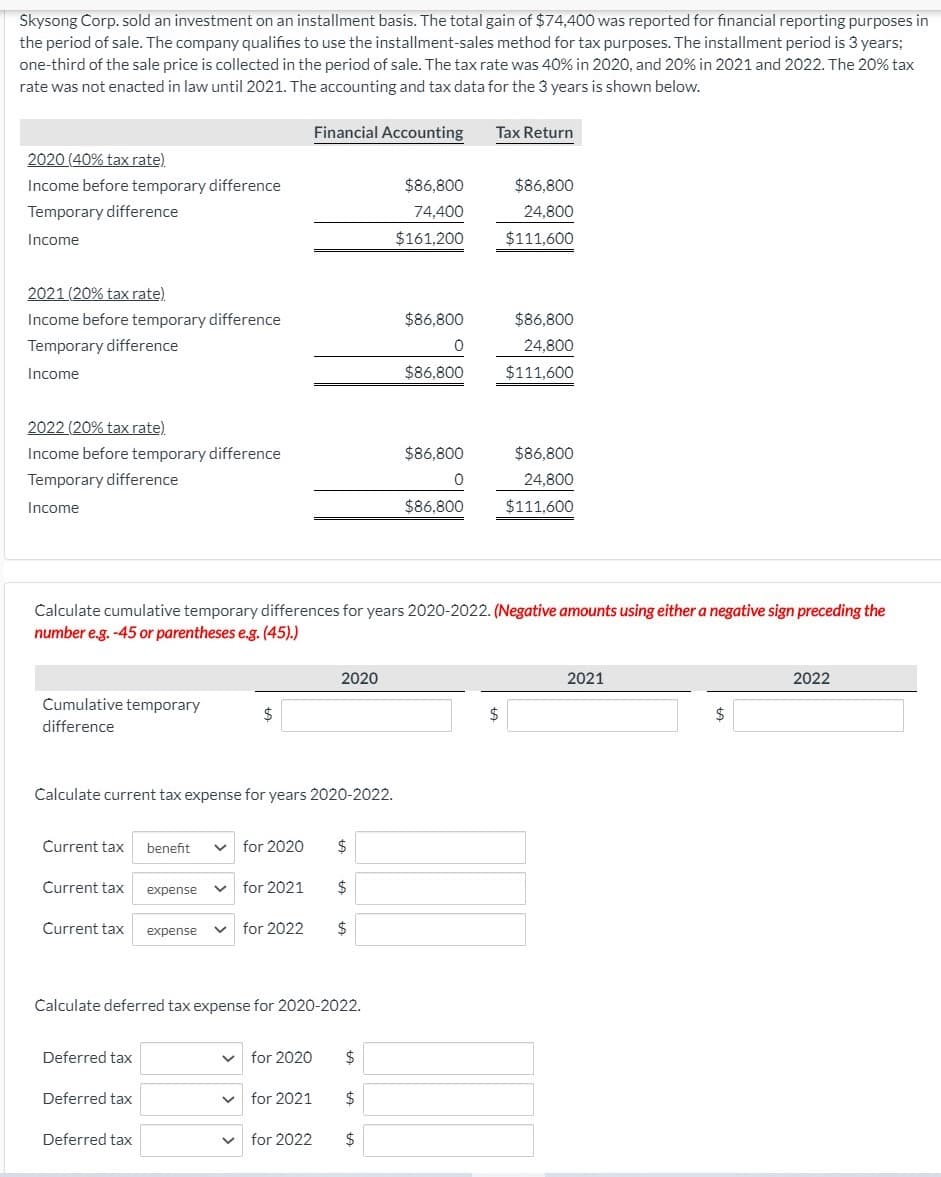

Skysong Corp. sold an investment on an installment basis. The total gain of $74,400 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below. Financial Accounting Tax Return 2020 (40% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 74,400 24,800 Income $161,200 $111,600 2021 (20% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600 2022 (20% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600

Skysong Corp. sold an investment on an installment basis. The total gain of $74,400 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below. Financial Accounting Tax Return 2020 (40% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 74,400 24,800 Income $161,200 $111,600 2021 (20% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600 2022 (20% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 4MC: Prior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the...

Related questions

Question

100%

Transcribed Image Text:Skysong Corp. sold an investment on an installment basis. The total gain of $74,400 was reported for financial reporting purposes in

the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years;

one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax

rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below.

Financial Accounting

Tax Return

2020 (40% tax rate).

Income before temporary difference

$86,800

$86,800

Temporary difference

74,400

24,800

Income

$161,200

$111,600

2021 (20% tax rate)

Income before temporary difference

$86,800

$86,800

Temporary difference

24,800

Income

$86,800

$111,600

2022 (20% tax rate).

Income before temporary difference

$86,800

$86,800

Temporary difference

24,800

Income

$86,800

$111,600

Calculate cumulative temporary differences for years 2020-2022. (Negative amounts using either a negative sign preceding the

number e.g. -45 or parentheses e.g. (45).)

2020

2021

2022

Cumulative temporary

$

$

difference

Calculate current tax expense for years 2020-2022.

Current tax

benefit

for 2020

2$

Current tax

expense

for 2021

$

Current tax

expense

for 2022

2$

Calculate deferred tax expense for 2020-2022.

Deferred tax

for 2020

2$

Deferred tax

for 2021

$

Deferred tax

for 2022

$

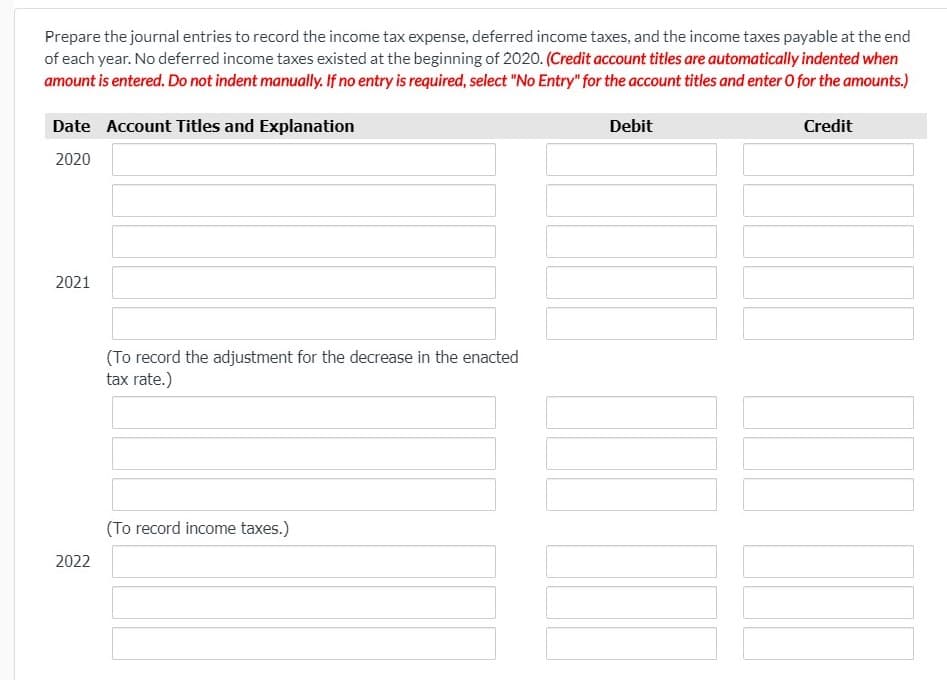

Transcribed Image Text:Prepare the journal entries to record the income tax expense, deferred income taxes, and the income taxes payable at the end

of each year. No deferred income taxes existed at the beginning of 2020. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

Debit

Credit

2020

2021

(To record the adjustment for the decrease in the enacted

tax rate.)

(To record income taxes.)

2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning