Smart Company prepared its annual financial statements dated December 31, 2020. The company applies the FIFO inv method; however, the company neglected to apply the LC&NRV valuation to the ending inventory. The preliminary 202 earnings follows: Sales revenue Cost of sales Beginning inventory Purchases Cost of goods available for sale Ending inventory (FIFO cost) Cost of sales Gross profit Operating expenses Pretax earnings $32,300 197,000 229,300 68,496 $293,000 160,804 132, 196 63,300 68.896

Smart Company prepared its annual financial statements dated December 31, 2020. The company applies the FIFO inv method; however, the company neglected to apply the LC&NRV valuation to the ending inventory. The preliminary 202 earnings follows: Sales revenue Cost of sales Beginning inventory Purchases Cost of goods available for sale Ending inventory (FIFO cost) Cost of sales Gross profit Operating expenses Pretax earnings $32,300 197,000 229,300 68,496 $293,000 160,804 132, 196 63,300 68.896

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Topic Video

Question

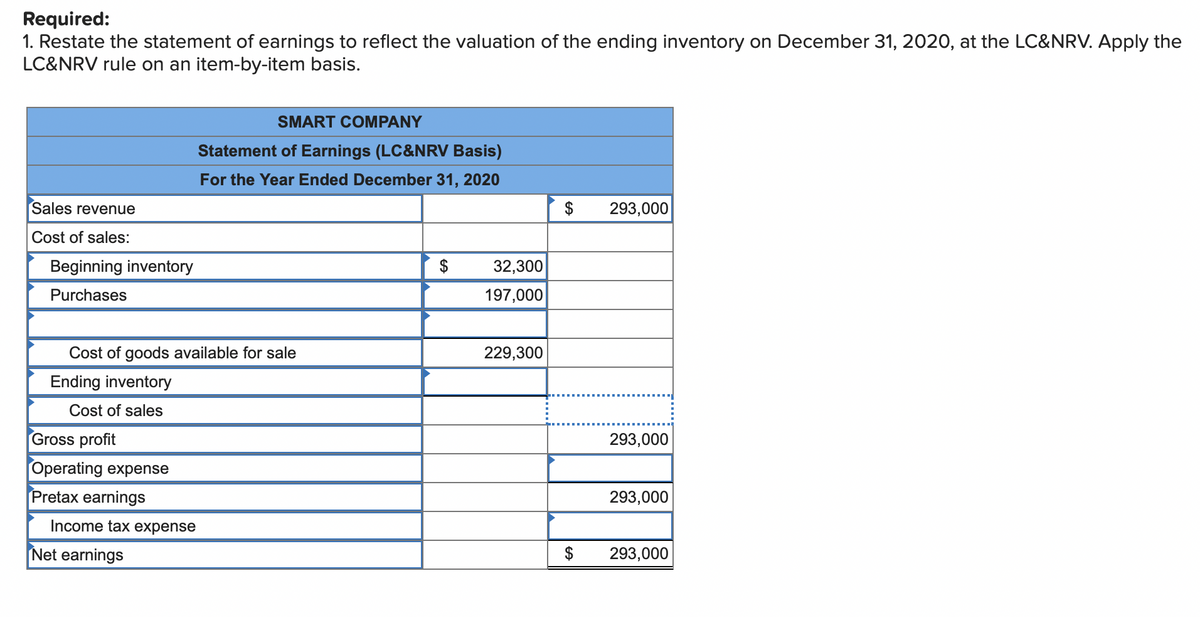

Transcribed Image Text:Required:

1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31, 2020, at the LC&NRV. Apply the

LC&NRV rule on an item-by-item basis.

Sales revenue

Cost of sales:

Beginning inventory

Purchases

Cost of goods available for sale

Ending inventory

Cost of sales

Gross profit

Operating expense

Pretax earnings

Income tax expense

SMART COMPANY

Statement of Earnings (LC&NRV Basis)

For the Year Ended December 31, 2020

Net earnings

32,300

197,000

229,300

$

293,000

293,000

293,000

293,000

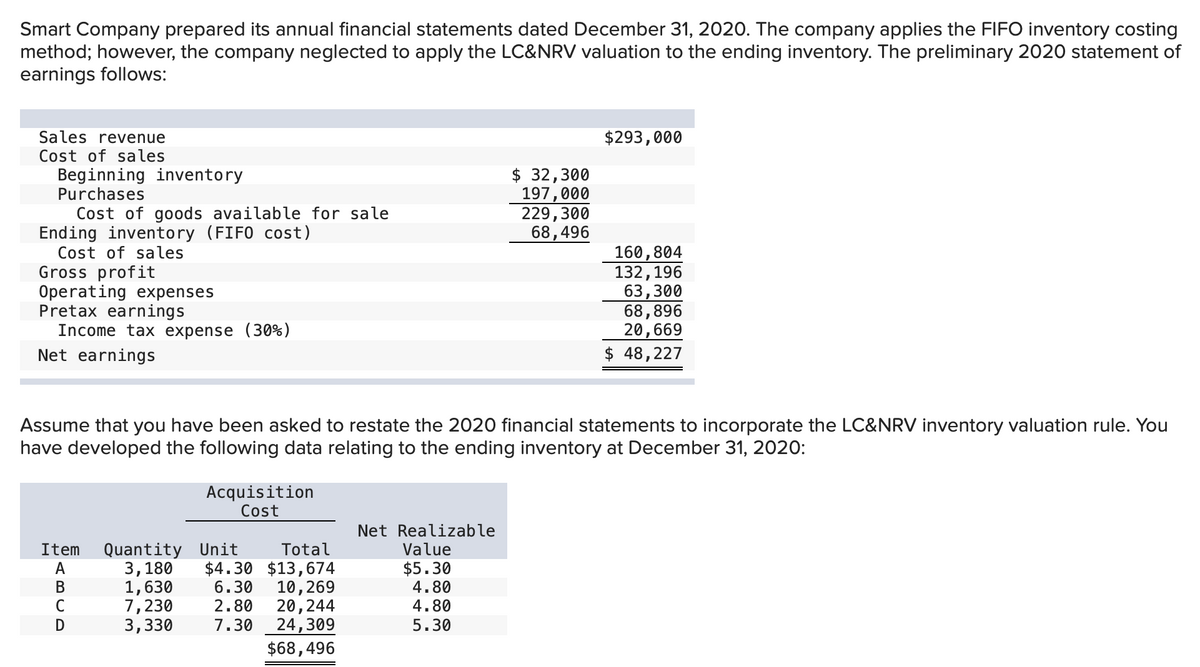

Transcribed Image Text:Smart Company prepared its annual financial statements dated December 31, 2020. The company applies the FIFO inventory costing

method; however, the company neglected to apply the LC&NRV valuation to the ending inventory. The preliminary 2020 statement of

earnings follows:

Sales revenue

Cost of sales

Beginning inventory

Purchases

Cost of goods available for sale

Ending inventory (FIFO cost)

Cost of sales

Gross profit

Operating expenses

Pretax earnings

Income tax expense (30%)

Net earnings

Item Quantity

ABCD

Assume that you have been asked to restate the 2020 financial statements to incorporate the LC&NRV inventory valuation rule. You

have developed the following data relating to the ending inventory at December 31, 2020:

Acquisition

Cost

Unit

Total

3,180 $4.30 $13,674

10,269

1,630 6.30

7,230 2.80

3,330 7.30

20,244

24,309

$68,496

$ 32,300

197,000

229,300

68,496

Net Realizable

Value

$5.30

4.80

4.80

5.30

$293,000

160,804

132, 196

63,300

68,896

20,669

$ 48,227

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,