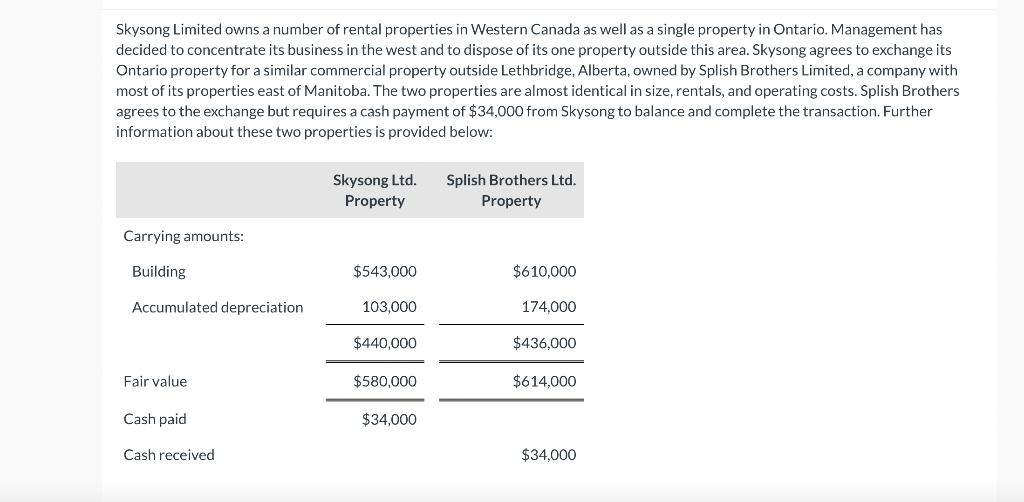

Skysong Limited owns a number of rental properties in Western Canada as well as a single property in Ontario. Management has decided to concentrate its business in the west and to dispose of its one property outside this area. Skysong agrees to exchange its Ontario property for a similar commercial property outside Lethbridge, Alberta, owned by Splish Brothers Limited, a company with most of its properties east of Manitoba. The two properties are almost identical in size, rentals, and operating costs. Splish Brothers agrees to the exchange but requires a cash payment of $34,000 from Skysong to balance and complete the transaction. Further information about these two properties is provided below: Carrying amounts: Building Accumulated depreciation Fair value Cash paid Skysong Ltd. Property $543,000 103,000 $440,000 $580,000 $34,000 Splish Brothers Ltd. Property $610,000 174,000 $436,000 $614,000

Skysong Limited owns a number of rental properties in Western Canada as well as a single property in Ontario. Management has decided to concentrate its business in the west and to dispose of its one property outside this area. Skysong agrees to exchange its Ontario property for a similar commercial property outside Lethbridge, Alberta, owned by Splish Brothers Limited, a company with most of its properties east of Manitoba. The two properties are almost identical in size, rentals, and operating costs. Splish Brothers agrees to the exchange but requires a cash payment of $34,000 from Skysong to balance and complete the transaction. Further information about these two properties is provided below: Carrying amounts: Building Accumulated depreciation Fair value Cash paid Skysong Ltd. Property $543,000 103,000 $440,000 $580,000 $34,000 Splish Brothers Ltd. Property $610,000 174,000 $436,000 $614,000

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 21P

Related questions

Question

Hw.113.

Transcribed Image Text:Skysong Limited owns a number of rental properties in Western Canada as well as a single property in Ontario. Management has

decided to concentrate its business in the west and to dispose of its one property outside this area. Skysong agrees to exchange its

Ontario property for a similar commercial property outside Lethbridge, Alberta, owned by Splish Brothers Limited, a company with

most of its properties east of Manitoba. The two properties are almost identical in size, rentals, and operating costs. Splish Brothers

agrees to the exchange but requires a cash payment of $34,000 from Skysong to balance and complete the transaction. Further

information about these two properties is provided below:

Carrying amounts:

Building

Accumulated depreciation

Fair value

Cash paid.

Cash received

Skysong Ltd.

Property

$543,000

103,000

$440,000

$580,000

$34,000

Splish Brothers Ltd.

Property

$610,000

174,000

$436,000

$614,000

$34,000

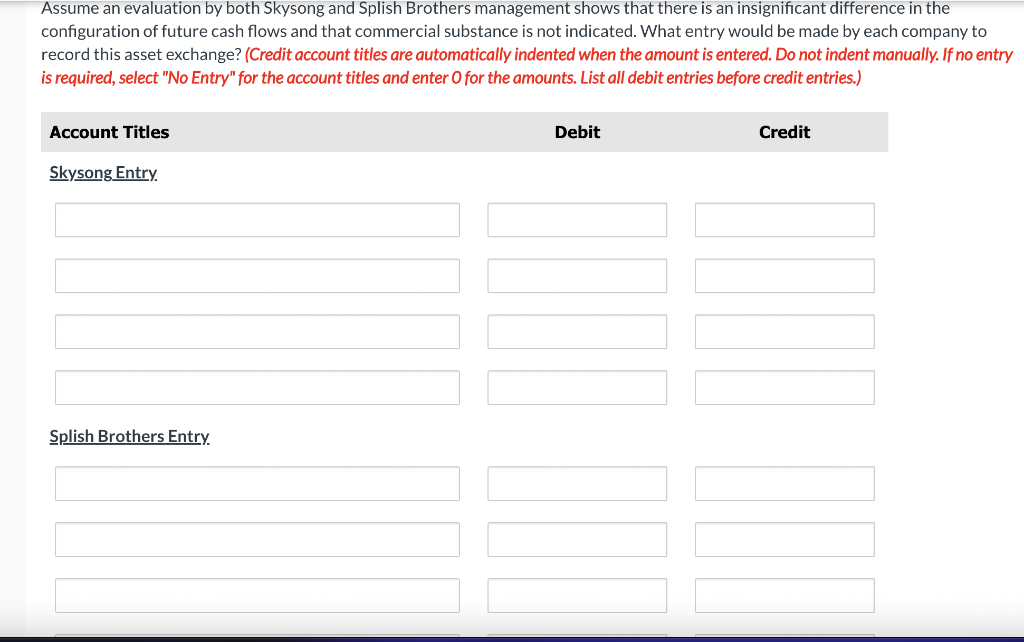

Transcribed Image Text:Assume an evaluation by both Skysong and Splish Brothers management shows that there is an insignificant difference in the

configuration of future cash flows and that commercial substance is not indicated. What entry would be made by each company to

record this asset exchange? (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry

is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles

Skysong Entry.

Splish Brothers Entry.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT