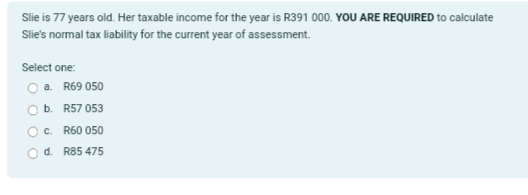

Slie is 77 years old. Her taxable income for the year is R391 000. YOU ARE REQUIRED to calculate Slie's normal tax liability for the current year of assessment. Select one: a. R69 050 b. R57 053 c. R60 050 d. R85 475

Q: A company's relevant range of production is 10,000 to 15,000 units. When it produces and sells…

A: The incremental cost is the difference between the cost at different level of production. The…

Q: Fiske Corporation manufactures a popular regional brand of kitchen utensils. The design and variety…

A: Lets understand the basics.As per high low method, total costs are divided between the fixed cost…

Q: Heidi Jara opened Pina Colada's cleaning services on July 1 2022. During July, the following…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Income before income tax Prior period adjustment: understatement of 20X2 depreciation expense…

A: Retained earnings statement is one of the financial statements which depicts the earnings which have…

Q: a. What is the allowable depreciation on Evergreen's property in the current year, assuming…

A: Basisc assumption : The current year is 2022. Tax jurisdiction USA. For the…

Q: Which of the following journal entries will increase the total balance of the debit accounts in the…

A: Journal entries are primary reporting of the business transactions in the books of accounts. These…

Q: JK Ltd leased equipment to Co. EF for 8 years, at which time the asset will revert to JK Ltd. The…

A: To determine how JK Ltd should classify this lease, we can apply the lease classification criteria…

Q: tion.com/ext/map/index.html Multiple Choice at would differ between a statement of cash flows for a…

A: Cash flow statement is one of financial statements includes three activities that areCash flow from…

Q: For each of the following independent cases A to D, compute the missing values: Note: Enter all…

A: Cost of goods sold (COGS) : Cost of goods sold budget shows the expenses incurred for producing a…

Q: The following transactions occurred for Lantana Company during its first month of operations and…

A: The balance sheet is a statement that shows the entity's financial situation at a certain point in…

Q: mbles electronic motor drives for video eras. The company assembles the motc es for several…

A: Conversion cost is direct labour and overhead cost.For budgeted cell conversion cost per hour, we…

Q: Fellar Corporation has identified the following information: Activity pools Materials handling…

A: Under activity based costing method, the cost is allocated to each activity based on its…

Q: PLEASE DO NOT ANSWER IN IMAGE!!! Q: Tierney Company begins operations on April 1. Information from…

A: Gross profit is the difference between sales revenue and cost of goods sold. The cost of goods sold…

Q: Gemma promises a local hardware store that she will pay for a lawn mower that her brother is…

A: Enforceable Contract: It is often defined as an agreement that legally binds the two or more parties…

Q: Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end…

A: Journal Entry is the primary step in recording the transactions in the books of accounts.The…

Q: n December 31, Year 1, BIG Company had accrued salaries of $6,400. Required a. Record in general…

A: The net income is calculated as the difference between the revenue and expenses. The cash flow…

Q: Merati Corporation has two manufacturing departments--Forming and Assembly. The company used the…

A: Answer:-Predetermined overhead rate:- An indirect cost rate is one that has been predetermined. The…

Q: Cedargrove Cider processes and bottles apple cider for sale through retail and big box grocery…

A: Work in Process Inventory: Work in Process (WIP) inventory, also known as in-process inventory or…

Q: NSF Lube is a fast-growing chain of oil-change stores. The following data are available for last…

A: Cost Variance-Cost variance is the procedure of evaluating the fiscal performance of your task. Cost…

Q: he December 31, 2024, adjusted trial balance for Fightin' Blue Hens Corporation is presented below.…

A: The financial statements include income statement and balance sheet. The financial statements are…

Q: Use the following amortization chart: Selling price of home Down payment Principal (loan) Rate of…

A: Given information,Selling Price of home = $93,000Down payment = $5000Principal = $88,000Rate of…

Q: The Lafayette Band Boosters purchased insulated tumblers to sell for a profit. They paid $15 for…

A: Breakeven is the point at which an entity is in a situation of no profit and no loss. At this point,…

Q: Muncey Fishing Charters consists of one boat with a capacity of 15 passengers, not including the…

A: Break-even analysis is a financial concept used to find the point at which total revenue equals…

Q: Required: Prepare journal entries to record Maple's import and export transactions during 20X5 and…

A: The foreign currency gain or loss is the amount which has been to the company through when there are…

Q: [The following information applies to the questions displayed below.] Bunnell Corporation is a…

A: The journal entries are prepared to record the transactions on regular basis. The direct Costs are…

Q: Which of the following is (are) deducted from EBIT to determine net income? A. Earnings per share B.…

A: Lets understand the basics.EBIT is abbreviation of "Earning before interest and tax". Net income is…

Q: a. What is the maximum amount of §179 expense ACW may deduct for 2023? b. What is the maximum total…

A: Deduction:- A deduction is a cost that a business can subtract from its revenue. It lowers the…

Q: in estimating annual pension expenses, which of the following factors would not be taken into…

A: Pension accountingThe accounting principle requires the clear and consistent presentation of pension…

Q: The following information, based on the 12/31/2024 Annual Report to Shareholders of Krafty Foods ($…

A: Income statement is one of the financial statements that are prepared by an entity for the purpose…

Q: The Old Country Company purchased the following instruments during the year. Assume the company's…

A: The adjusting journal entries are posted at the end of the accounting period to adjust revenues and…

Q: E2-2 The assets (in thousands) that follow were taken from the September 30, 2021, statement of…

A: BALANCE SHEET The balance sheet is one of the important financial statements of the company. Balance…

Q: Donald has two investments in activities that are considered nonrental passive activities. He…

A: Passive activity losses are subject to limitations based on whether the taxpayer is actively…

Q: Emma Company uses two activity pools. Each pool has a cost driver. Information for Emma Company…

A: Plantwide Overhead Rate is the rate used to allocate manufacturing overhead cost to cost object…

Q: Who among the following is not a "covered member" for purposes of the Sarbanes CPA firm's audit of…

A: A "covered member" is a term used in auditing and accounting to refer to individuals or entities…

Q: A company sells a product that has a unit sales price of $8.80, unit variable cost of $6.30 and…

A: Break even point :— It is the point of production where total cost is equal to total revenue. At…

Q: Cash Flow Type 10 11 12 13 Cash 1 FA 2 3 4 5 6 OA (21,000) 7 8 9 61,500 IA (18,000) OA (1,500)…

A: Current assets are those which are realizable within a time period of one year or twelve months. It…

Q: During the year, Wright Company sells 475 remote-control airplanes for $120 each. The company has…

A: LIFO Method :— It is one of the methods of inventory valuation in which it is assumed that recent or…

Q: The following balances were taken from the books of Whispering Corp. on December 31, 2025. Interest…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Crane Company makes 2 products, sleep masks and sleep socks. Additional information follows: Units…

A: Variable costs are those costs which changes along with change in activity level. Fixed costs do not…

Q: Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two…

A: The overhead is applied to the production on the basis of the pre-determined overhead rate. The…

Q: create a t account and tnter july 31 balance

A: T account helps to track the all financial and non-financial transactions of the business. All of…

Q: Below is a scrambled list of accounts of Jubli Berhad, a technology company (in RM mil). Construct…

A: Income statement is the financial statement prepared by the entity for the purpose of determining…

Q: What was the net cash flow from operating activities?

A: The cashflow statement is a financial statement which is used to show the inflow and outflow of cash…

Q: Pablo Company calculates the cost for an equivalent unit of production using process ce Data for…

A: There are two methods which are used for accounting of costs in process costing methods. These are…

Q: eBookShow Me How Question Content Area FIFO and LIFO Costs Under Perpetual Inventory System The…

A: Lets understand the basics.FIFO: FIFO stands for First-In, First-Out. In this method inventory…

Q: Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest…

A: According to the question given, we need to compute the tax liability, average tax rate, and,…

Q: Wang Company manufactures and sells a single product that sells for $540 per unit, variable costs…

A: MARGINAL COSTING INCOME STATEMENTMarginal Costing Income Statement is one of the Important Cost…

Q: PROBLEM 1: You were assigned to audit the shareholders' equity of Glory Inc. for the year ended…

A: Stockholders’ equity refers to the ownership interest in the business. It is the claim of the owners…

Q: On December 30, 2022, Whitney sold a piece of property for $300,600. Her basis in the property was…

A: The installment sales method is an accounting approach used when a seller receives payments from a…

Q: Question 3: Bill Phinnes decides to open a cleaning and laundry service near the local college…

A: Financial statements refer to the reports prepared by the business entities. These reports represent…

Step by step

Solved in 3 steps

- Arthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________Emily, who is single, sustains an NOL of 7,800 in 2019. The loss is carried forward to 2020. For 2020, Emilys income tax information before taking into account the 2019 NOL is as follows: The 2019 single standard deduction is 12,200; Emilys itemized deductions will exceed the 2020 single standard deduction (after adjustment for Inflation). The medical expense AGI floor is 10% In 2019. How much of the NOL carryforward can Emily use in 2020, and what is her adjusted gross income and her taxable income?